Dive Brief:

- Stock-trading app Robinhood has indefinitely postponed its U.K. launch, the company said Tuesday. The company planned to make its app available to U.K. users by the end of this year. That rollout timeline was previously delayed from early 2020, Bloomberg reported.

- The company is closing its waitlist, which opened in November 2019, and will take down its U.K. website "shortly," it said. U.K. customer email addresses will be deleted from the company’s systems to protect users’ privacy, CNBC reported.

- The halt to overseas expansion marks the latest setback in what has been a rough several months for Robinhood. The company pulled its banking charter in December, suffered a series of outages in March and was mentioned in the suicide note of a 20-year-old trader in June.

Dive Insight:

"We’ve come to recognise that our efforts are currently best spent on strengthening our core business in the US and making further investments in our foundational systems," the company wrote to prospective British customers in an email seen by Bloomberg. The U.K. waitlist had about 250,000 signups, according to TechCrunch.

Robinhood plans to transfer most of its 10 U.K.-based employees to U.S. teams, CNBC reported. Others will be let go.

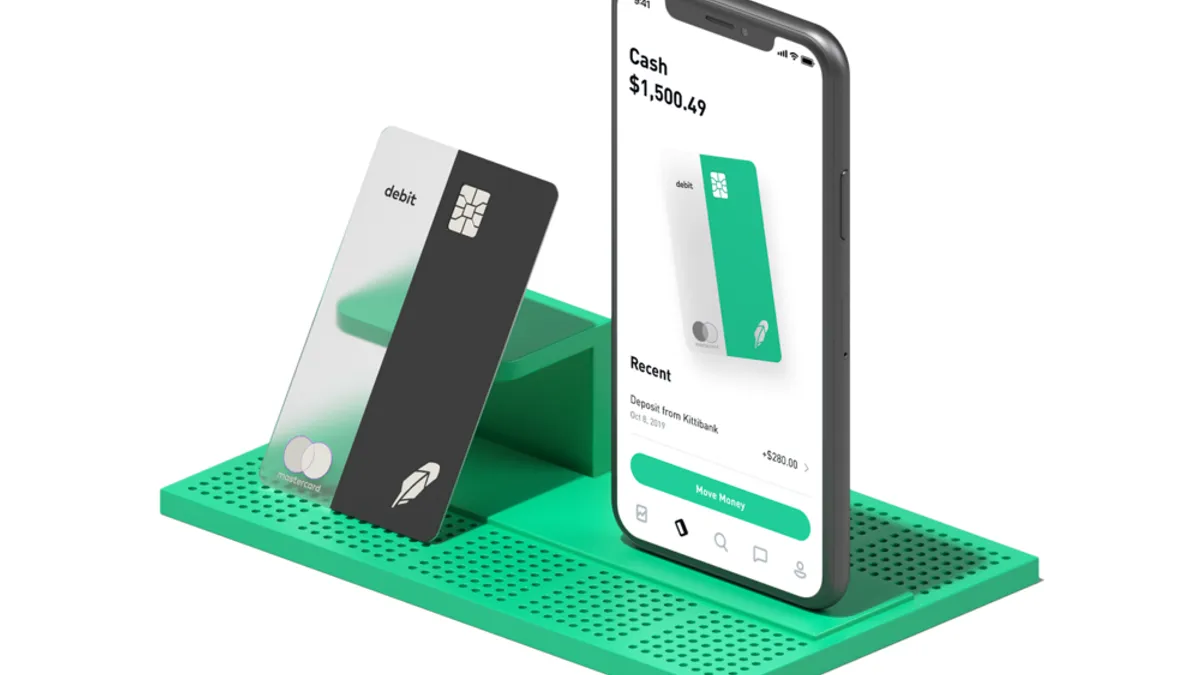

The app, which has grown from 1 million users in 2016 to 13 million this year, is a popular venue for first-time traders. Expansion to the U.K. would have pitted the company against traditional online brokerages such as Hargreaves Lansdown and AJ Bell, as well as startups such as Revolut and Freetrade.

Robinhood saw three outages in just over a week in early March. The first prevented users from buying and selling shares for much of March 2, when the Dow Jones Industrial Average saw its largest one-day percentage gain since March 2009.

The outage spawned a lawsuit from investors, and prompted the company to offer customers $75 goodwill credits in an emailed apology. Attorneys argued the credits were meant to persuade users to waive their right to participate in the class-action suit. A federal judge denied the plaintiffs’ request to halt the offer.

The company came under fire months later, when 20-year-old Alex Kearns took his own life after saying he lost $730,000 on the app. Kearns was likely trading put options, and didn’t realize that his negative cash balance was temporary, Forbes reported. Robinhood that week donated $250,000 to the American Foundation for Suicide Prevention and vowed to make it more difficult for users to access options trading.

The company is valued at $8.6 billion, including $320 million it raised this month. The app saw 3 million new accounts during the first quarter of 2020, according to Cointelegraph. Robinhood, which hasn’t set a date for a potential initial public offering, obtained broker authorization from the U.K.’s Financial Conduct Authority last August.

"Although our global expansion plans are on hold for now, we’re committed to democratising finance for more people around the world. We look forward to the day when we can bring this mission to the U.K.," the company said in a statement.