Dive Brief:

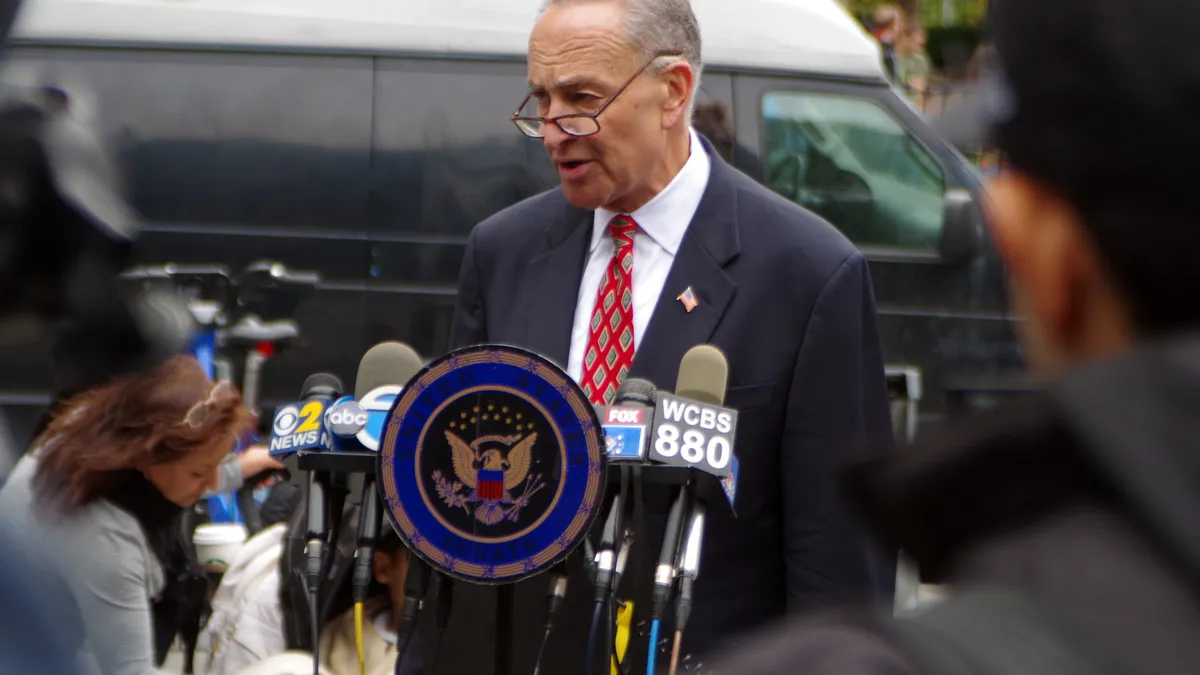

- Senate Minority Leader Chuck Schumer, D-NY, is urging regulators to provide clarity for financial institutions looking to bank industrial hemp-oriented businesses.

- In a letter to the Federal Deposit Insurance Corp. (FDIC), the Federal Reserve and the Office of the Comptroller of the Currency (OCC), Schumer asked the agencies to issue updated guidance "as soon as possible, to help growers, producers and industry harvest the massive potential of this versatile crop."

- While the production and sale of industrial hemp was legalized with the passage of the 2018 Farm Bill, Schumer said financial institutions still question whether they can extend their services to businesses associated with the product.

Dive Insight:

Similar to the banking issues facing marijuana-related businesses, Schumer's letter highlights how hemp growers are also dealing with financial institutions' reluctance to service their industry.

"It is important that financial institutions recognize hemp as a legal agricultural industry as set forth in the 2018 Farm Bill," Schumer said in his letter to regulators. "I urge the FDIC, Federal Reserve, and OCC to provide guidance and best practices to the institutions under their authority that are looking to serve hemp farmers and businesses."

Hemp is a strain of the cannabis plant and typically contains less than 0.3% of the psychoactive substance tetrahydrocannabinol (THC). It was designated a controlled substance under federal law for that reason until Congress last year passed the Farm Bill, which legalized hemp across the U.S.

The hemp industry will suffer until regulators give banks additional clarity.

"Without access to traditional financial services, such as checking accounts and credit, many hemp businesses have been unable to effectively expand beyond their basic business operations," Schumer said in his letter to regulators. "In order to alleviate these concerns, updated guidance would provide certainty for financial institutions to assess risk and make available a wider range of financial products to hemp cultivators and manufacturers. Small businesses and new entrants are hit hardest by these regulatory uncertainties."

The American Bankers Association also called for more clarity on the issue in June.

"[T]he lingering confusion over the legal status of hemp is frustrating the congressional intent of the 2018 Farm Bill by restricting access to financing, credit products, and traditional banking services for this fledgling industry," the trade group said in its letter to the Fed, OCC, FDIC and the Financial Crimes Enforcement Network.