Following the uber-high highs of 2021, the reality for the fintech sphere has been sobering in the years since. Forbes declared 2022 fintech’s “year of layoffs,” and according to eFinancialCareers, more than 100 fintechs laid off staff between 2022 and 2023.

But by the current year’s middle point, roughly two dozen fintech companies had let go of staff. Some firms, like Block, let go of thousands; others, like BillGO, laid off far fewer. Many of the companies on this year’s running list cut workers to reduce costs, and Boston Consulting Group and QED Investors’ latest global fintech report noted just that as a reason to, ahem, “redesign.”

“Organizationally, a redesign that eliminates layers and redefines role charters can have significant cost implications,” the report said. “[M]any fintechs have yet to apply [cost reduction practices] comprehensively.”

Compared to the highs of 2021, fintech funding is down 70%, according to the report. But it’s not all bad: “There is no shortage of capital in fintech,” Hans Morris, NYCA Partners managing partner, said in the report. “There was just an overabundance in 2021.”

Revenues have grown, the report said: 14% over the past two years industrywide and 21% when crypto- and China-related fintechs are excluded.

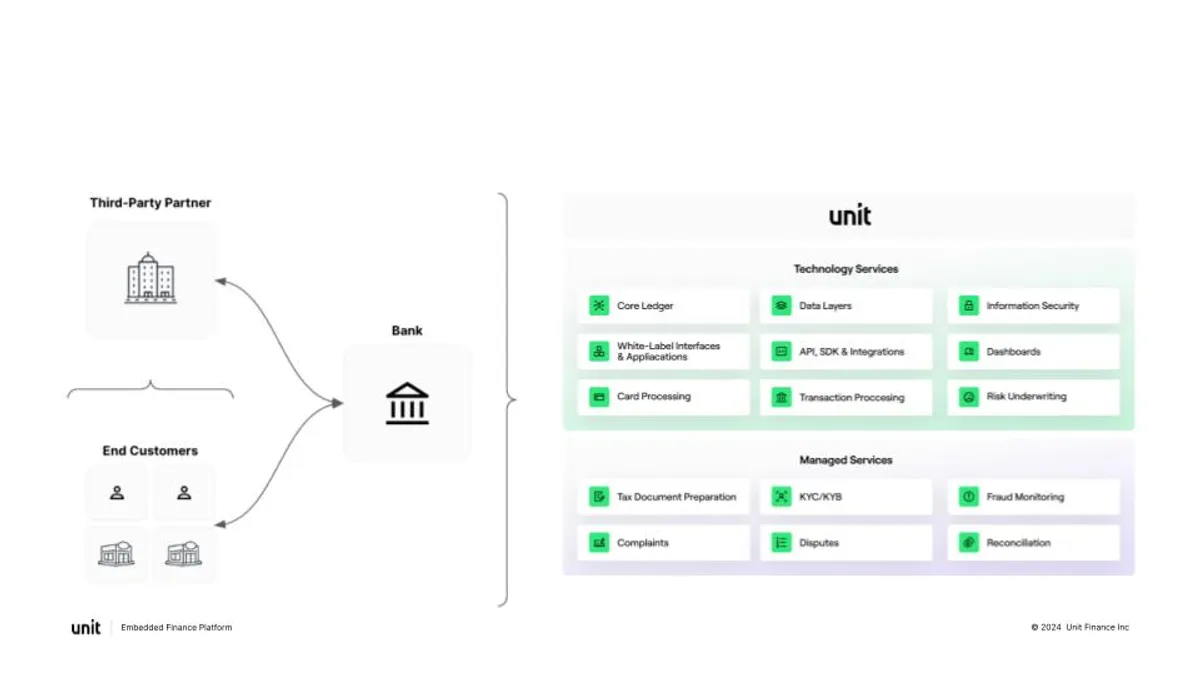

One of the hottest narratives in fintech right now is regulatory scrutiny over the relationships these firms have with their partner banks. Some fintechs have responded to this scrutiny with modifications to their business model which have, in turn, led to layoffs.

Beyond fintech, layoffs in the broader tech world numbered nearly 100,000 as of mid-June.

“The big-name companies aren’t struggling for the most part,” Giuseppe Gasparro, a partner and managing director at New York City-based consulting firm AlixPartners, said in an interview with CFO Dive. “It’s really a re-balancing. The markets are asking them to be more cost-conscious and bottom-line-conscious and very targeted with investments.”

Below is a running list, with details, of fintech firms that have conducted layoffs this year. Check back later for new additions.