Business banking startup Rho last week launched a corporate expense-management tool aimed at larger clients with complex financial needs.

The move is part of a broader effort to reach organizations with dedicated finance teams, said Everett Cook, the New York-based company’s co-founder and chief executive.

“[These companies] want to be as efficient as possible, and they're not Fortune 500 companies … but they're operating at the same level, they're competing at the same level,” Cook said.

Rho’s new capability lets clients set custom spending rules and auto-approves employee expenses based on pre-set rules. It prompts users to provide receipts and other documentation and escalates out-of-policy expenses to managers for approval, the company said.

The product upgrade comes as competition for business-banking tools — particularly for middle-market business customers — heats up.

Fintech Brex announced in June it would shift away from small-business clients in favor of venture-backed startups. The move paved the way for competitors like corporate expense-management startup Ramp to pursue those clients. Ramp, for example, doubled its revenue run rate since the start of the year while going after businesses at all stages of maturity, TechCrunch reported.

Rho, meanwhile, said recent developments haven’t changed its core strategy.

“We’ve had the same laser focus on the mid-market,” or companies with revenues between $10 million to $1 billion, Cook said. Rho differentiates itself through an integrated cash and spend-management platform, he added.

The company sees old-guard incumbents, such as American Express and SAP Concur, as its competitors. But it won’t be easy to loosen those companies’ hold on much of the market, analysts said.

“I’m a bit skeptical that Brex, Rho and Ramp pose a serious threat to traditional expense management platforms any time in the near future,” said Jason Mikula, a fintech consultant at 312 Global Strategies BV. “Displacing Concur is far more difficult than convincing an early-stage startup to use your product and then growing with it over time.”

One advantage for Rho is its ability to operate alongside clients’ primary bank relationships, said Gilles Ubaghs, a strategic adviser for commercial banking and payments at Aite-Novarica Group.

“If it can sit alongside primary bank relationships and scrape away business,” it should be able to grow, given that many businesses are slow to shed those primary ties, Ubaghs said.

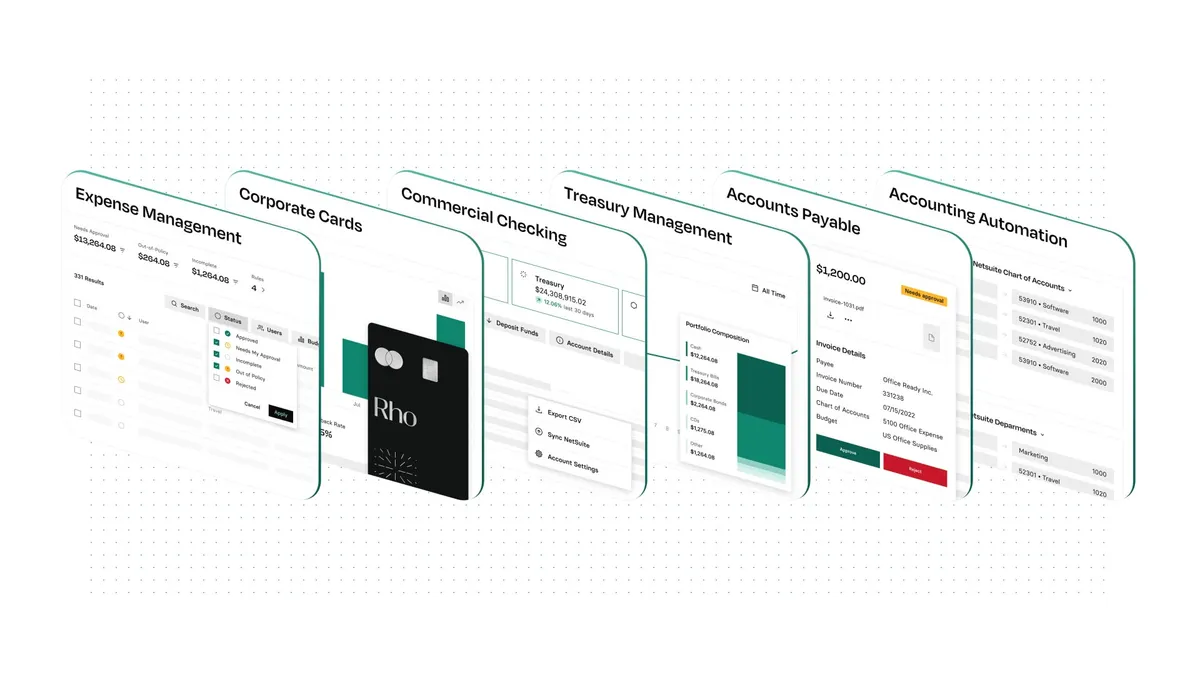

Rho, which was founded in 2018, has raised a total of $205 million in equity and debt financing. It partners with Evolve Bank & Trust and Webster Bank to deliver its products. It launched with a business checking account, and has since expanded to treasury management, credit cards and an accounts-payable offering. The platform also has integrations with NetSuite and Intuit QuickBooks.

Rho generates a significant proportion of its revenue from interchange fees, which Cook said is a good model if it scales properly. The company doesn’t charge subscription fees.

“If you're going after a consumer that is going to spend $1,000 a month on your piece of plastic, that’s fine, but you have to make sure that the rest of your cost structure is aligned with that,” he said. “Our customers are of a scale where we can afford to build the best products … and cover our expenses.”

Room to deepen relationships

Through a business-to-business model, Rho has more room to deepen relationships with clients, compared to consumer-focused neobanks that have come under pressure, Cook said.

“There's only so much innovation that you can actually do for a consumer checking account,” he said. “Our customers are much bigger. We’re solving much more complicated problems for them than just giving them a checking account and a piece of plastic.”

Rho declined to comment on customer or revenue numbers, but Cook said the company has onboarded “more complex organizations” and that clients run the gamut of tech, private equity, construction, manufacturing and health care sectors.

At the time of its Series B fund raise in December 2021, the company said its annualized transaction volume grew from a little less than $2 billion in December 2020 to a cumulative volume of $3 billion between January and November 2021. The company has 200 employees globally, Cook said.

Cash and expense-management startups may serve companies of all sizes, but venture-backed startups may continue to be a focus for many, Mikula said.

“The players that deploy a wider array of capabilities aimed at venture capital-backed startups are the most likely to come out on top — think offerings like ‘revenue-based financing’ or venture debt, or software-as-a-service-like software capabilities,” he said. “I think the dream of companies in this space is to become a tech-led version of Silicon Valley Bank — not American Express.”