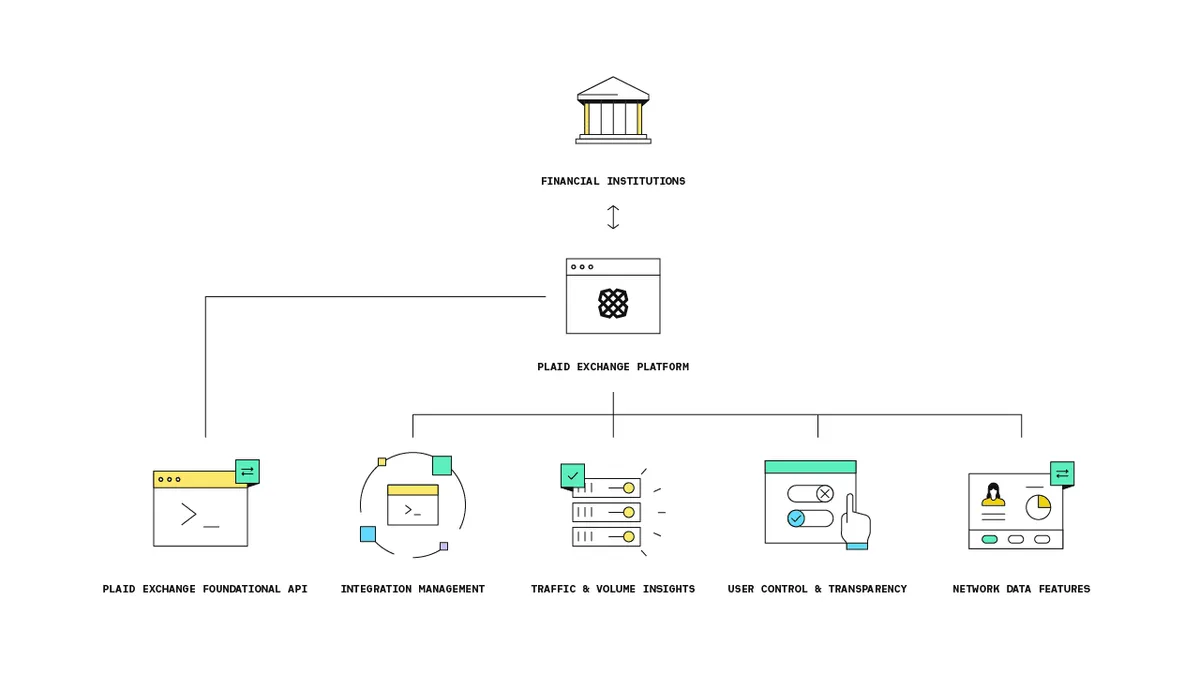

Data aggregator Plaid is launching a new application programming interface (API) platform called Plaid Exchange, a product the startup says will help smaller financial institutions compete with the likes of Wall Street banks.

"The objective was really to make sure that there is no barrier for those institutions to get onto APIs," John Pitts, Plaid's head of policy, told Banking Dive. "The last thing we would want is a future where the digital options for customers of Wall Street banks are different from the digital options of the customers of Main Street banks."

Plaid Exchange, which has been in development for the past year, is "rooted in user transparency and control," and addresses a consistent concern among banks: consumers' use of credential sharing, Pitts said.

"To enable data sharing with Plaid Exchange, we can move away from credential sharing onto an API-based access that significantly reduces concerns around privacy. There's also greater transparency for the bank," he said. "The nice thing about an API is the bank will be able to have real visibility into not only where Plaid connections are, but also what data each shared customer of that bank, Plaid and the app is sharing."

As bank-fintech partnerships become more widespread in the industry, some banks have made moves to limit third-party access to user data in the name of consumer privacy.

Using account login credentials provided by the customer, data aggregators have used screen scraping to collect information from users' bank accounts for years. Screen scraping is a method of data collection where a third party requests credentials from a customer's account to "scrape" information which is then provided to a fintech.

The practice has enabled Plaid to connect fintech apps such as Venmo, Chime and TransferWise to customers' bank accounts.

But recent security and policy changes at several large banks — including PNC and JPMorgan Chase — have blocked some aggregators from accessing passwords.

Banks have said consumers often are not aware of the information they are sharing with third parties, while fintechs have argued banks are limiting consumer choice by blocking third-party access.

Large banks such as JPMorgan Chase have created their own in-house APIs in an effort to stop screen scraping and credential sharing. The country's largest bank announced at the beginning of the year that it would ban third-party apps from accessing customer passwords and instead issue tokens for access to its own API-based dashboard.

But not all banks have the funds to build their own APIs, and Pitts said the costs associated with building one in-house can be a significant hurdle for institutions with smaller technology budgets.

After consulting with around 100 banks, Pitts said Plaid found that developing an API in-house could be a three- or four-year endeavor that could cost a bank between $10 million and $20 million per year.

"There are a number of banks who already have put a bunch of resources into their own APIs and Plaid has signed data access agreements and is doing API integrations with those banks already, but you can't solve this problem at scale without making it available to everyone," Pitts said.

It takes about 12 weeks for a bank to integrate with Plaid Exchange, and 20 banks are using the new platform, Plaid said.

"The main partners we're looking to integrate with here are banks that really want to have something that supports a digital strategy and want to make sure that their customers have access to all the apps and third-party services that they're using and relying on but don't necessarily have the time, in-house expertise, or the economic resources to build something themselves," Pitts said.

Pitts said the company doesn't want cost to be a barrier for any bank that wants to use Plaid Exchange, and pricing will vary largely around implementation needs based on the size of a financial institution's internal team and capabilities.

"We expect there will be some cost to implement, but will make this as cost-effective as we can, and will work with [financial institutions] on a case-by-case basis to make sure this is something they can adopt," a Plaid spokesperson told Banking Dive.

"We have a self-interest here just in improving the data quality, without having to then charge banks in addition to that," Pitts said.

As more banks adopt APIs, one of the biggest challenges for fintechs is negotiating data access agreements with the thousands of financial institutions that exist in the U.S., Pitts told a panel the Consumer Financial Protection Bureau (CFPB) hosted in February. "It's very hard to scale," he said.

Plaid Exchange’s additional offerings include a "consumer control center" that gives a bank’s customers visibility and control over how their financial information is shared and where their accounts are connected.

Visa announced plans in January to purchase Plaid for $5.3 billion.