When bank customers request forbearance or miss payments, there can be some underlying financial hardship reasons that are often ignored.

SpringFour, a fintech, said it has identified the root causes of some of these problems and has come up with a tool aimed at helping those in need of financial assistance.

Using cloud-based tools, the Chicago-based firm said it strives to provide borrowers with a list of reputable nonprofit and government assistance programs in over 30 categories, including employment, health insurance and financial services that can help people regain financial footing.

“We are a social impact fintech organization, really trying to say that part of somebody's financial health is not just product related; if we can connect them to resources that help with their cash flow, remove issues that they are having around household expenses, there is going to come a time where they can access a product in your product suite or move up that ladder to a better finding,” Rochelle Gorey, CEO of SpringFour said. “When more clients believe that providing access to financial health information and referrals is a good thing that results in a better financial health picture for their client.”

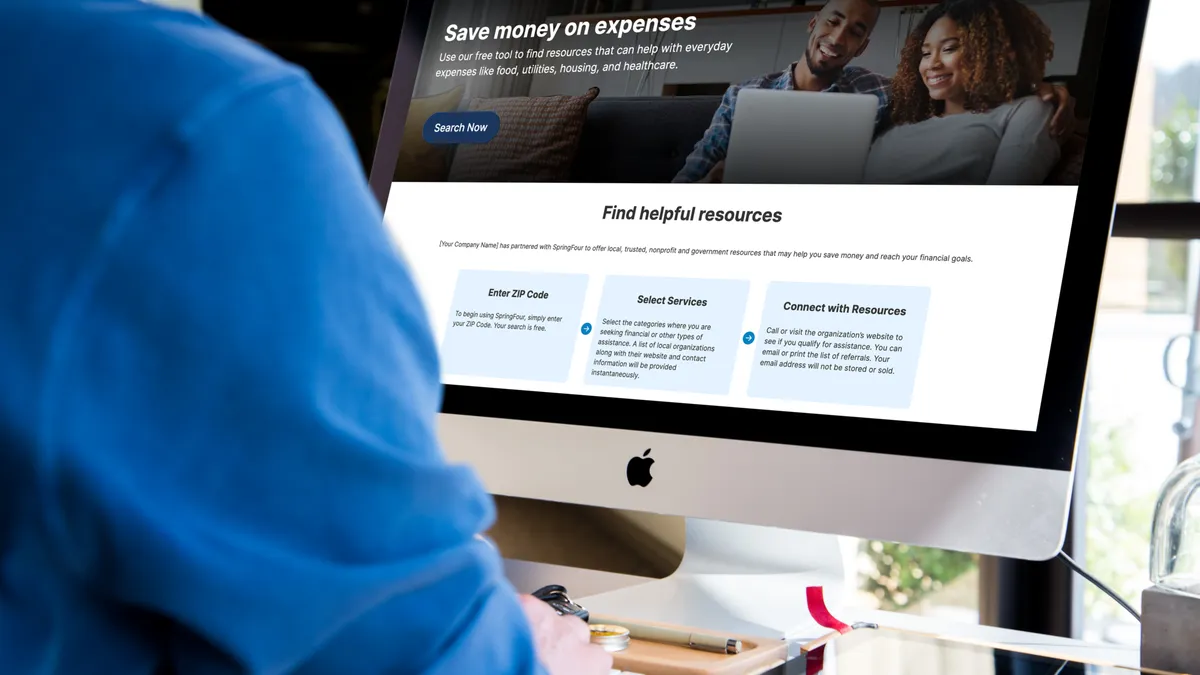

SpringFour offers call center and digital tools that help financial institutions search the cloud-based platform by zip code and categories to find local assistance programs for their customers, she said. Banks pay to use the fintech’s technology and have access to unlimited referrals — a key feature of SpringFour, according to Gorey.

Institutions can also provide SpringFour’s digital self-serve portal for customers to seek help privately.

SpringFour was founded in 2005 as MortgageKeeper to help address the underlying difficulties homeowners faced that led some to default on their mortgage payments. During that time, SpringFour helped many consumers avoid foreclosures by offering counseling and other resources. The name was changed to SpringFour in 2015.

With over 23,000 curated financial health resources and 17 financial health guides, the woman-led fintech can be accessed in over 665 cities across the country, the company said.

Destigmatizing seeking assistance

Financial institutions choose the categories they would like to offer their customers. On the digital portal, these categories are tailored to the bank’s needs and displayed on the screen for customers to use. Bank of Montreal, Capital One, KeyBank and M&T Bank are some of the banks that SpringFour works with.

“We work with each of our bank partners to message the availability of SpringFour resources in whatever way that they would like, but we have a wide range of best practices and marketing messages that we feel worked really well for a customer,” Gorey said. “We are really trying to work with our bank partners to destigmatize the need for assistance.”

The need to destigmatize is important since over 60% of Americans struggle to pay their bills, according to Gorey.

Along with referrals, the fintech offers financial guides to raise the comfort of first-time aid seekers since educational content demystifies the process, she said. But those in immediate need should be referred to quick assistance, she noted.

Customers feel assured when they see their banks guiding them on ways to save and improve financial health, Gorey said.

Some customers grapple with financial hardships year-round, so financial institutions understand the value of long-term partnerships with fintechs to provide solutions promoting overall financial well-being, she said.

“We are increasingly seeing that more and more things are happening in a very macro-environment that have a very dire impact on your customer or consumer who is living paycheck to paycheck,” Gorey noted.

SpringFour saw a surge in demand for its resources during the pandemic and the last government shutdown, Gorey said.

This year, SpringFour is on track to deliver more than 5 million financial health resources, according to the firm. Last year, the fintech delivered 4.4 million financial health resources to households in need in partnership with banks, credit unions and fintech lenders.

As of August, the most requested financial health categories were food savings, heating and utility costs, employment services, rental resources and financial counseling.

“At SpringFour we are really trying to change that dynamic and say it's okay to seek help when you need it and also help the industry understand that when they operate from a place of empathy and providing assistance, it's going to come back to them as well in increased customer engagement, repayment performance [and] increased trust with their borrowers,” Gorey said.