Treasury Prime, an embedded banking software platform, launched OneKey Banking, giving customers the ability to make instantaneous cross-bank network transfers, the fintech announced last month.

The product allows fintechs and other enterprises to choose a banking partner from a network of more than 15 financial institutions and instantly move money between them, Treasury Prime said.

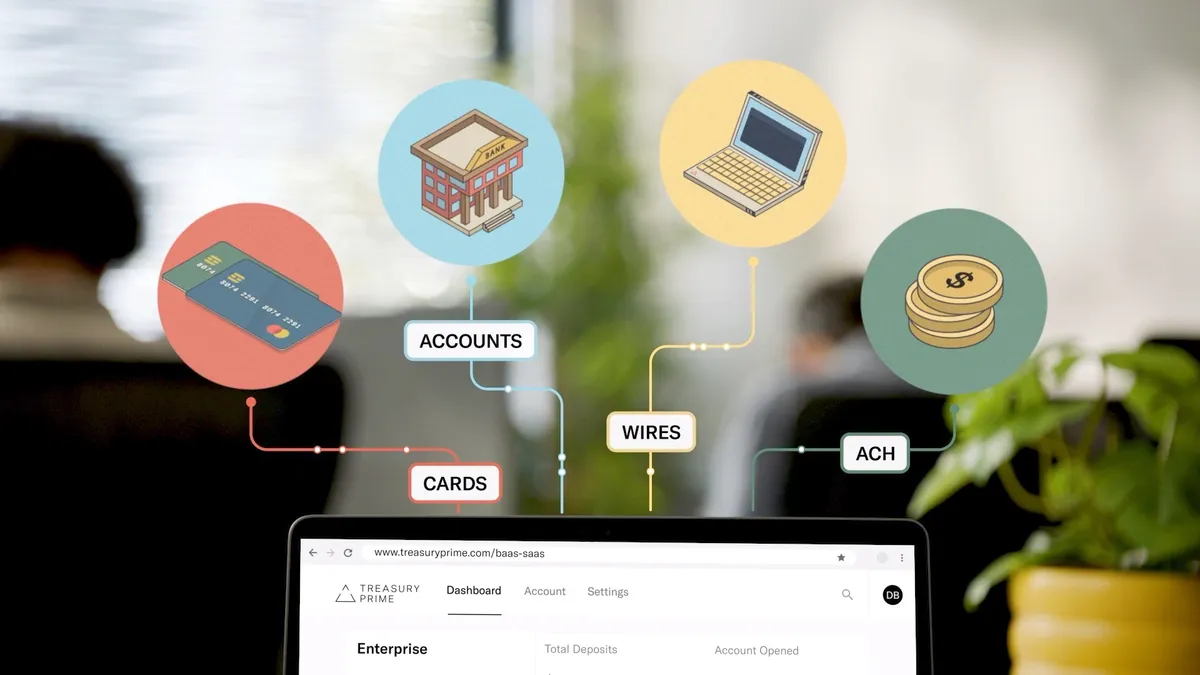

Any fintech can access single or multiple banks and avail their features using a single application programming interface, Treasury Prime said. OneKey Banking eliminates the need to change providers as deposits grow, according to the fintech.

"OneKey Banking brings us that much closer to our vision of creating a de facto banking standard for our partner banks," Treasury Prime CEO Chris Dean said in a statement. "An enterprise can treat its partner banks as a true network using the same tools they would with any single bank in our network.”

The San Francisco-based fintech said the solution allows embedded finance companies to access the multibank network, build new products across the banks, and transfer money between them while managing deposit growth.

"The U.S. banking system is strangely and surprisingly fragmented," Dean told Banking Dive. "We [have] had this idea from really early on for Treasury Prime that we would launch a part of our platform that lets you treat the banks directly. Then you don't need to have different technology, different ways to access the bank."

Treasury Prime tested the tool in beta with AngelList Ventures, which is using it to move money among three banks, Dean said.

Grasshopper Bank recently deployed OneKey Banking with an existing customer and is on the verge of securing a new client with the platform, according to the fintech.

"We have a strong partnership with Treasury Prime, where a few of us on the team have been working with them since their founding years ago," Chris Tremont, Grasshopper's chief digital officer, told Banking Dive via email.

The New York City-based bank partnered with Treasury Prime at the beginning of 2022 to launch the fintech's embedded banking platform with FIS.

"Since that time, we have welcomed a number of fintech and technology clients onto the platform,” Tremont said. “The OneKey offering is a powerful one in the market and adds an extra layer of comfort and security to clients looking for the ability to work with multiple bank partners.”

The primary difference between OneKey Banking and older technologies is the direct relationship to the bank, Dean said.

"The banks love it because it's just the bank accounts [and] they're confident that it's real money," he said. "They're confident in the relationship; they are confident in the compliance; banks are great at handling compliance. And by letting them do that, the fintechs can take advantage of all the work the bank does already."

OneKey Banking enabled more than $350 million in deposits across Treasury Prime’s partners within the first month of its launch, the fintech said.