Dive Brief:

- TD named Michelle Myers as its next global chief auditor, effective Dec. 9, the bank announced Friday.

- Myers, previously, TD’s controller and chief accountant, will replace Anita O’Dell, who is retiring, the bank said. O’Dell will serve in an advisory role at TD until May 31, 2025.

- Personnel moves at TD are being closely watched since the Canadian lender agreed last month to pay $3.09 billion in penalties to the U.S. Justice Department and regulators over investigations into the bank’s anti-money laundering deficiencies. The bank also agreed to a $434 billion cap on its U.S. retail assets.

Dive Insight:

Concerns for TD are extending to the bank’s board, too. A climate-focused shareholder advocacy group, Investors for Paris Compliance, asked the bank Friday to launch an independent review into its board governance policies and the criteria it uses to select board members.

“In light of the bank’s recently exposed governance failures, we are looking for board accountability and renewal, including that new board members are properly qualified to manage major risks and opportunities,” Kyra Bell-Pasht, the advocacy group’s director of research and policy, said Friday in a statement seen by The Globe and Mail.

The Federal Reserve ordered TD in October to conduct an independent review of the bank’s board and management.

“Plans are underway to [fulfill] this requirement and we will carefully consider any insights received as part of this review,” TD spokesperson Lisa Hodgins told The Globe and Mail in a statement. “We are committed to sound corporate governance and regularly review our practices and policies to align with legal and regulatory expectations and industry best practices.”

The advocacy group highlighted two separate assessments concluding that TD is falling short on its net-zero commitment.

“Because it is difficult for a board to assess itself, shareholders request an external review of TD’s board governance policies and director selection criteria with a view to improving director accountability and competency for existing risks and emerging priorities like net zero,” Investors for Paris Compliance said Friday in a proposal also signed by Boston-based Green Century Capital Management.

The groups lay out concerns that the governance issues that contributed to TD’s compliance failures may be systemic, which might create gaps beyond money laundering. Further, they said, the bank’s guidelines are unclear on how committee members are held accountable, and do not detail consequences for underperformance.

As for the change in auditing personnel, Myers joined the bank in 2022 from KPMG, where she spent 17 years, according to her LinkedIn profile.

TD on Friday also named Keith Lam, the bank’s deputy chief U.S. auditor, as acting chief U.S. auditor, reporting to Myers.

O’Dell, meanwhile, will leave the bank after roughly 14 years in a number of roles, including chief and deputy chief U.S. auditor. TD lauded O’Dell on Friday for her “professional rigour and strong governance mindset,” as well as her commitment to diversity and inclusion. She served as U.S. chair of the bank’s Corporate Women in Leadership committee and co-chair in Canada, TD said.

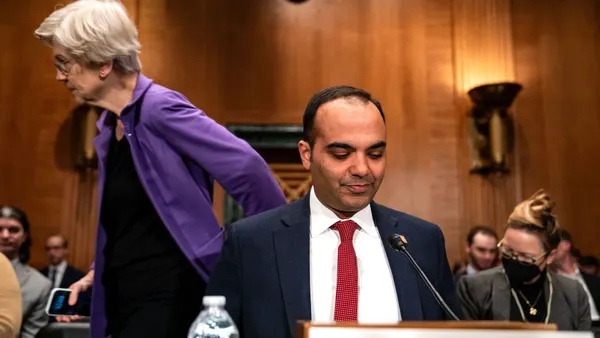

Auditing is not the only area where the bank has seen turnover since rumors of TD’s AML woes went public. The bank named a new chief compliance officer in July. And, more recently, TD CEO Bharat Masrani announced in September that he would retire in April 2025, paving the way for Raymond Chun, the bank’s Canadian personal banking head, to take the chief executive role.