Challenger bank Upgrade secured $40 million in a Series D funding round led by Santander InnoVentures, the venture capital fund of Santander Group, last week — fresh capital the fintech plans to use to boost its credit card and launch a new mobile banking platform.

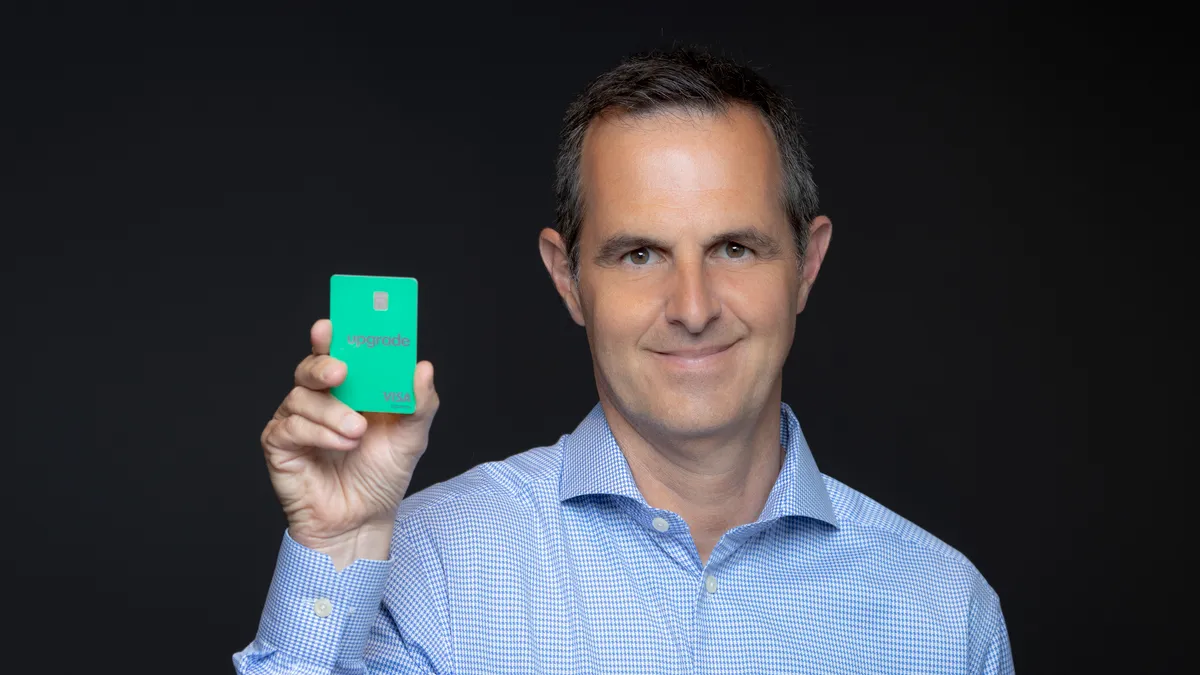

The company's co-founder and CEO, Renaud Laplanche, said the investment, combined with the current environment created by the coronavirus pandemic, make it the perfect time to bring mobile banking to Upgrade's users.

"The mobile account will significantly expand our offerings," Laplanche told Banking Dive, adding that a digital checking account, called Upgrade Account, is expected to launch this year. "And we think it's the right time to bring a differentiated new bank model to a more mainstream, mature population."

Chris Gottschalk, senior adviser at Santander InnoVentures, who will be joining the Upgrade board, said the firm is "excited to support Upgrade in their next stage of growth."

"Upgrade is building a neobank with credit at its heart, which we believe is a smart strategy as credit represents 70% of banking revenue globally and is often the main reason customers seek banking services," he said in a statement.

Upgrade's latest funding round has also boosted the startup’s valuation to $1 billion, giving it "unicorn" status alongside other neobanks such as Chime, Dave, Monzo, Revolut, N26 and NuBank, all of which are valued at or above $1 billion.

"It shows that our category is growing and there is growing interest to explore banking outside of the traditional banks," Laplanche said.

Laplanche, however, is quick to point out key differences he sees between Upgrade and its challenger bank peers.

The San Francisco-based company offers personal loans and cards to customers with the goal of providing products not offered by traditional banks, Laplanche said. The company said it delivered more than $3 billion in consumer credit through cards and loans since its launch in 2017.

Upgrade's credit card, which the company launched in October, is also unique in the way it combines monthly charges into installment plans and allows customers to choose a period between 24 and 60 months to pay it off. The company debuted a contactless card in April.

Another differentiation Laplanche points out is the company’s target demographic.

Upgrade’s customers are, on average, 42 years old with an annual income of $90,000 and a credit score of around 700, metrics that skew higher than most other digital banks.

"Typically, challenger banks have been focusing on younger populations, lower credit quality or incomes, often underbanked," Laplanche said. "We have some very mainstream consumers including some more mature consumers who didn't really grow up in a digital environment, and over the last three months really discovered online banking with a lot of branches closed."

In addition to launching Upgrade Account, Laplanche said he is considering offering auto loan products.

"We see some interesting potential, particularly right now with auto refinancing," he said. "There aren't a lot of auto purchases going on right now, but interest rates have come down a lot. So this is potentially an interesting time to refinance for consumers, especially those who financed their cars from the dealers directly."