Dive Brief:

-

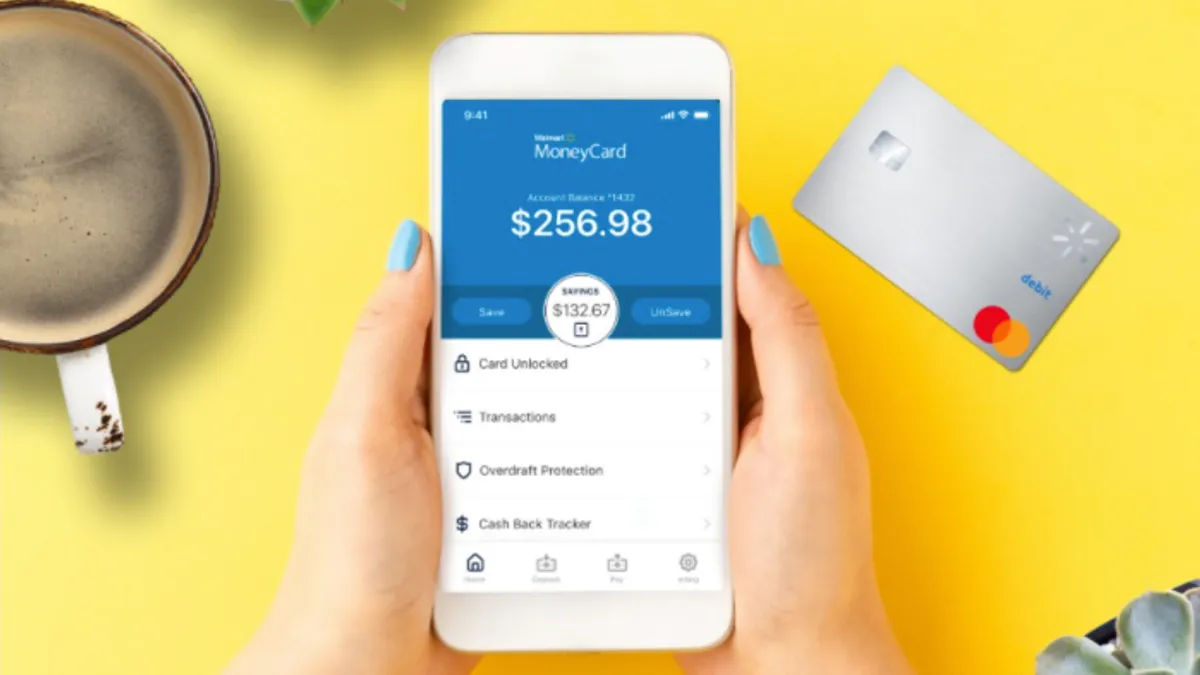

Walmart and the fintech Green Dot said Thursday the retailer's MoneyCard is now offered as a demand deposit account, according to a press release. Users can manage their finances digitally or at Walmart's 4,500 locations or more than 90,000 Green Dot retail distribution locations nationwide.

-

Consumers who convert their Walmart MoneyCard to a demand deposit account can access perks such as overdraft protection and no monthly fee for a qualifying direct deposit of $500. Walmart MoneyCard users can access a digital banking platform that is "similar to a traditional banking account," the retailer said.

-

Walmart is offering a $20 bonus to customers who activate a Walmart MoneyCard bought online or in-store and deposit $500 or more by Aug. 15, the retailer said.

Dive Insight:

Walmart has more than 1 million MoneyCard account holders across the U.S. and Puerto Rico, according to Thursday's announcement. The company plans to add more features for demand deposit account holders.

"We are excited to work with Green Dot to provide a more convenient and innovative way for customers to manage their finances with the new Walmart MoneyCard, which offers cash back, overdraft protection, direct deposit, interest on savings and more," Julia Unger, Walmart's vice president of financial services, said in a statement.

The rollout of demand deposit accounts marks a continuation of Walmart's relationship with Green Dot. In 2019, the companies renewed their prepaid card deal through Jan. 1, 2027. That same year, the companies teamed up to create fintech accelerator TailFin Labs to develop products, services and technologies that integrate omnichannel shopping for consumers and businesses with Green Dot's banking-as-a-service platform.

Walmart is also creating a fintech startup, in partnership with venture capital firm Ribbit Capital, to "develop and offer modern, innovative and affordable financial solutions." Although details have been scarce — apart from a trademark filing that revealed the name and a potential logo for Hazel by Walmart — the startup managed to poach two leading executives from Goldman Sachs's consumer banking arm, Marcus.

Walmart is also teaming up with Green Dot and PayNearMe to provide customers a new way to pay their bills in cash at its stores.