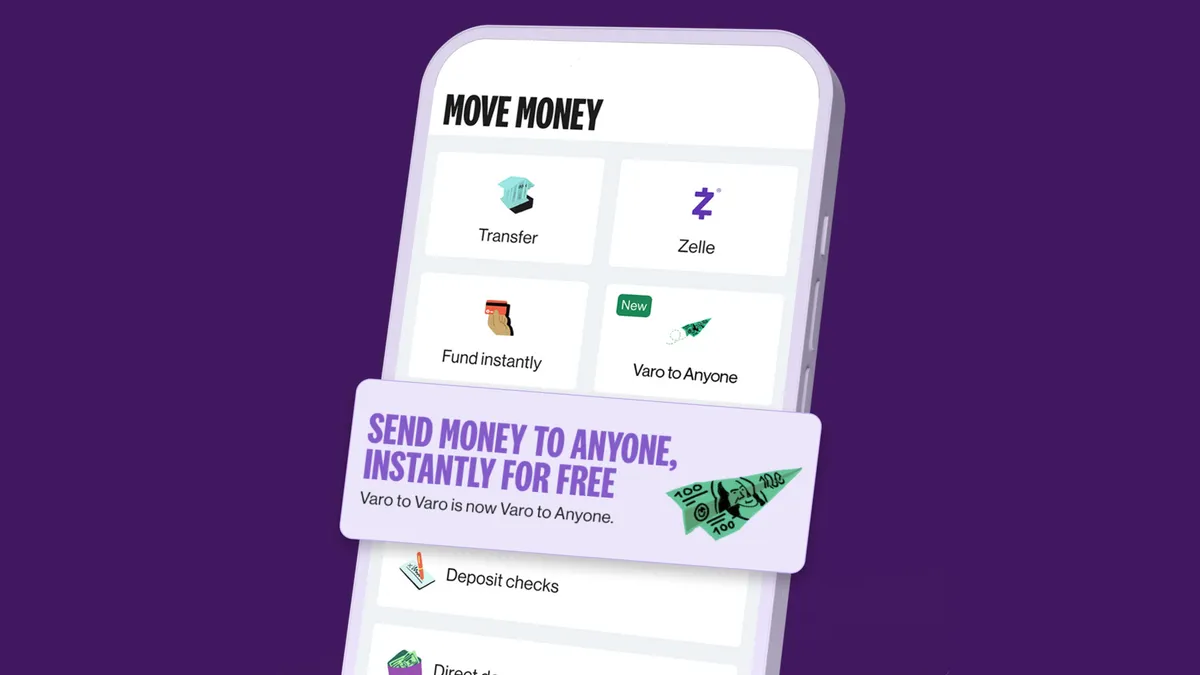

Varo Bank customers can now send funds to anyone with a U.S. bank account, the company announced Thursday, part of a new feature called “Varo to Anyone.”

The feature allows Varo account holders to instantly transfer funds at no cost to anyone with a U.S. debit card, the company said.

After inputting a recipient's U.S. phone number or email in the Varo app, the recipient will get a text or email notification about the payment with instructions on receiving their funds.

They can instantly transfer the money for free to their bank account by entering their debit card information in Varo Bank’s portal, according to the firm.

“It's all operating on our secure platform,” said Colin Walsh, CEO of Varo Bank, which in 2020 became the first neobank to be granted a national bank charter by the Office of the Comptroller of the Currency. “As an OCC regulated bank, we are subject to a lot of scrutiny. The recipients have to come onto our platform to claim the funds, so it's a really secure way of moving money.”

The feature is the third iteration of Varo’s peer-to-peer payments offerings. “Varo to Varo” allows the bank’s customers to send funds to other Varo account holders. Varo customers also have access to Zelle, the bank-owned P2P payments network that allows for money transfers to other bank account holders with Zelle access.

But despite having access to the aforementioned payment methods, many Varo customers still use third-party payment apps to send money, Walsh said.

“Almost 3 million transactions a month … were going through peer-to-peer rails like Cash App, Venmo and PayPal,” he said.

Walsh said he hopes Varo’s latest P2P feature will displace some of the payments volume going through third-party rails, bringing more transaction activity into Varo’s ecosystem.

As for the bank’s future plans for Zelle, Walsh said Varo is taking a wait-and-see approach to how it moves forward with the payments feature.

“We don't know yet — because it's still early days — if there is a kind of cannibalization of the Zelle volume now that we have Varo to Anyone, or if it is just different transaction types,” he said.

Low-cost marketing

Walsh is betting the ability to send money to any U.S. bank account, without having to use a third-party payment app, will have broad appeal to Varo’s core demographic: Americans who live paycheck to paycheck.

The new feature comes as Varo looks to regain its footing following a difficult 2022, where it laid off 10% of its staff and made cuts to its advertising budget.

At the time, the bank’s burn rate put the firm at risk of running out of funds by the end of that year, prompting the firm to make the cuts in an effort to move closer to profitability.

In tandem with the bank’s efforts to rein in spending, Varo launched Varo Tech, a business unit aimed at reducing costs and allowing more internal collaboration across the company.

Walsh hopes Varo to Anyone, born out of Varo Tech, will work as a marketing tool for the bank, filling in the bank’s gap in advertising activity following the budget cuts.

“This is a way of getting our message out in front of millions of consumers without having to do expensive marketing,” he said. “It’s a creative product-lead way of getting out in front of consumers who may not otherwise have had exposure to the brand.”

Varo beta-tested the new P2P feature with a “few hundred thousand” accounts over several weeks before its official launch Thursday, Walsh said.

“We're seeing really nice pickup and adoption on this, both in terms of money being sent, but also recipients clicking through and applying for Varo accounts as well,” he said. “We've been very pleased with the early results.”

Varo’s efforts to cut out the middleman — in this case, P2P payments apps like Venmo and Cash App — follow a warning from Consumer Financial Protection Bureau Director Rohit Chopra regarding consumers’ use of digital wallets and money-transfer apps to store funds.

Instead of just moving money from place to place, many consumers maintain balances on P2P apps, which in most cases are not fully insured, Chopra said during a Washington Post Live event in April.

Chopra urged users who maintain balances on their digital wallets and money-transfer apps to move any uninsured money to a bank account.