Commercial: Page 41

-

Webster Bank gets $9B boost with interLINK acquisition

The deal comes three months after a Dallas bank alleges interLINK’s owner, StoneCastle Partners, “unilaterally terminated” a previous deal to sell the business for $91 million in cash and stock.

By Dan Ennis • Dec. 6, 2022 -

Newtek gets OCC green light to acquire NBNYC

The approval comes 16 months after Newtek proposed to reposition itself as a bank holding company. The acquisition should strengthen Newtek’s foothold as the third-largest lender in the SBA’s 7(a) program.

By Rajashree Chakravarty • Dec. 6, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Permission granted by Frost Bank

Permission granted by Frost Bank Trendline

TrendlineTop 5 stories from Banking Dive

Since the approval of Capital One’s acquisition of Discover, banks have increasingly waded into new deals. Beyond that, they’ve doubled down on strategy, from organic growth to branch placement to app design.

By Banking Dive staff -

Fed’s Barr calls for stricter capital requirements

The vice chair for supervision did not say when a review of the stress test framework would be complete, but more details are expected early next year.

By Rajashree Chakravarty • Dec. 5, 2022 -

Wells Fargo launches new commercial banking platform

Vantage replaces the bank’s two-decade-old Commercial Electronic Office Portal and aims to bring a "consumer-like experience" to Wells' commercial and corporate clients, an executive said.

By Anna Hrushka • Dec. 5, 2022 -

10 top reads from Banking Dive

If you're new, welcome. Here's a chance to catch up on some of our best work.

By Dan Ennis • Dec. 4, 2022 -

TD, BMO adjust their timelines for First Horizon, Bank of the West deals

TD now aims to wrap its transaction by April and give First Horizon stockholders an extra $0.65 per share. BMO said its deal is “rounding third base,” on track for a first-quarter close.

By Dan Ennis • Dec. 2, 2022 -

State Street, Brown Brothers Harriman scrap $3.5B deal

“The regulatory path forward would involve further delays, and all necessary approvals have not been resolved,” State Street said.

By Dan Ennis • Dec. 1, 2022 -

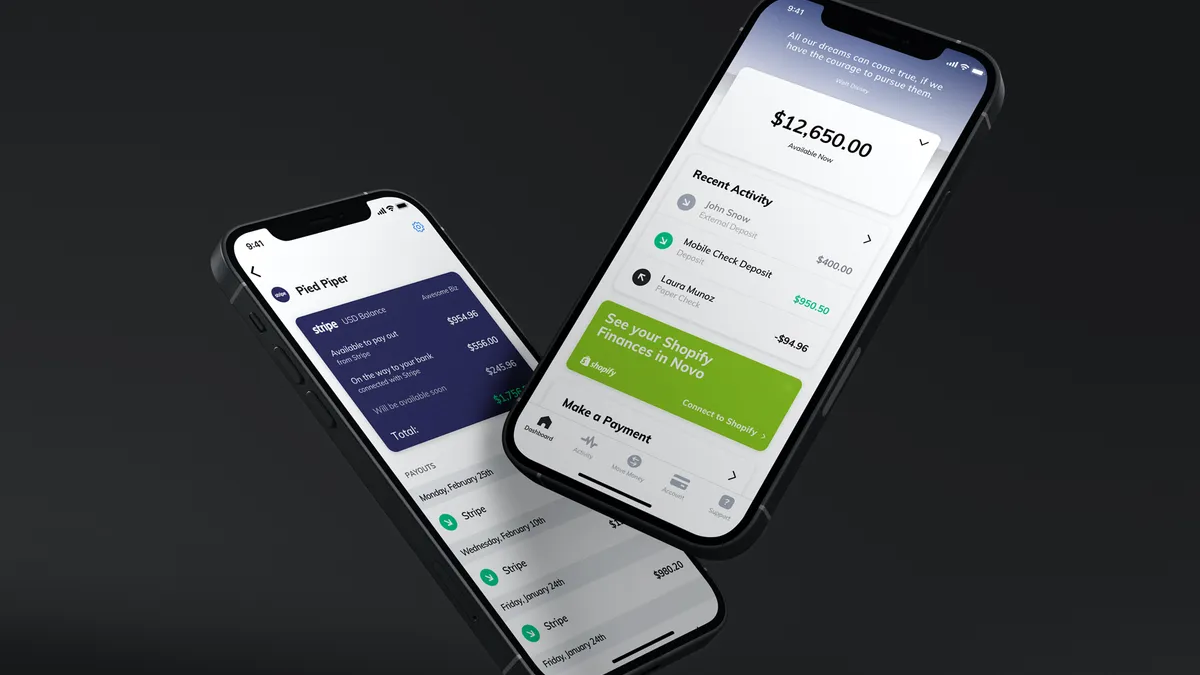

Novo grows customizable small-business banking platform, eyes lending

The fintech, which raised $35 million from GGV Capital last week, announced a new partnership Wednesday with LegalZoom to provide entity formation services to Novo customers.

