U.S. Bank’s 2021 acquisition of TravelBank, a travel and expense management fintech, gave birth to its first collaborative launch Tuesday: a middle-market focused commercial rewards card.

According to U.S. Bank Head of Middle Market Bankcard Product Dan Skaggs, the new card “definitely delivers on one of the strategic intents” the bank had with the acquisition of TravelBank, one of a handful of moves it’s made since 2019 to optimize expense management for corporate clients.

There was a gap in the marketplace, Skaggs explained. Small businesses with a couple of hundred employees start to experience bigger problems and bigger needs as they scale and grow, including expense management issues, he said.

While what’s available to growing small businesses now is too simplistic – with many companies relying on Microsoft Excel and emailed photos of receipts – the expense management solutions available to larger businesses are “extremely complex [and] their user interfaces are very dated,” and therefore are also not the right fit for the emerging middle market, he said.

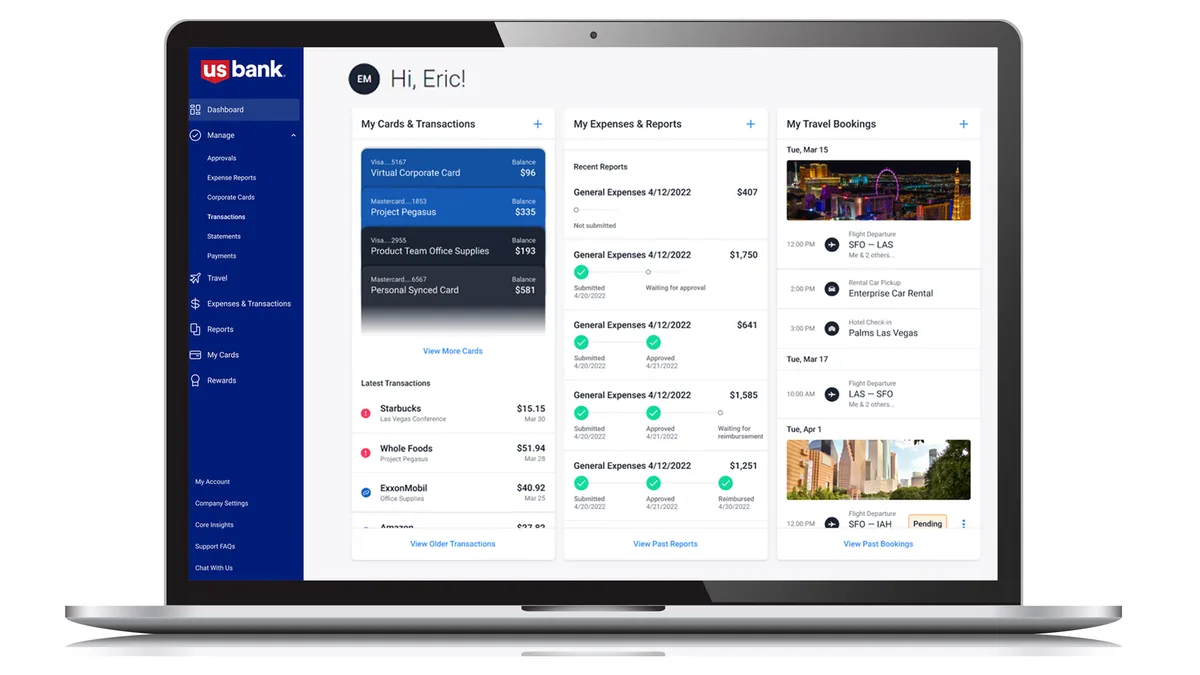

The all-in-one card, expense and travel management solution launched Tuesday aims to help such businesses, particularly those with $10 million to $150 million in annual revenue, automate expense management, control spend and earn rebates for business expenses.

The need is there: Roughly seven in 10 CFOs believe that travel and expense management absorbs more of their finance teams’ time and attention than it should, according to a survey of 150 finance executives by CFO Dive earlier this year.

TravelBank co-founder and CEO Duke Chung said that remedying that issue was exactly what he and his co-founder Reid Williams set out to do in 2015.

“By joining forces with one of the leaders in corporate payments, we’re making that vision a reality. Both TravelBank and U.S. Bank have deep experience serving emerging middle market companies, and we’re confident the Commercial Rewards Card will help them continue to grow,” Chung said.

Businesses that utilize U.S. Bank’s commercial rewards card product can issue cards to multiple employees, with no annual fee and no card issuance fee, and set both dynamic card controls and customizable travel policies.

“Maybe [for one person] we're going to be a little more lenient, and we'll let [them] spend at certain types of merchants or certain types of retailers. But for [another person], they can only go to, let's say, Staples, or go buy supplies on it. You have that complete kind of control over the card,” Skaggs said.

With every swipe of the card, employee expenses are automatically reconciled, leaving no one with the clunky responsibility of Excel expense reports and emailed receipt photos, he said.

As for the future, Chung said TravelBank and U.S. Bank would be partnering with the bank further on delivering value to emerging market clients, though he neglected to share details.

“Another thing that's really exciting is by bringing together the products, we're also able to bring together a lot of data … and we think the data is really powerful for these businesses to make better decisions moving forward. The card data, the expense data, the travel data – we're looking at a lot of that and using our experience around fintech to help [U.S. Bank] accelerate the momentum of innovation.”