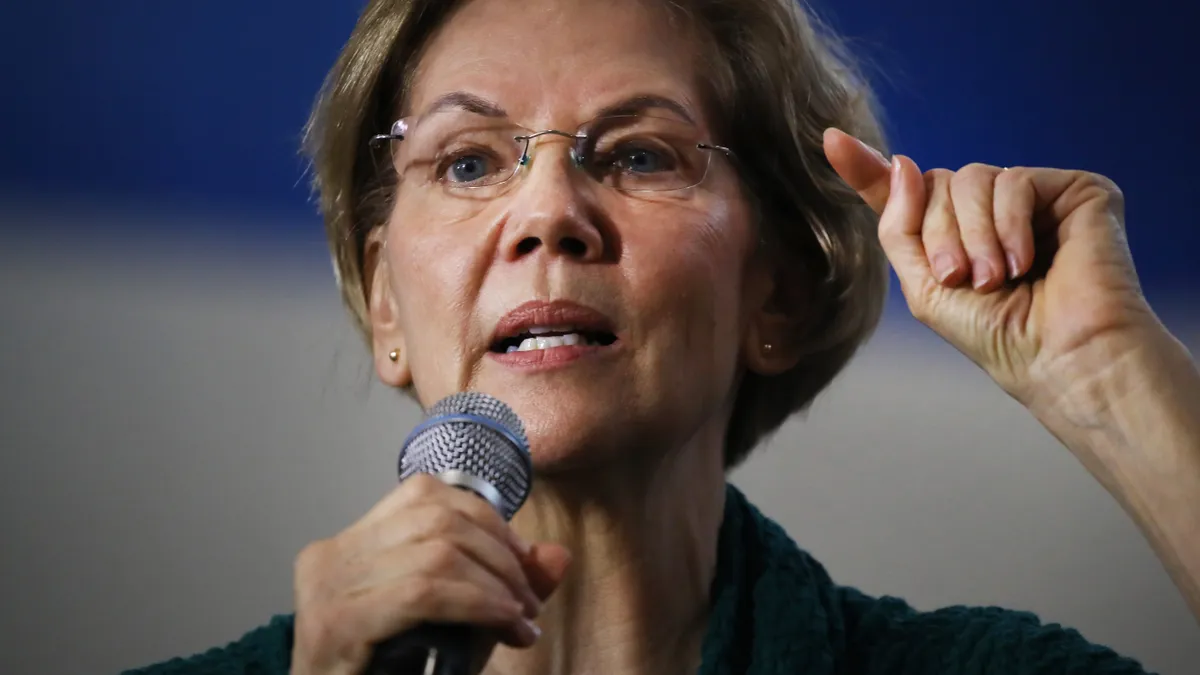

In a letter Sunday, Sen. Elizabeth Warren, D-MA, called out the Office of the Comptroller of the Currency for talking tough with regard to bank mergers and acquisitions but, in her view, failing to follow through.

Warren and 12 congressional Democrats wrote Acting Comptroller Michael Hsu and the Federal Reserve’s vice chair for supervision, Michael Barr, urging the regulators to block Capital One’s proposed $35.3 billion acquisition of Discover on the grounds that it would reduce competition — and, with it, take away card issuers’ incentives to offer customers favorable terms.

Warren and the co-signers also asked Hsu to strengthen a policy statement the OCC issued last month that aimed to give more transparency into how merger applications are considered and which factors add up to approval.

The proposal would do away with a 1996 OCC rule dictating that bank deals are deemed approved by the OCC on the 15th day after the end of the comment period, unless the agency removes the filing from expedited processing.

“One risk is that we approve too many mergers and therefore we’re approving bad mergers. The other risk is we approve too few mergers and therefore there are good mergers that should happen that aren’t,” Hsu told Reuters last month. “The purpose of being transparent is to encourage more accuracy on both ends.”

Warren, however, argued the OCC’s “actions fly in the face of these concerns.”

“The agency approved almost every merger application it received in the last three years: 43 mergers in 2021, 30 in 2022, and 23 in 2023,” including JPMorgan Chase’s acquisition last year of First Republic, she wrote.

The policy statement, she added, “essentially codifies the OCC’s current, permissive approach to bank mergers — the same standard operating procedure that for decades has failed to protect consumer and the financial system.”

This is hardly the first eight-figure proposed bank deal against which Warren has spoken out. Warren in June 2022, urged the OCC to block TD’s proposed $13.4 billion acquisition of First Horizon, citing a Capitol Forum report that alleged TD incentivized employees to enroll customers in new accounts and services like overdraft protection without their consent. TD and First Horizon terminated the deal over “uncertainty” as to whether or when the tie-up would gain U.S. regulators’ approval.

The U.S.’s preeminent bank CEO, JPMorgan Chase’s Jamie Dimon, advocated Monday for Capital One to get a fair shake.

“My view is, let them compete,” Dimon told CNBC. “Let them try, and if we think it’s unfair, we’ll complain about that.”

If the acquisition is approved, Capital One would surpass JPMorgan as the nation’s largest credit card lender.

Approval, in Dimon’s eyes, would also mean Capital One would have an “unfair advantage versus us” in debit payments because the Durbin Amendment limits debit fees for large banks, but not card companies like Discover.

“Of course, I have a problem with that,” Dimon told CNBC. “You know, like why should they be allowed to price debit different than we price debit just because of a law that was passed?”

Warren, meanwhile, went on to list further objections to a Capital One-Discover tie-up, including each company’s past transgressions. She noted the 2019 breach of Capital One customer data by a former employee of the bank’s cloud provider, Amazon Web Services. Warren also pointed to the October consent agreement Discover reached with the Federal Deposit Insurance Corp. over shortcomings in the card network’s compliance management system.

Warren also noted a report another regulator, the Consumer Financial Protection Bureau, issued this month that found “[n]early half of the largest credit card issuers” — including Capital One — “offer[ed] cards with a maximum purchase [annual percentage rate] over 30%.” Average fees charged by large card issuers are 70% higher than those charged by small institutions, the bureau also found.

Warren sought to ensure the OCC’s stance matched President Joe Biden’s 2021 executive order aiming to provide “more robust scrutiny” of bank mergers. She cited Capital One-Discover as “one of the most important tests” of that effort.

Hsu, for his part last month, said “merger applications exist along a spectrum.”

“Some have significant deficiencies. Others are straightforward because the acquiring bank is a model of safety and soundness and has earned the trust of the community and its supervisors,” he said. “The majority lie somewhere in between and require varying degrees of scrutiny and multiple rounds of inquiry.”

The Capital One-Discover proposal, Warren argued Sunday, “has significant deficiencies.”