Commercial: Page 21

-

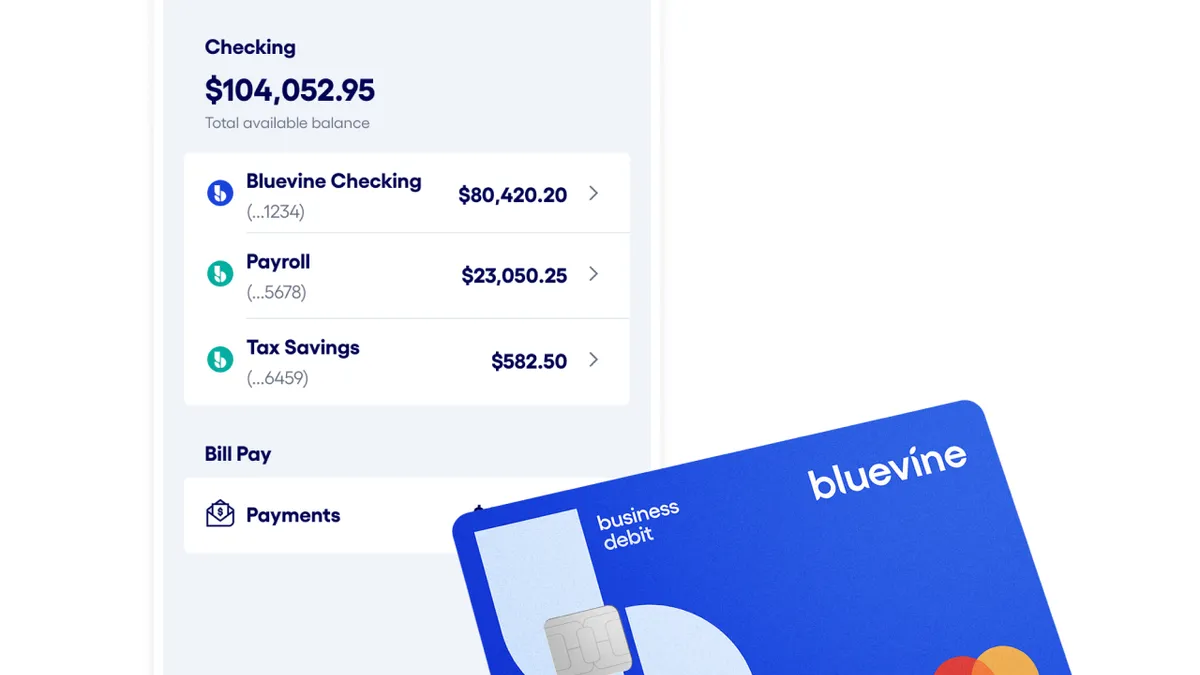

Bluevine rolls out high-yield interest rate for SMBs

The offering pairs a high return with cash flow flexibility, two features in strong demand among small-business owners, Charles Amadon, the fintech’s senior vice president and general manager of banking said.

By Anna Hrushka • Nov. 8, 2023 -

Iowa community bank becomes 5th to fail this year

The $66 million-asset Citizens Bank of Sac City, Iowa, entered receivership of the FDIC on Friday and was then acquired by Iowa Trust & Savings.

By Gabrielle Saulsbery • Nov. 7, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

UBS reports first quarterly loss since 2017

The bank paid out $500 million to retain key Credit Suisse staff, moved $5 billion in managed assets to a wind-down unit and cut headcount by 3,000. But wealth management saw $22 billion in new money.

By Dan Ennis • Nov. 7, 2023 -

Truist CFO: Structure reorg is key to $750M cost-cutting plan

CFO Mike Maguire says the bank is making good progress, as it grapples with a string of high-profile executive departures.

By Suman Bhattacharyya • Nov. 7, 2023 -

Citi considers 10% job reduction in major units: report

Chiefs of staff and chief administrative officers across the bank will be cut this month, sources told CNBC. The firm has reportedly hired Boston Consulting Group to help it carry out the plan.

By Anna Hrushka • Nov. 6, 2023 -

Goldman promotes 608 execs to managing director

Around 47% of the class hails from Goldman’s investment banking and trading arm, a figure that reflects the firm’s efforts to refocus on core competencies, following a retreat from retail banking.

By Anna Hrushka • Nov. 3, 2023 -

Former First Republic Bank executives under FDIC investigation

The FDIC can ban former directors and officers from the banking industry if they are found to have made decisions with "willful or continuing disregard" for a bank’s best interests. The FDIC can also impose fines on these individuals.

By Gabrielle Saulsbery • Nov. 2, 2023 -

"Royal Bank of Canada's global headquarters at 200 Bay Street in Toronto, Canada" by Francisco Diez is licensed under CC BY 2.0

"Royal Bank of Canada's global headquarters at 200 Bay Street in Toronto, Canada" by Francisco Diez is licensed under CC BY 2.0

RBC pumped $2.95B into City National this year to boost capital

The capital infusion was part of RBC purchasing debt securities with unrealized losses from its U.S. subsidiary, according to a quarterly call report filed with a U.S. regulator earlier this week.

