New leadership of the Consumer Financial Protection Bureau under President Donald Trump may have its hands full if it seeks to reverse course on the agenda the bureau has pursued under Director Rohit Chopra – and that may have been strategic.

“At some level, one has to assume that Chopra’s strategy was to make that as hard as possible by making the list as long as possible,” said Jonah Crane, a partner at financial services advisory and investing firm Klaros Group, during an American Fintech Council webinar Thursday.

Since Oct. 1, the CFPB has issued six proposed rules and four final rules, and filed or issued no fewer than 20 lawsuits and enforcement actions, according to Crane. “That’s just a lot of activity in that span of time,” he said.

Included in that burst of activity: an open banking rule, a rule capping overdraft fees at $5, and a rule giving the bureau oversight of big tech firms offering digital wallet apps.

Once new leadership of the consumer watchdog is in place, a weeks- or months-long review of what’s been put in place under Chopra will be conducted, as the Trump administration considers whether to go in a different direction and how they’ll do that, webinar panelists said.

Policy statements, guidance or interpretive rules can be adjusted “pretty much with the flick of a pen,” said Ian Moloney, head of policy and regulatory affairs for the AFC, during the webinar.

For more recent formal rulemakings, the Congressional Review Act – which permits lawmakers to repeal executive agency regulations – might come into play; the window for that lookback began Aug. 1, 2024.

Moloney expects a lot of activity in that area, as lawmakers on the House Financial Services and Senate Banking committees consider what to pursue, given the limited window of time. Congress generally has about 60 days to introduce a resolution disapproving of a rule.

In other cases, new leadership may evaluate whether to stand up a new rulemaking process to revoke the final rule in question, although a revocation rule can be challenged in court by those who favored the original rule, noted Mike Silver, a Husch Blackwell attorney who spent a dozen years at the CFPB. “This process with final rules is very messy and unwieldy, and can lead to outcomes that maybe are idiosyncratic,” he said.

Since so many of the CFPB’s recently finalized rules have been challenged in court by industry stakeholders, new bureau leadership will also have to decide how to proceed with ongoing litigation, and whether to keep defending a rule or change its position, Silver said.

Ultimately, which policies are rolled back or adjusted as well as how could be dictated by who’s chosen to run the bureau, webinar panelists said. The populist leaning of the Trump administration could complicate whether certain rules such as the overdraft cap are scrapped.

Loper Bright and other recent Supreme Court decisions “hangs over a lot of this activity,” Crane said, since it may affect how courts view agencies adopting new policies or reversing course on existing policies.

Current CFPB leaders have also laid groundwork that appears to arm states looking to pick up the mantle. A document the CFPB released earlier this month, prior to the inauguration, compiled major, non-rulemaking guidance documents under Chopra, and an accompanying letter seemed to lean on Loper Bright as a shield against a future bureau arguing the guidance is invalid or wrongly interpreted, Silver said when reached by phone after Thursday’s webinar.

That appeared to be a strategic maneuver on their part to give states or even private plaintiffs a set of guidance they can use to make legal arguments, which points to CFPB leaders taking a more proactive approach to promoting their view of the law going forward, Silver said.

“Don’t sleep on the current top leadership at the CFPB continuing to promote these policies and their agenda,” Silver said during the webinar.

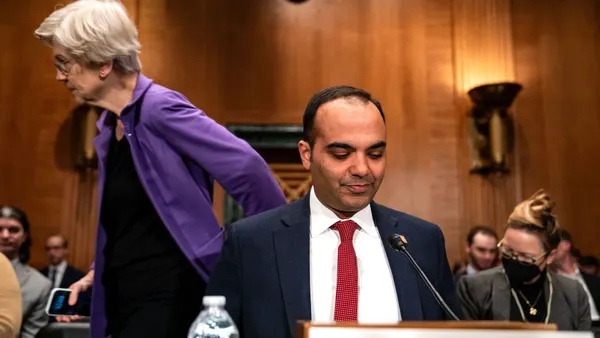

Chopra’s tenure

Silver called it a “shock” that Chopra remains at the helm of the CFPB about two weeks into Trump’s term; a New York Times story Thursday indicates even Chopra himself is surprised he’s not yet been fired.

Appointed by former President Joe Biden, Chopra is serving a five-year term that runs through October 2026. But the CFPB director, the Supreme Court decided in 2020, is an at-will employee, and Chopra has been widely expected to be ousted by Trump. Biden fired Trump-appointee Kathy Kraninger on his first day in office.

Silver, speaking after the webinar, wondered if Chopra is making a push to keep the job, noting the CFPB director is supposedly friendly with Vice President JD Vance, and Chopra this week called out de-banking, an issue Trump took aim at the week prior.

Still, Chopra’s departure is almost certainly imminent, Silver said. It’s likely the Trump administration has had to put certain pieces into place before cutting him loose. The head of the CFPB has a seat on the board of the Federal Deposit Insurance Corp., and the federal Vacancies Act means Trump would have to appoint someone already serving in a senior government position if he fired Chopra, Silver pointed out during the webinar.

Bloomberg reported Thursday that the Trump administration is considering the Treasury Department or Office of Management and Budget to oversee the CFPB after firing Chopra. During Trump’s first term, Mick Mulvaney, after being confirmed OMB director, served as acting director of the CFPB, Silver noted. It’s likely Chopra has remained at the agency simply because the Trump administration needed some of its Cabinet appointees confirmed before letting him go.

“Everything I’ve heard is that they’re just taking time to sort this all out,” he said after the webinar. “The CFPB is just not the highest priority in the pecking order of the things they’re tackling.”