Commercial: Page 27

-

BMO Capital Markets cuts 100 jobs: reports

While dealmaking has slumped 42% so far in 2023, compensation in banking has grown 17% year over year, according to research from the National Bank of Canada.

By Gabrielle Saulsbery • June 29, 2023 -

UBS could cut 35K jobs by October: reports

Employees can expect three rounds of layoffs, including one by July, according to Bloomberg. Credit Suisse's investment bank, back office and Swiss retail bank could see deep cuts, Reuters reported.

By Dan Ennis • June 28, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

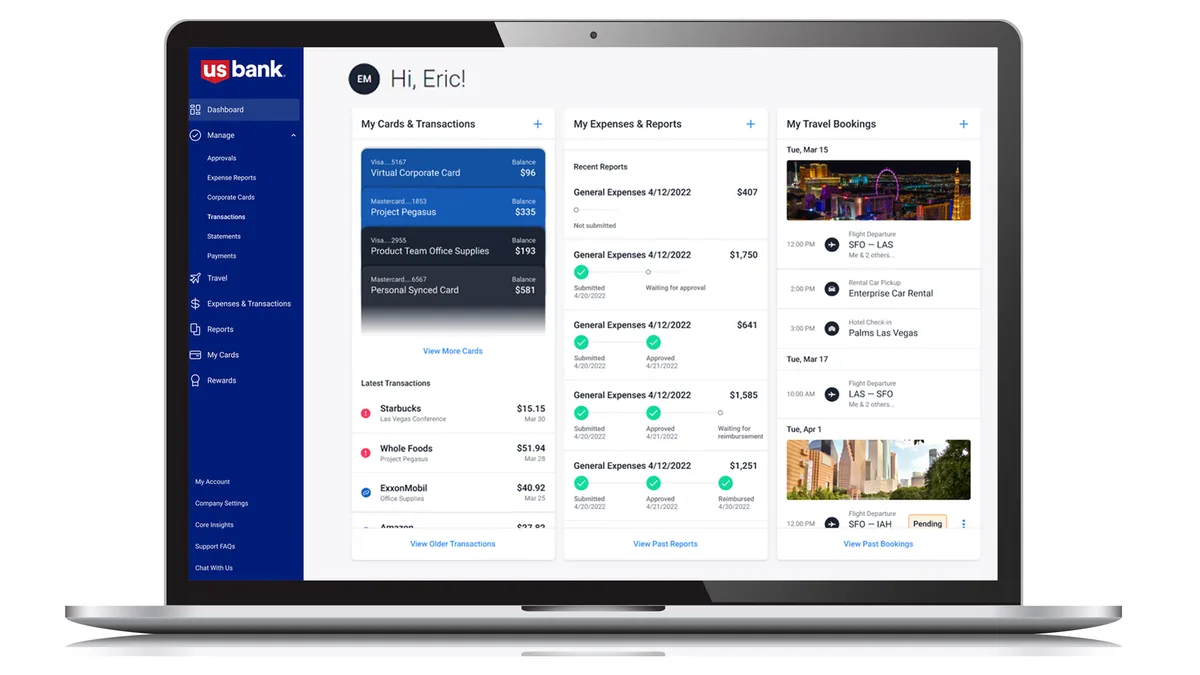

U.S. Bank’s fintech acquisition materializes in card launch

U.S. Bank and TravelBank, which it acquired in 2021, this week launched a commercial rewards card for the emerging middle market.

By Gabrielle Saulsbery • June 28, 2023 -

TIAA’s banking unit to return to legacy EverBank brand

The name change will take effect when the transaction closes this summer, and will include the home field of the NFL's Jacksonville Jaguars, the company said.

By Rajashree Chakravarty • June 27, 2023 -

At JPMorgan, Goldman and Cowen, layoffs mount

Goldman reportedly cut 125 managing directors, lending credence to earlier rumors of a third round of right-sizing at the bank.

