Emily Luk and Channing Allen, two fintech pros who fell in love at a company eventually acquired by Walmart, were on sabbatical. They were traveling the world, and going back and forth on an idea born out of their own shared experience — how do we financially plan for a future together, and can we create an app that answers that question for fellow millennials?

“In moments where we’d think, ‘Let's explore other ideas,’ we’d meet another couple and they’d proactively bring up how complicated it was to manage money together or to figure out how much they needed to plan for a house or kids. We kept getting these signals that there were so many people running into the same problem,” Luk said.

The duo heeded those signals and sketched out different drawings of what the product would look or feel like, if they took a crack at developing it.

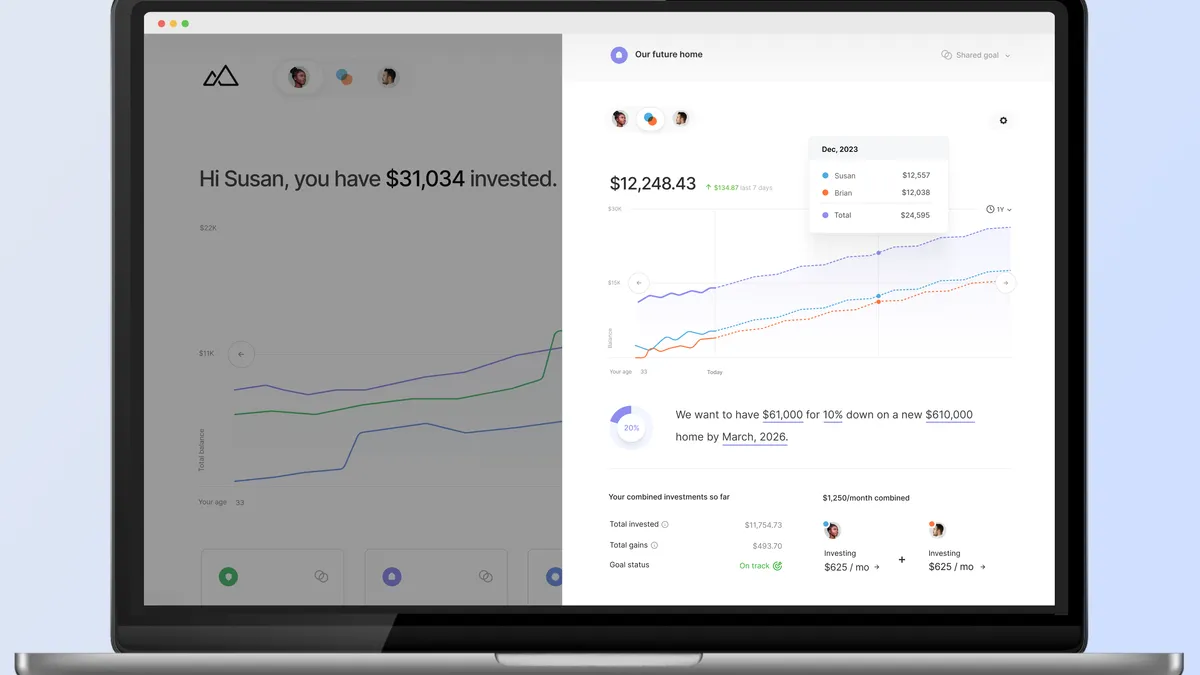

Now, parts of those sketches are live in Plenty, a wealth-building app geared to help couples manage and invest their money together.

“The other [couple-focused] products we've seen typically focus on expense splitting, which tends to be a much earlier chapter of someone's relationship,” Luk said. “When people start to use our product, they're like, ‘We actually are in a place where we [share expenses]. We don't care about one-off transactions, we're really rounding things at this point.’”

Plenty users connect their financial accounts to the app and choose which accounts to share with their partner.

From there, they’re able to transfer money into Plenty’s cash management product, a managed portfolio of money market funds custodied by BNY Mellon | Pershing that currently offers a 5.1% annual percentage yield, and earmark certain stashes of money to specific shared goals; or into its investment product, which aims to make investing “as simple as possible” for the end user.

“Ultimately, we want to make it as simple as you pressing [a button] and you can immediately deposit $100 and we will manage everything for you,” Luk said.

Millennials, she said, are still at the point in life where investing or saving just 1% more annually can have a huge payoff when retirement rolls around.

Plenty, which is a Securities and Exchange Commission-registered Investment Advisor, asks its users a few simple questions: What are your goals? Do you want to buy a house in five years, or are you focused on saving for retirement? Additionally, what are your values?

Most people don’t realize where their current 401K is being invested in, Luk said.

“Your retirement account could actually be invested in a payday lender. You would never invest in a payday lender, but [investment management firms] are some of the biggest investors in the payday lending space in America. They're also some of the largest investors in for-profit prisons,” she said.

Plenty users declare their values — for example, saying ‘yes’ to investing in tobacco companies, but ‘no’ to investing in companies that engage in animal testing – and the program creates a customized portfolio to align with those values.

Currently, Plenty is invite-only, and Luk wouldn’t divulge how many users it had. But it will be available to the public in the first half of this year, for at $200 per year per couple or $150 per year for a single user.

Bucking the trend

According to The Future of Fintech, a report released earlier this month by Forrester, the current landscape for business-to-consumer fintechs like Plenty is a challenging one.

“The days of neobanks’ splashy launches, massive hype, and blitzscaling are over. In fact, B2C fintech firms as a whole face more adversity than they have since the dawn of fintech: As one fintech founder quipped, ‘Friends don't let friends make B2C startups,’” Forrester wrote.

Luk – whose product is, of course, B2C – doesn’t disagree.

“Both Channing and I have always been pretty strong first principles thinkers, and if someone’s like, ‘I'm going to start a B2C fintech’, the first thing I would tell them is, ‘No one needs another debit card. No one needs another checking account. And if the product isn't different, I wouldn't do it,’” she said.

“We've made really key decisions from the very beginning [that have made] our product different,” she said. “It serves unique functionality you can't get elsewhere for a demographic that, largely, people have missed – people have missed the fact that there are so many people managing money with another individual,” she said.

She noted that many of the original joint-investment products on the market and even some popular joint credit cards weren’t built for both partners to have equal access to managing those investments.

”We came in from the very beginning knowing that there were a set of key architectural decisions that would be really important to build a multiplayer functionality. That's really different than if you had not planned to build it and now you're trying to build it after the fact,” she said.