Banking-as-a-service platform Treasury Prime has laid off about half of its nearly 100 employees, CEO Chris Dean confirmed Wednesday.

Treasury Prime laid off teams focused on selling its products to other fintechs, including marketing, as a result of a strategic pivot that will, from now on, have the company focusing its sales efforts exclusively on banks.

The firm has historically marketed itself to fintechs, then connected the fintech with a banking partner that would use Treasury Prime’s platform. However, Dean said the “interesting activity,” for the past six months or more, has been on the bank-direct side, and banks have wanted more to negotiate and ink deals with fintechs directly than with Treasury Prime as the liaison.

“If that's where the puck is going, let's just go there right now,” Dean said, confirming a development initially reported by Jason Mikula, publisher of Fintech Business Weekly, Wednesday morning on LinkedIn.

Treasury Prime is, first and foremost, a software company, he said, and the intention early on was that banks on its platform would find their own fintech partners.

“[But] the volume of fintechs that wanted to talk to the banks was far more than the banks could deal with, so they asked us to help and we ended up building out a whole go-to-market team for years to support that. We get lumped [into a category of middlemen], though we really don't think of ourselves like that,” he said. “And at some point [in the] last six months, we realized that what we wanted to do when we started, finally, both the regulatory environment and the banks have caught up to that. So let's just do that directly. It's better business. It's better for the banks, it's better for the fintechs, the regulators like it better, it’s better all around.”

Regulators have trained their sights on bank-fintech partnerships, of late — focusing on due diligence and third-party risk management, pushing banks to take the reins on these functions.

“Treasury Prime’s pivot to focus on serving as a technology provider to banks will help the company focus on its core value proposition and differentiate them in the market,” said Jonah Crane, partner at financial advisory firm Klaros Group. “They are skating to where the puck is likely headed.”

“These strategic pivots are always difficult, and layoffs are no fun. But they are probably inevitable given the strategic pivot, and likely necessary to position the company for success over the next couple years,” he said.

Former Federal Deposit Insurance Corp. Chair Jelena McWilliams said in November that she fears the third-party guidance released by regulators last June will have a chilling effect on bank-fintech partnerships.

“They can’t specifically prohibit [third-party partnerships]. And I think they’re trying to make it more difficult for banks to engage in those partnerships,” McWilliams said at the time.

“Regulatory scrutiny of banks' oversight of their fintech programs has been steadily increasing: nearly 40% of formal enforcement actions by federal banking regulators in the fourth quarter of 2023 were directed at fintech partner banks,” Crane said. “The regulatory agencies have given no indication this trend will slow and, in fact, we see it speeding up. But that focus will lead to greater clarity regarding regulators’ expectations.”

Dean said the decision to step away from being an intermediary was “highly connected” to the regulatory goings-on around bank-fintech relationships.

“This move solidifies the idea that the fintech [is] not our client, it’s directly the bank's client. The person who manages that relationship is the bank, and according to our banks — pretty much 100% of them — that is exactly what all the regulators want. They want to be able to say like, ‘Look, it's been managed by the bank, who is the chartered institution, who cares about compliance, who knows how to manage this problem, as opposed to some intermediary,’” Dean said.

The layoffs come one year after a $40 million Series C round, which followed a year of triple-digit growth.

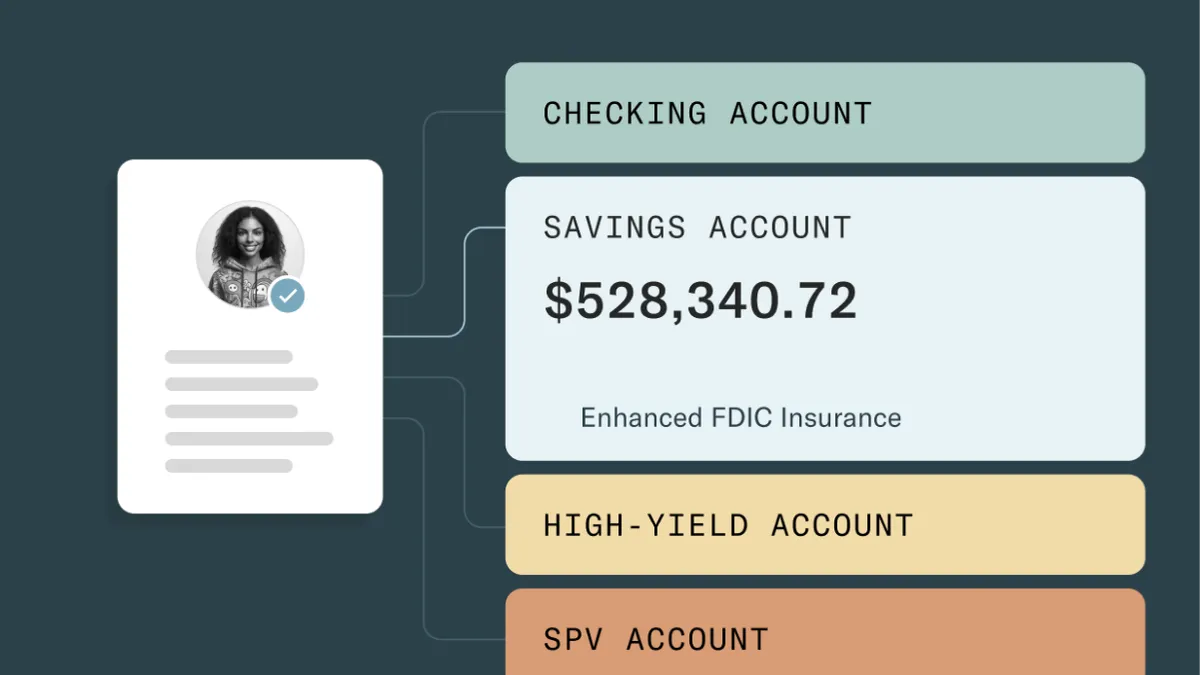

Treasury Prime has since launched its own instant payments rail, OneKey Banking, for fintechs to transfer funds between banks integrated with the company’s banking platform; and has announced several partnerships.

The 40 to 50 employees affected by the layoffs were notified Tuesday, and have received “healthy severance,” Dean said, adding that cutting staff was “like a body blow.”

“But if you look at from the business side of like, ‘Oh, dang, this is what everyone wants to do anyway, and this is where we make all our money. Why don't we just do it that directly?’ Everyone's asking me [if] we’re gonna run out of money. No, we have years of runway. This is not the issue here,” Dean said. “We're just trying to reflect what the reality of the world is. When the problem changes, the answer changes, and the problem has changed the past few years.”