By Gabrielle Saulsbery • June 26, 2023 -

PacWest continues liquidity push with $3.5B portfolio sale

The beleaguered bank said Monday it received $2.01 billion from a portion of the loan portfolio sale to Ares Management Corp.

By Dan Ennis • June 26, 2023 -

HSBC to leave Canary Wharf for central London HQ

The bank intends to leave its 45-story tower in late 2026 — possibly for the redeveloped former head office of telecom group BT. The move would cut HSBC’s headquarters footprint in half.

By Dan Ennis • June 26, 2023 -

JPMorgan names head to new data and analytics business

Company vet Teresa Heitsenrether will lead the charge in implementing artificial intelligence, something CEO Jamie Dimon recently called “critical to our company’s future success.”

By Gabrielle Saulsbery • June 22, 2023 -

Dimon won’t face 2nd deposition in Epstein case

A U.S. district court judge stopped an attempt by the U.S. Virgin Islands to reopen depositions against JPMorgan’s CEO in the bank’s litigation over its ties to Jeffrey Epstein.

By Rajashree Chakravarty • June 20, 2023 -

SVB’s investment bank gets a rebrand

A group led by SVB Securities CEO Jeff Leerink will buy the business from its bankrupt ex-parent company and rename it Leerink Partners.

By Dan Ennis • June 20, 2023 -

Customers Bank hires 30 Signature bankers, acquires $631M portfolio

The new team is expected to be onboarded in the next few weeks. The Pennsylvania bank bought the portfolio at approximately 85% of book value, it said.

By Dan Ennis • June 16, 2023 -

Regions customers get an extra day to avoid overdraft fees

The new enhancement will be effective from June 15 for all Regions consumer banking and private wealth management checking accounts.

By Rajashree Chakravarty • June 16, 2023 -

NFL gets $78M in loans from 16 nonwhite-owned banks

The deal will generate Tier 1 capital for the banks. Fees and interest garnered from the loan will strengthen the banks' lending power by millions of dollars, CNBC reported.

By Gabrielle Saulsbery • June 15, 2023 -

Column

Perella Weinberg’s cuts show it’s an employer’s market again

The boutique bank is cutting about 7% of its workforce to free up funds to hire top talent, Bloomberg reported. That's a far cry from January 2022, when banks were sweating first-year salaries.

By Dan Ennis • June 15, 2023 -

Wells Fargo CFO warns of commercial real estate weakness

Wells Fargo CFO Mike Santomassimo is the latest big-bank executive to detail commercial real estate distress and its potential impact on lenders.

