This week’s Money20/20 conference in Las Vegas seemed equal parts Athenian democracy and New York Stock Exchange floor. Thousands of people huddled together in discussion spaces to hear an exchange of ideas and perhaps pick up some stray wisdom for their business or personal finances. And yet the central expo hall could be a chaotic fever dream of sales pitches.

The drumbeat driving all of this was the search for what’s new:

-

"Identity is the new money," said panelists from PayPal and Citi.

-

"Data is the new oil," was attributed to executives at both BBVA and Mastercard.

Or what’s next, which itself seemed contradictory at times:

"Simply being good at one thing is a great starting point, but it won’t last," David Talach, the general manager of payments at Square, said Wednesday at the conference. "Even with suites of products, that window will close."

Meanwhile, the splashiest news announcement at the conference was just that: a new suite of products in a payment platform by Uber.

Other legacy brands drilled the idea that, "Hey, we’re not just this." Even arriving at the airport, those retrieving their luggage were surrounded by digital Mastercard billboards that read, "Vegas, our game goes beyond cards."

Yet couched beneath the pivots toward the future was a fear of stagnation:

"Our biggest competitor is inertia — a lack of awareness in the marketplace," said Dustin Cohn, head of brand and marketing for consumer and investment management at Goldman Sachs.

And a desire to connect to people, be it as they reflect all of us:

- "You are what you spend."

-

"Data is an extension of the individual’s identity … [that] can and should be used to create a more sustainable world," said Carlos Torres Vila, BBVA’s chief executive.

Or on a virtual level:

-

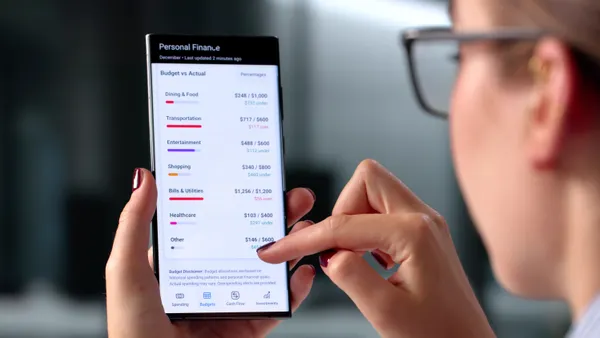

Peggy Mangot, the head of Wells Fargo’s Greenhouse, described her bank’s money management tool as a coach standing side by side with the consumer, helping him or her create better outcomes.

But an unequivocally human plea hit me the hardest:

-

"I would rather die than to disappoint a Walmart or an Apple or a Stash or an Uber or anyone else," said Green Dot CEO Steve Streit, on what keeps him motivated after 20 years leading the company. "Or a Green Dot customer who calls me at midnight because they got my cell phone off the internet, and is angry because this and that happened to their card — and I’d handle it. And there’s a certain piece of that that becomes addictive."

It's easy among 12,000 reported attendees to feel anonymous. But in hearing such a raw ache amid the polish of public relations, I found the beating heart of banking.