Dive Brief:

-

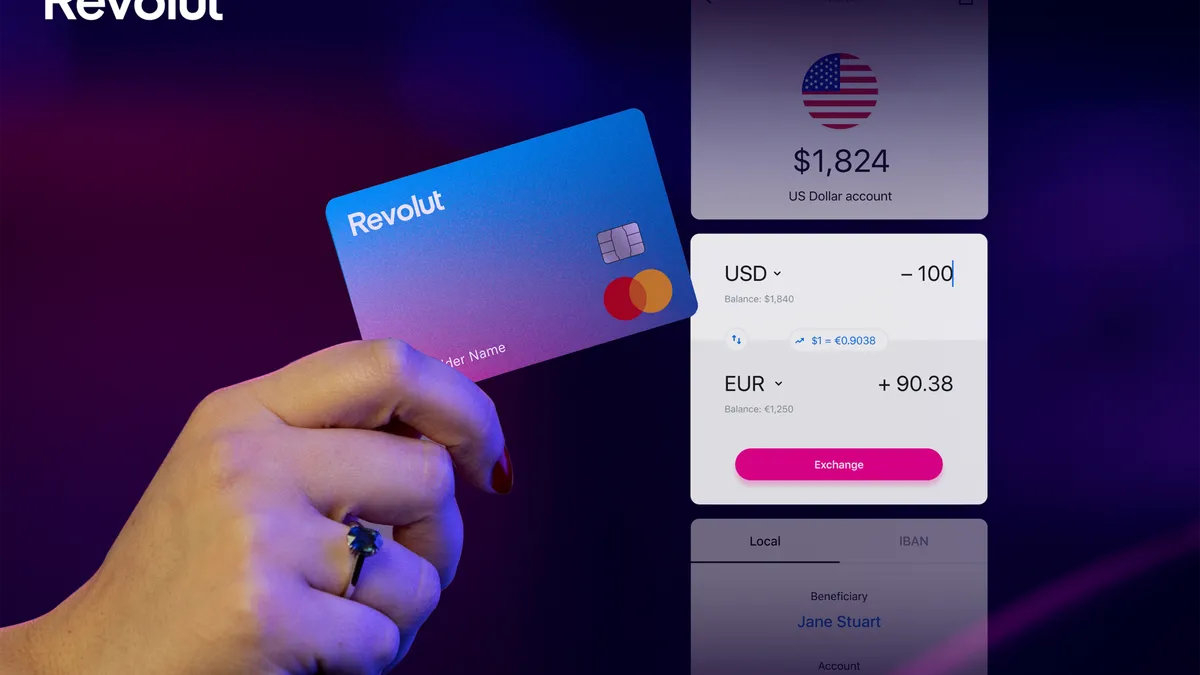

Revolut officially launched its digital banking platform and debit card in the United States, the British fintech announced Tuesday.

-

The challenger bank has been in beta in the U.S. since June and has about 60,000 testers, the company told The Verge.

-

Revolut, launched in 2015, could face unique challenges as it expands to a new market at a time of economic uncertainty caused by the coronavirus pandemic.

Dive Insight:

"America, we come bearing good news in these uncertain times," Chad West, Revolut’s head of marketing and communications, wrote in a blog post.

The fintech claims to have more than 10 million total users and joins a number of European neobanks that have made recent leaps across the pond.

Berlin-based N26 entered the U.S. market last July, and British challenger bank Monzo launched a limited rollout in June.

Revolut also faces U.S.-based contenders Chime and Varo Money, which are battling for customers.

"This move was expected," said Sarah Kocianski, head of research at fintech consultancy 11:FS. "However, Revolut has a different position to many challengers, being less widely used as a 'primary' account, or even the 'daily spending' account."

Revolut offers remittances in addition to banking services. U.S. customers can spend and send money overseas at the real exchange rate with no hidden fees, the fintech said. Users can also hold and exchange 28 currencies in the app, including the British pound, Canadian dollar and the euro.

The fintech lets its Europe-based customers buy cryptocurrencies and invest in the stock market. Revolut said it plans to introduce more features to U.S. users over the coming months.

The company will face stiff competition in the U.S. from other digital banks and fintechs, Kocianski told Banking Dive.

"The other aspects of its service at launch, and those it plans to roll out, already have established competitors in the U.S.," she said. "Remittances are already well served. It will find it tough to compete with Robinhood, which is already pretty well-established in the market and offers a similar proposition in terms of stock trading and crypto."

London-based Revolut is expanding to the U.S. during a time of widespread economic disruption caused by the coronavirus pandemic.

"COVID-19 will have more of an impact on Revolut's business than it thinks," Kocianski said. "People aren't and can't travel abroad at the moment, a situation that's unlikely to change in the coming months. Free spending abroad is a large part of what attracted customers to Revolut in Europe in the first place.

"That's also true of the send-money-abroad feature," she added. "Many of the people who will be sending money abroad to loved ones in the U.S. will fall into the remittance category."

A large segment of Revolut’s U.S. customer base may be gig or contract workers, a group likely to be hardest hit by the pandemic and with less money to spend, Kocianski said.

Revolut’s "split-the-bill" feature and its contactless cards, which are supported by Apple Pay and Google Pay, may also face some hurdles in the U.S.

"People aren't going out and socializing, so the idea of splitting the bill is pretty moot," Kocianski said. "Finally, contactless payments just aren't that popular in the U.S. yet, and a large part of that is merchants not having the terminals to accept these payments, so hyping up Google, Apple Pay and contactless cards will have minimal impact at launch."

Revolut is partnering with New York-based Metropolitan Commercial Bank to offer FDIC-insured deposits to its U.S. customers.

The fintech in September said it was set to more than triple its staff to 5,000 at a time when payment networks Visa and Mastercard were vying to partner with it.