Dive Brief:

-

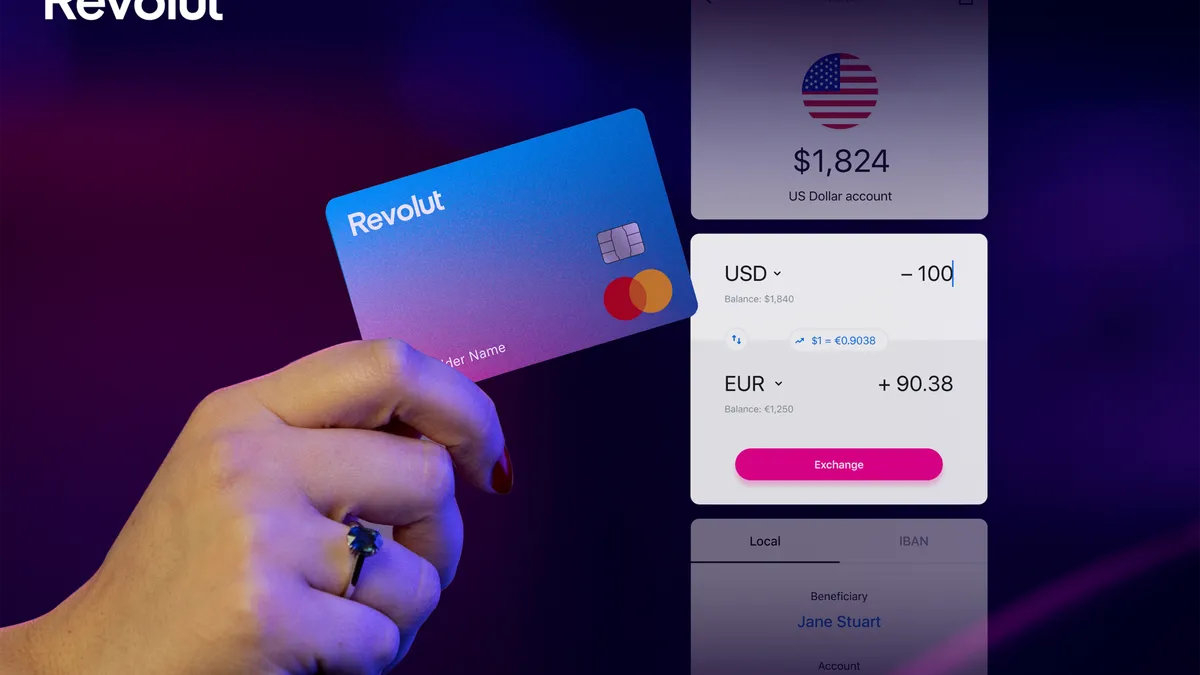

U.K. challenger bank Revolut submitted a draft application with the Federal Deposit Insurance Corp. (FDIC) and the California Department of Financial Protection and Innovation to obtain a banking license in the U.S., the London-based fintech announced Monday in a press release seen by Banking Dive.

-

Revolut, which says it has 15 million customers worldwide, last week launched Revolut Business across all 50 states, the digital bank said in a blog post.

-

The challenger bank has been operating in the U.S. for one year and provides its U.S. consumers with FDIC-insured accounts through a partnership with Metropolitan Commercial Bank, which also issues its cards.

Dive Insight:

Revolut said a U.S. banking license would allow it to provide a broader range of financial products to U.S. customers, including overdraft protection, loans and deposit accounts.

"We’re on a mission to build the world’s first global financial superapp, and pursuing a US banking license is an integral part of the journey," Revolut co-founder and CEO Nik Storonsky said in a statement.

Revolut claims it has "attracted hundreds of thousands of customers" since launching in the U.S. market in March 2020.

With the launch of Revolut Business, the company is showing that it’s also targeting U.S. small and medium-sized businesses, in addition to the consumer accounts fellow digital players Chime and Varo Bank are chasing.

"Small and medium-sized businesses are massively underserved in the US, and we want to empower them with the tools to grow and scale globally," Storonsky said. "Tackling fragmented processes, high fees, and other business banking pain points, we built an end-to-end solution that saves business owners time and resources to focus on what really matters — running their business."

The challenger bank said its business banking service has amassed over 500,000 sign-ups in Europe. The service allows companies to access multi-currency accounts, issue physical and virtual corporate cards, and make free money transfers in 29 currencies.

The account also includes free and instant money transfers between companies that are signed up for Revolut Business, foreign currency accounts, and tools for expense and subscription management.

Revolut’s U.S. charter application and its small-business banking launch come two months after it announced it was pursuing a bank charter in the U.K.

Revolut said in January it submitted its application for a U.K. bank license to the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA).

Revolut was granted an EU banking license in Lithuania in December 2018 and has begun rolling out banking services in Central Europe.

Other fintechs pursuing bank charters in the U.S. include San Francisco-based Brex, a fintech best known for offering banking services to startup businesses, which applied for an industrial loan company charter (ILC) last month.

Fintechs are finding that the charter route, however, is expensive and time-consuming. Varo Bank’s historic charter journey took the digital bank three years and cost it $100 million before it was approved last summer.

Online lender SoFi, which filed a de novo application with the Office of the Comptroller of the Currency (OCC) in July, announced plans this month to purchase Golden Pacific Bancorp, a Sacramento, California-based community bank, for $22.3 million, to accelerate its path toward a national bank charter.