Treasury Prime, an embedded software company, announced Tuesday that it partnered with Narmi to enable its banking customers to send and receive money instantly through the FedNow service.

Narmi, a platform providing digital banking solutions for financial institutions, will act as the small and mid-sized banks’ official service provider for FedNow and connect directly to the Federal Reserve posting transactions to the core banking system. The fintech will also empower the operations team of the financial institutions to meet the compliance requirements, the companies said.

The digital banking platform’s FedNow service will support a range of FedNow service offerings, including receiving, sending to linked and external accounts, and offering request-for-payment options.

“It's our bet that [real-time payments] may have struggled a little bit just because of adoption,” Treasury Prime CEO Chris Dean told Banking Dive. “There are so many banks in the U.S. that enough coverage is challenging. But FedNow has really been the opposite of that; the amount of coverage they have on banks, it's just extraordinary.”

The partnership will help financial institutions in Treasury Prime’s network to offer their fintech clients a secure and user-friendly platform for real-time payments and boost their revenue, he added.

Grasshopper will be the first bank to offer the FedNow capabilities that the Treasury Prime and Narmi integration allow their clients to make use of. This will be the first time the roughly $700 million asset-worth bank will be offering FedNow capabilities to a fintech.

The bank is planning to launch receive-only capabilities to a subset of their clients by the end of the first half of the year, Luther Liang, director of product at Grasshopper Bank, told Banking Dive via email.

“On the Grasshopper side, we saw an increase in requests from our fintech clients for this service and, as an innovative bank, we want to ensure their needs are met. Narmi and Treasury Prime are key strategic partners for the bank and we are long-standing partners of both organizations,” Liang said. “We are a partner-first organization, so creating synergies between our partners significantly benefits our end clients.”

Chris Griffin, a co-founder of Narmi, said in a statement that both firms are aligned to serve the needs of small to medium-sized financial institutions.

“This partnership with Treasury Prime represents a significant leap forward for these banks, opening doors to new revenue streams and enabling them to meet the ever-increasing demand for real-time payment solutions in the modern financial landscape,” Griffin said Tuesday.

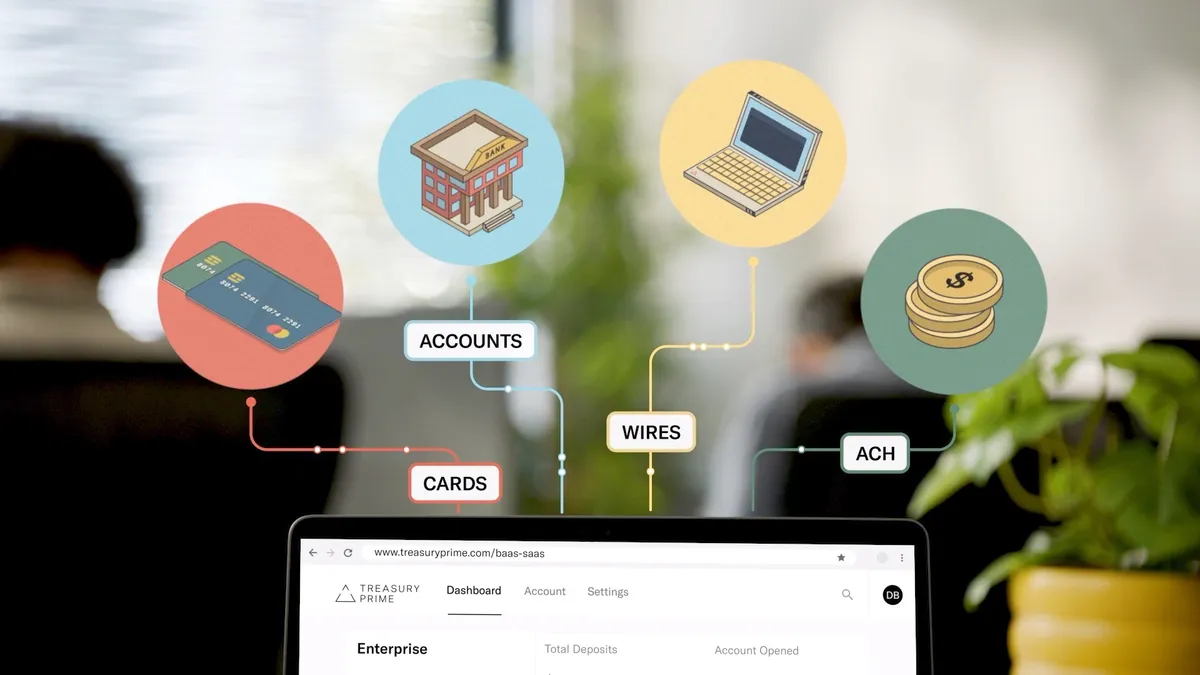

The different methods used to transfer money, including the Automated Clearing House network, wire transfers, or paper checks, are either expensive or slow, according to Dean. FedNow fills in the gap with fast and less expensive money transfers and is a sign of the maturity of the U.S. banking system, he added.

Liang echoed the importance of FedNow and the bank-fintech partnerships using the Fed’s infrastructure.

The partnership “is specifically designed to empower our fintech clients to revolutionize the financial experiences they deliver. Together, with our partners’ expertise and our commitment to cutting-edge solutions, FedNow will unlock a new era of efficiency and opportunity for our fintech clients,” he noted.

Bank-fintech partnership in BaaS space

Recently, Treasury Prime pivoted and decided to double down on the banks since they are the firm’s main customers. The market is “chaotic” right now because of the way banks and fintechs partner, Dean added.

Dean headed Silicon Valley Bank’s fintech group for two years before establishing Treasury Prime in 2017. He built the company on the insights he gained from his interactions with regulators while working there.

The fintech’s software helps to identify any lapse in governance or compliance, which it then brings to the bank’s attention.

One of Treasury Prime’s long-time partners, Piermont Bank, entered into a consent order with the Federal Deposit Insurance Corp. for the deficiencies in its banking-as-a-service work and partnerships with fintech, the regulator disclosed Friday.

“I know the Piermont Bank folks really well. They are a longtime partner of mine. I am confident in their ability to run a good bank. But I think that if you look at the larger picture, it’s just a wake-up call,” Dean said, adding that since governance matters in partnerships, “you have to be careful here.”