By Rajashree Chakravarty • Nov. 2, 2023 -

Funding Circle gets long-awaited shot at SBA lending

Funding Circle joins Arkansas Capital Corp. and Alaska Growth Capital BIDCO as the first nondepository institutions to be granted new Small Business Lending Company licenses in 40 years.

By Anna Hrushka • Nov. 1, 2023 -

SEC investigates Wells Fargo’s cash sweep feature

The SEC is investigating the cash sweep options the bank provides to investment advisory clients, adding to the laundry list of regulatory scrutiny the bank has come under in recent years.

By Anna Hrushka • Nov. 1, 2023 -

BMO to lay off 228 in California

The Canadian lender continues to shed positions following its acquisition of San Francisco-based Bank of the West in February.

By Anna Hrushka • Nov. 1, 2023 -

TD buys carbon removal credits

Over four years, TD said it will purchase 27,500 metric tons of direct-air-capture carbon dioxide removal credits from Occidental Petroleum. Financial details of the transaction were not disclosed.

By Gabrielle Saulsbery • Nov. 1, 2023 -

Nides to exit Wells Fargo to focus on Middle East

Thomas Nides, a former U.S. ambassador to Israel, said the events in Israel and Gaza have had a “profound effect” on him. William Daley will return to his prior role as vice chairman of public affairs.

By Rajashree Chakravarty • Oct. 30, 2023 -

What bank, fintech execs are saying about AI

Ahead of the Biden administration’s landmark executive order unveiled on Monday, banks and fintech executives discussed AI use cases and implications at Money20/20 last week.

By Anna Hrushka , Gabrielle Saulsbery • Oct. 30, 2023 -

Sponsored by Amdocs

Merchants demand more from banks and their payment devices experience

As banks look to remain competitive in acquiring merchants and win out over fintechs, they must modernize in four different areas and go beyond just a digital facelift.

By Zur Yahalom, Senior Vice President, Head of Financial Services at Amdocs • Oct. 30, 2023 -

JPMorgan CEO Jamie Dimon to reduce stake in bank

Dimon and his family plan to sell $141 million worth of shares in the New York City-based firm, marking the CEO’s first such stock sale since taking the helm of the bank almost two decades ago.

By Anna Hrushka • Oct. 27, 2023 -

Old National to buy CapStar in $344M deal

The deal would boost the Evansville, Indiana-based lender’s assets by $3.3 billion and help it expand in Nashville, Tennessee, and three other high-growth metro areas, the companies said.

By Rajashree Chakravarty • Oct. 27, 2023 -

Capital One leapfrogs Citi in small-biz banking satisfaction

A J.D. Power study found that the small-business owner satisfaction index has jumped due to improved digital experience and in-person support channels.

By Rajashree Chakravarty • Oct. 26, 2023 -

Morgan Stanley names Ted Pick as next CEO

The move caps a years-long, three-way race to find a successor to James Gorman. But the bank also gave expanded roles — and $20 million one-time bonuses — to each of its contenders.

By Dan Ennis • Updated Oct. 27, 2023 -

U.S. Bank claims spot in the BNPL space

The launch of the point-of-sale option Avvance comes as nearly one in five consumers surveyed by the New York Fed say they've used buy now, pay later loans within the past year.

By Gabrielle Saulsbery • Oct. 26, 2023 -

Cross River CEO predicts ‘bonanza’ for fintech, BaaS banks in 2024

While elevated interest rates continue to hammer traditional firms, banking-as-a-service remains a strong business model for tech-savvy firms who have fostered partnerships with fintechs, Gilles Gade said at Money20/20.

By Anna Hrushka • Oct. 25, 2023 -

Cadence Bank to sell its insurance unit to Arthur J. Gallagher for $904M

The sale of Cadence Insurance is expected to help generate capital while boosting the bank's strategic transformation effort and growing its core functions.

By Rajashree Chakravarty • Oct. 25, 2023 -

17 AGs push back on language in JPMorgan’s Epstein settlement

Language in the settlement limits governments from seeking damages from sex trafficking, New Mexico Attorney General Raul Torrez wrote. Similar language is not included in Deutsche Bank's agreement.

By Dan Ennis • Oct. 24, 2023 -

Goldman alum Sarsfield to become CEO of asset manager P10

The 23-year Goldman veteran served as global co-head of asset management until December, then left the firm four months later.

By Rajashree Chakravarty • Oct. 23, 2023 -

Fed approves Banc of California’s PacWest acquisition

The deal, now set to close by the end of the year, would nearly quadruple the Santa Ana-based lender's asset total and create the third-largest California-based commercial bank.

By Dan Ennis • Oct. 23, 2023