By Maura Webber Sadovi • June 14, 2023 -

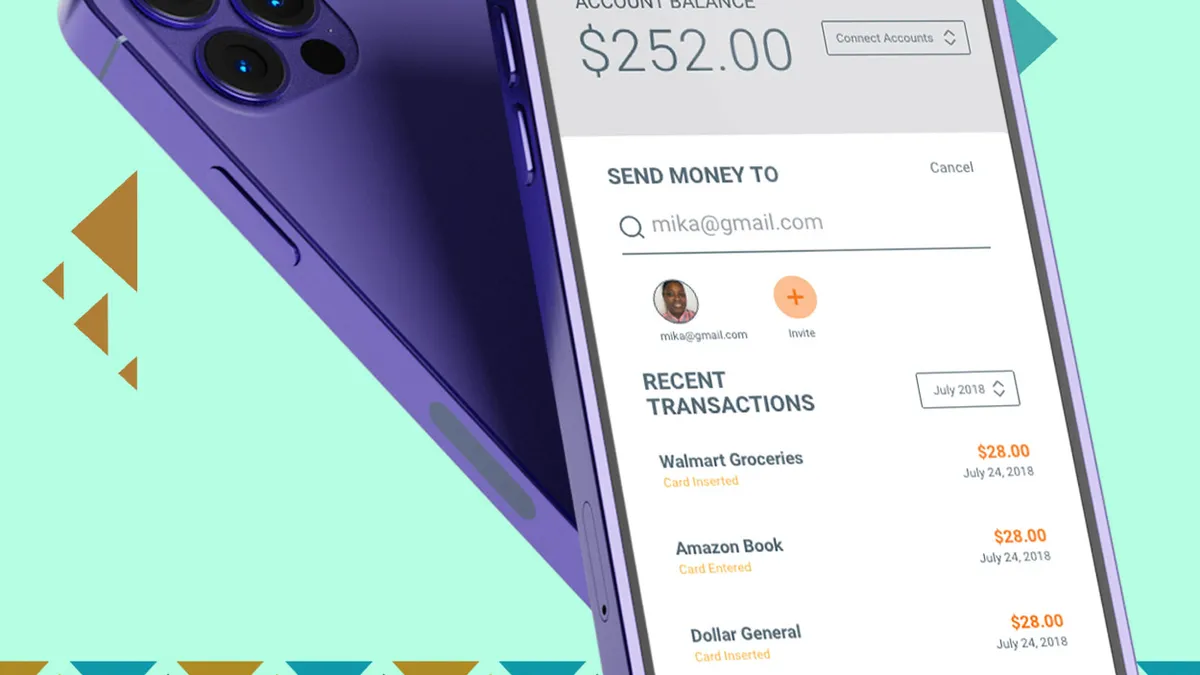

BNY Mellon, MoCaFi link up to bring digital payments to unbanked

The bank's treasury services clients will now be able to disburse payments to those without bank accounts through MoCaFi.

By Gabrielle Saulsbery • June 14, 2023 -

HSBC sustainability exec takes sabbatical

The move comes less than a week after Goldman Sachs’ Platform Solutions chief, Stephanie Cohen, took a leave of absence.

By Gabrielle Saulsbery • June 14, 2023 -

Bittrex to open for customer withdrawals

The U.S. arm of Bittrex Global filed for bankruptcy last month following regulatory enforcement.

By Gabrielle Saulsbery • June 14, 2023 -

Citizens hires 50 ex-First Republic bankers in wealth-management buildout

The hires are meant to help Citizens establish a wider presence in metropolitan New York, Boston and Florida, and add new commercial banking capabilities on the West Coast.

By Dan Ennis • June 13, 2023 -

Credit Suisse CFO, others out as UBS deal closes

Roughly 20% of the 160 leadership positions at the combined bank are coming from Credit Suisse, a UBS spokesperson told Bloomberg. Meanwhile, Credit Suisse employees must adhere to a few new rules.

By Dan Ennis • June 12, 2023 -

Column

After TD, First Horizon appears ready for its hot bank summer

Investor events for both banks this week indicate each is eyeing aggressive growth. If they were people, they might be checking each other’s social-media feeds and engaging in a relationship detox.

By Dan Ennis • June 9, 2023 -

Goldman Sachs exec Stephanie Cohen goes on leave

“I have made the decision that taking some time away from work to focus on my family is the best choice,” the Platform Solutions chief wrote in a memo Friday, according to reports.

By Rajashree Chakravarty • June 9, 2023 -

Climate First mulls Florida exit after anti-ESG bill passes

In response to the legislation, the bank nixed its exclusionary list, outlining the sectors with which it has said it won’t do business, such as the fossil-fuel sector or other extractive industries.

By Anna Hrushka • June 9, 2023 -

Morgan Stanley, JPMorgan consider cutting ties with hedge fund

The move comes after the Financial Times published a report in which 13 women accused financier Crispin Odey of misconduct. The U.K.'s Financial Conduct Authority is investigating.

By Rajashree Chakravarty • June 8, 2023 -

Citizens to end car dealer financing business

The bank had $11.5 billion of auto loans outstanding as of March 31 — down 6.5% from the end of December, and 20.1% from March 31, 2022.

By Anna Hrushka • June 8, 2023