Embedded finance fintech Unit has cut 15% of its staff, according to a company blog post.

Co-founders Itai Damti and Doron Somech told affected employees June 17 and announced it publicly on a blog post shortly thereafter, citing slower than expected revenue growth and plans to become profitable without additional capital raises.

A Unit spokesperson would not confirm the amount of employees affected. According to PitchBook, Unit had 172 employees in 2023, meaning the 15% cut amounts to about 25 employees.

“We believe that our company needs to think in longer time frames,” they wrote. “Banks in the fintech ecosystem have slowed down in the last year due to increased regulatory scrutiny. While we believe that the slowness is temporary and Unit will actually benefit from the resulting regulatory clarity, it will take time. For now, we need to focus on efficiency and account for slower than expected revenue growth.”

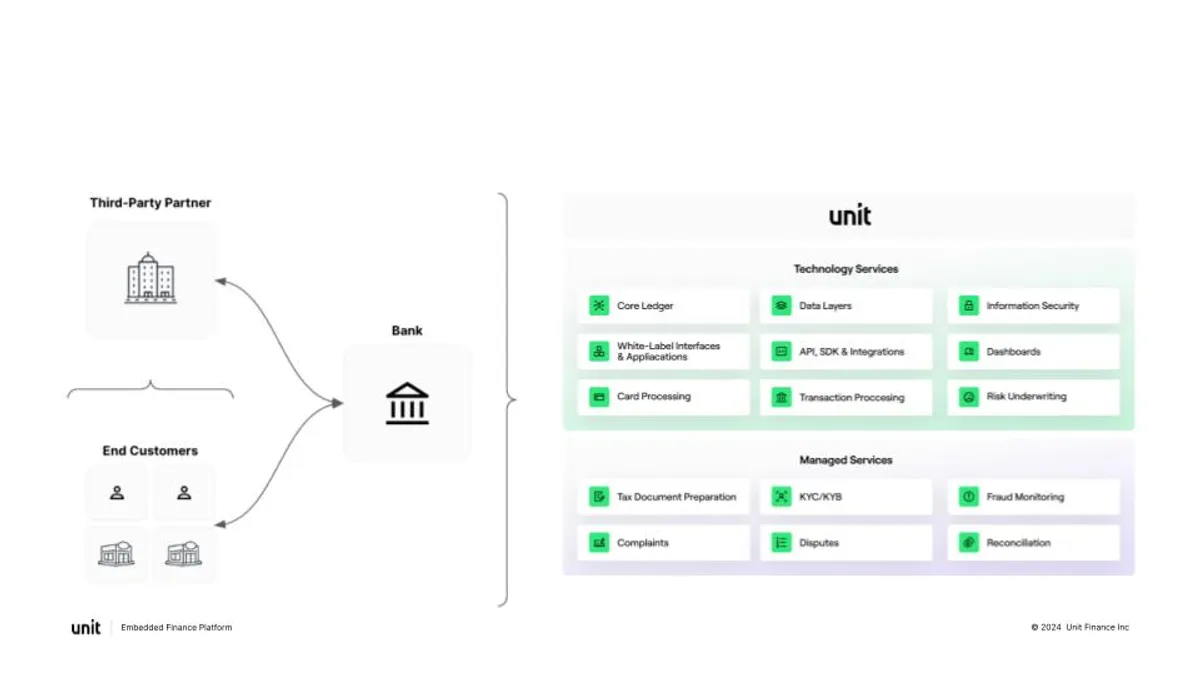

The duo founded Unit in 2019 to build infrastructure enabling banks and technology companies to enter direct relationships. In five years, the company has grown to have eight bank partners and work with high-growth start-ups and publicly traded companies alike, serving 1.38 million end-customers in the first quarter of 2024 with an annualized transaction volume of $28.7 billion, according to data shared by Unit in May.

In May, Damti, also the CEO, addressed the increased regulatory scrutiny fintech faces, and the costs Unit has incurred to rise to the occasion.

“We’re at a point in time where the bar for operating in the space is rising quickly for banks, and Unit wants to be well-positioned to serve those banks and grow our partner bank network,” Damti told Banking Dive at the time.

In the blog post, Damti and Somech noted that their firm “has always maintained a large balance sheet, and the changes we are making today will further solidify our strength.”

“While we could choose to raise additional capital in the future, we’re executing on a plan to become profitable without the need to do it,” they wrote. “This independence will help us realize our mission - powering modern financial experiences - reliably and for the long term.”

“We believe that the end-customer demand for modern financial services is stronger than ever, and that quality infrastructure is the only way to power these services. Unit is still in its early days,” Damti and Semech continued. “We’ve recently seen strong and new types of demand for our product, such as banks using Unit and its white-label app to power their own bank-branded digital experiences.”

A number of fintech firms have laid off employees this year, including embedded finance company Treasury Prime in February and crypto infrastructure platform Paxos this week. Both firms cited shifts in focus to certain parts of their business.

A Unit spokesperson declined to share details beyond the company blog post.