Alternative payment methods (APMs) have experienced widespread adoption in many global markets, raising this question: Can APMs ever gain significant traction in the US, a market heavily dominated by card payments? An EY survey of large US merchants1 reveals that more than 85% of merchants are planning to accept new APMs — defined as nontraditional payments, like digital wallets, account-to-account (A2A) bank transfers and buy now pay later (BNPL) — in the next one to three years. With digital wallets (funded via a card or bank account) now serving as the leading method of payment for North American e-commerce purchases,2 the time may well be now for APMs to be at the forefront of the US payment roadmap.

Given the changing market landscape, issuers, acquirers, processors and PayTechs should consider investing in APMs as the following drivers become prominent:

- Customers demand rich, frictionless experiences bundled with rewards. The pandemic greatly accelerated customer demand for frictionless digital payments, particularly when combined with differentiated offerings. BNPL and wallet players, for example, provide price drop notifications, targeted rewards and merchandise tracking as additional benefits beyond typical payment and lending services. Similarly, as customers are embracing new ways of paying that make their commerce journey simpler, J.P. Morgan Payments, as an example, is piloting biometrics payments, where a user can scan a palm or face for a secure and faster checkout experience.3 Merchant-owned apps are increasing digital engagement by including order-ahead and pick-up services, gamified loyalty points and seamless QR code-based checkouts. According to Manish Jain, Head of Consumer Goods & Retail, J.P. Morgan Payments, “checkout is the last touch point of the customer journey; having an experience like biometrics not only helps customers check out faster, but also makes purchasing easier and memorable.”

- Merchants are looking to simultaneously grow sales and reduce payment acceptance costs. Facing uncertain economic conditions and rising operating costs, merchants are increasingly looking to their payment providers to help them grow their top line and reduce costs of payment operations. In our merchant survey, over 70% of merchants recognized that failing to accept APMs could impact sales, putting pressure on acquirers to make them readily available. On the cost side, APMs, especially A2A or closed-loop payments, can offer a competitive edge by reducing typical payment processing costs associated with cards and supporting faster merchant funding via new instant-payment rails.

- Payment providers are seeking opportunities to diversify payment revenue. APM payment volume reached $19t globally in 2022, meaning that processing fees alone may have approached up to $250b.4 While a portion of these fees are contributing to credit card interchange income since wallets can be funded via cards, that income could be at risk as A2A, BNPL and other payment methods grow in adoption. Further, as regulators continue to scrutinize late, overdraft and interchange income — with some recent regulatory proposals in the US seeking to cap swipe fees to increase competition — incumbents need to have a diversified payment revenue strategy while protecting existing income streams.

In addition to these drivers, as customers interact directly with APM providers, banks risk witnessing their brand getting relegated to the background and consequently losing market share, especially as leading APM providers now offer competing bank-like services. In response, banks are already working toward launching their own digital wallet5 that can help bring new revenues and drive customer engagement. Some are looking to directly offer competing APMs to rival new providers, like Citi expanding their “Citi Pay” services, which offers customers new payment options, like revolving lines of credit and installment loans.6

