Dive Brief:

- Investing and banking app Stash this month appointed Chien-Liang Chou as chief technology officer, a move meant to help the company scale more rapidly and possibly prepare for an initial public offering.

- Chou comes to Stash from neobank Dave, where he worked for nearly three years — first as executive vice president of engineering and later as CTO. He oversaw the company’s journey to go public in 2022, including tripling the size of the team and leading changes to technologies and processes. He also was vice president of technology at LendingClub from 2016 to 2018.

- “His deep knowledge of the category is just a huge short cut and creates an immediate positive impact for us,” CEO Liza Landsman said. “His track record of scaling companies and scaling them in a high-quality, healthy way is unparalleled.”

Dive Insight:

Chou takes over from Cliff Hazelton, who left the company last year.

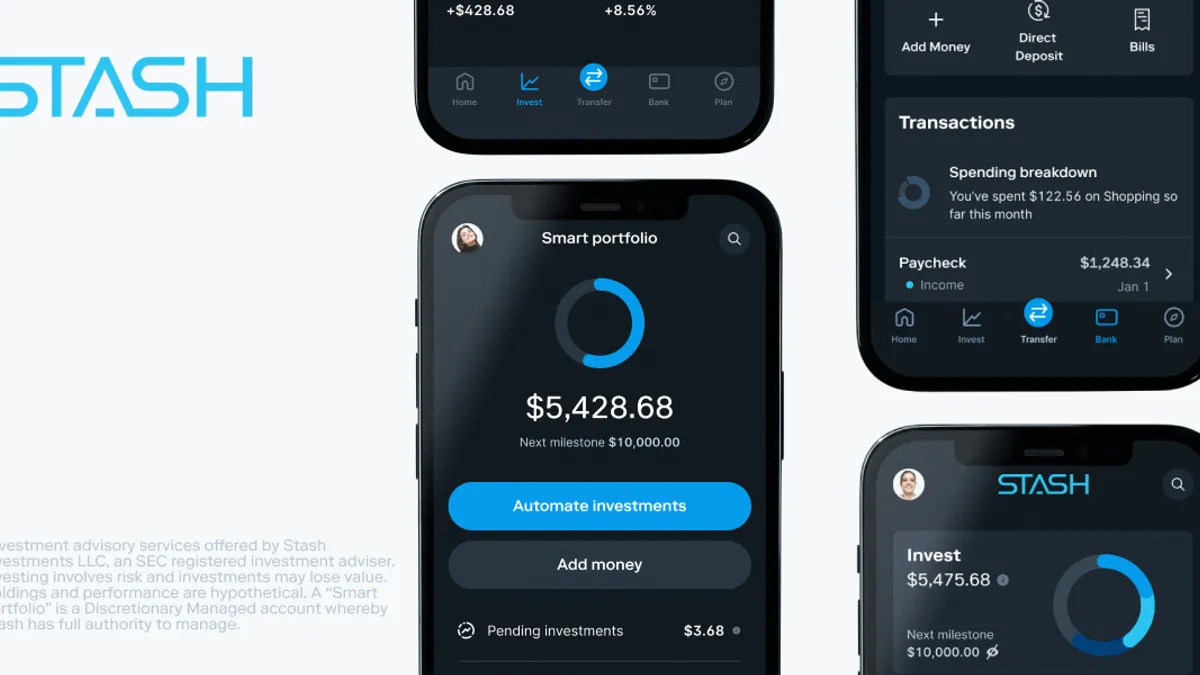

He said he will focus on improving the user experience for the platform's 2 million active users, while ensuring the technology infrastructure is operating as efficiently as possible.

“My vision here is how can we really push our … user experience to the next level so that a lot more people can participate,” Chou told Banking Dive. “At the same time, internally we need to be able to scale our system, provide much better quality and optimize our cost structure to support that vision.”

Stash wants to smooth its user-experience flow, preparing the customer for the best next action, Landsman said.

“When you increase feature functionality, sometimes in the core user flows, it creates a bit more of the paradox of choice,” Landsman said. “Part of the work we’re doing right now is trying to create more simplified, happy paths for consumers,” including how to set goals and choose products that best fit a customer’s financial situation, she added.

Stash reported $100 million in annual revenue last year and a more than 70% gross margin.

Improvements in the company’s cost structure can be attributed to the firm’s transition to Stash’s core system, which was developed in partnership with Mastercard, Stride Bank, Marqeta, Mambu, and Alloy. The fintech previously partnered with Green Dot.

“We don't charge ourselves the margin that a third party [would],” Landsman said. “When we look at our all-in cost structure on the banking component of the platform — [from] where it was when we were on the third-party vendor previously and where it is now — we went from basically negative 21% gross margin to plus 50% gross margin, just for that piece of the platform.”

Asked if the company is preparing for an IPO, Landsman said it’s not a winning proposition to time the markets, but the company is focused on readying itself for a new phase, whether public or private. She said she expects the company to be cash-flow positive by the third or fourth quarter of 2024.

“Our job as the leadership team is to get the business in the best shape of its life so that it could be either IPO-ready or a really profitable standalone private business,” she said. “All of the things you would do to get ready for an IPO are also the things you would do to have a thriving, healthy, profitable private company — getting the company profitable, getting the infrastructure ready to scale, having the right sort of audit, security [and] disclosures in place.”