By Anna Hrushka • Nov. 30, 2022 -

UBS chair rules out M&A for its US growth strategy

“The message in the States is organic growth, no optionality, no distractions, no M&A,” Colm Kelleher said two months after a $1.4 billion deal to buy Wealthfront collapsed.

By Dan Ennis • Nov. 30, 2022 -

RBC to buy HSBC’s Canada unit for $10B

The transaction, expected to close in late 2023, would bolster Canada’s largest lender with a further $99.6 billion in assets and 130 branches. It may also ease investor pressure on HSBC to divest its foreign footprints.

By Dan Ennis • Nov. 29, 2022 -

Can the SBA make its 7(a) loan program attractive to fintechs?

A new proposal could pave the way for nonbanks to grab a share of the small-business agency’s 7(a) lending program, but not everyone is convinced the program is suited for fintechs.

By Anna Hrushka • Nov. 29, 2022 -

BMO unveils $40B community benefits plan

The five-year effort aims to boost homeownership and small-business growth for borrowers of color and in LMI areas. It also comes ahead of BMO’s one-year deadline to close its Bank of the West acquisition.

By Rajashree Chakravarty • Nov. 29, 2022 -

Credit Suisse warns of $1.6B Q4 loss

Credit Suisse saw $88.3 billion in outflows between Sept. 30 and Nov. 11, the bank reported Wednesday. Wealth-management customers removed $66.7 billion of that.

By Dan Ennis • Nov. 23, 2022 -

Credit Suisse cuts one-third of China-based investment-banking jobs

The bank also laid off research staffers headquartered in the country as part of a wider effort to trim 9,000 jobs over three years. Some 2,700 cuts are expected to come this quarter.

By Gabrielle Saulsbery • Nov. 22, 2022 -

Morgan Stanley’s generational drain continues

Franck Petitgas, a 29-year veteran of the bank who has run its capital-markets business and served as global co-head of investment banking, is stepping down Jan. 1 but intends to stay on as a senior adviser.

By Dan Ennis • Nov. 22, 2022 -

JPMorgan maintains status as world’s most systemically important bank

Citigroup and HSBC maintained their position since last year at a 2% buffer while BNP joined Deutsche Bank and Goldman Sachs at the 1.5% level this year.

By Rajashree Chakravarty • Nov. 21, 2022 -

BM Technologies’ acquisition of Seattle community bank pushed to 2023

The deal would, over time, create a $2 billion-plus institution, and regulators want more details on the infrastructure that would support that growth, CEO Luvleen Sidhu said.

By Anna Hrushka • Nov. 21, 2022 -

KeyBank taps chief strategy officer as next CFO

Clark H.I. Khayat has guided the Cleveland-based lender through several niche acquisitions. He succeeds Don Kimble, who is set to retire May 1.

By Rajashree Chakravarty • Nov. 18, 2022 -

Wintrust boosts wealth management with deal for Rothschild unit

The acquisition, expected to close in the first quarter of 2023, will add $8 billion in assets under management to Wintrust’s subsidiary, Great Lakes Advisors.

By Rajashree Chakravarty • Nov. 17, 2022 -

BankProv braces for $27.5M hit on bad crypto mining loans

The Massachusetts-based bank said it has delayed the release of its financial statements for the most recent quarter, adding that losses could exceed the $27.5 million estimate.

By Anna Hrushka • Nov. 17, 2022 -

NY Fed, banks launch new 12-week CBDC project

Citi, Wells Fargo, BNY Mellon, U.S. Bank, PNC Bank, TD Bank, Truist, HSBC and Mastercard are set to participate in the proof-of-concept trial.

By Rajashree Chakravarty • Nov. 16, 2022 -

Deep Dive

How deep of a banking threat is Walmart’s One?

The retailer has scale, brand recognition and a pedigree in an ex-Marcus CEO. The proof may come when the company turns its beta test loose on customers.

By Anna Hrushka • Nov. 16, 2022 -

OceanFirst, Partners call off $186M merger

OceanFirst had closed seven acquisitions since 2015 but cited regulatory delays in the Partners deal’s disintegration. The tie-up recently passed its initial one-year deadline.

By Rajashree Chakravarty • Nov. 14, 2022 -

WaFd to buy Luther Burbank in $654M deal to enter California

The all-stock transaction, set to close in the second quarter of 2023, gives WaFd a deeper home-lending focus and will create a bank with $29 billion in assets, $23 billion in loans and $22 billion in deposits.

By Dan Ennis • Nov. 14, 2022 -

Puerto Rico’s FV Bank launches digital asset custody

The bank joins exclusive company in allowing clients to hold, transfer and settle crypto and fiat currencies in one account. But the move comes as confidence in crypto appears shaken.

By Rajashree Chakravarty • Nov. 10, 2022