Strategic go-to-market considerations

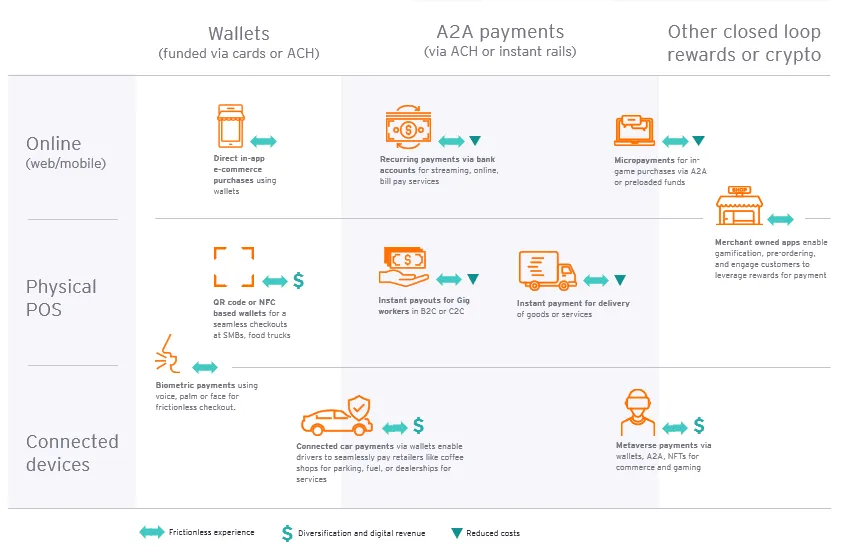

It is unlikely that a single solution would address all drivers, given that different use cases and commercial contexts demand different offerings. For example, A2A payments via ACH may be a great option for online recurring transactions, whereas a QR-code-supported wallet is better-suited to physical POS. The snapshot below provides a view into the emerging APM use cases and how providers can utilize different channels (e.g., online, physical POS, connected devices) with a combination of unique payment instruments and rails (e.g., cards, ACH, instant, closed-loop systems) to optimize the cost of processing.

Emerging APM use cases across channels

Optional CaptionPermission granted by EY

Optional CaptionPermission granted by EYTo capitalize on these changing dynamics and strengthen revenue streams, payment service providers should consider the following as they build out their investment strategy for APMs:

- Examine customer needs and identify the most relevant business verticals and customer segments. Merchants and payment providers alike need to identify their target segments, understand the intended value-add for the customer and evaluate which incentives effectively encourage APM adoption. Younger generations, like Gen Z and millennials, have shown a high propensity to use APMs and are expected to continue that trend, with the demographic alone projected to have over

87 million APM users by 2026.7 Domains, like e-learning, gaming, online retail and wealth management, have shown promising indications to be the top verticals that are looking to offer APMs. - Strengthen back-office, risk and compliance operations. According to our merchant survey, fraud management and regulatory compliance capabilities were the key factors that merchants considered when choosing payment processors, with 87% of respondents claiming it as a priority.8 Payment service providers should focus on offering critical services, like fraud reduction, dispute management and compliance measures, for changing regulations, like Reg E, as a foundation for their full-service APM solutions, particularly when these value-added services are nonnative to the solution.

- Evaluate strategic partnerships. Strategic partnerships should be built with PayTechs and other players across the payment ecosystem to offer specialized capabilities, like digital overlays, account validation, fraud monitoring and dispute handling while decreasing time-to-market and optimizing investment spend. J.P. Morgan Payments, as an example, has partnered with Mastercard to start offering simplified and secure Pay-by-Bank solutions to its merchants leveraging open banking capabilities.9 Max Neukirchen, Head of Payments & Commerce Solutions, J.P. Morgan Payments confirms, “In today’s environment, it’s critical to help our merchants remove any barriers for their customers to buy – that means enabling all payment methods, including pay-by-bank, digital wallets, and biometrics, to deliver a seamless experience not only for their customers, but for our merchants in their back-end processes as well.” Banks building these services should collaborate with internal lines of business, like issuing/lending partnering with the merchant acquiring business to expand the market reach of their new APMs in a potential B2B2C model.

Summary

As APM adoption continues to grow, incumbent banks need to act now to avoid operating solely as a background funding instrument. Offering new digital payment solutions, especially those that blend lending, rewards and personalization, along with multichannel and payment rail flexibility, can create new revenue pools and further drive customer engagement.

The views reflected in this article are those of the author and do not necessarily reflect the views of Ernst & Young LLP or other member firms of the global EY organization.

1 EY survey of 60+ merchants with >100m revenue

2 Worldpay from FIS®, The Global Payments Report 2023

3 Biometrics-Based Payments Pilot | J.P. Morgan (jpmorgan.com)

4 EY analysis

5 https://www.wsj.com/articles/banks-plan-payment-wallet-to-compete-with-paypal-apple-pay-11674433472

7 Insider Intelligence: Payments Trends to Watch for 2023

8 EY survey of 60+ merchants with >100m revenue

- Examine customer needs and identify the most relevant business verticals and customer segments. Merchants and payment providers alike need to identify their target segments, understand the intended value-add for the customer and evaluate which incentives effectively encourage APM adoption. Younger generations, like Gen Z and millennials, have shown a high propensity to use APMs and are expected to continue that trend, with the demographic alone projected to have over