In October, nearly 44 million Americans returned to paying their loan installments — a payment they haven't made in over three years. With the end of COVID-19 forbearance programs and the resumption of federal student loans, most borrowers might find it challenging to pick up where they left off a few years back.

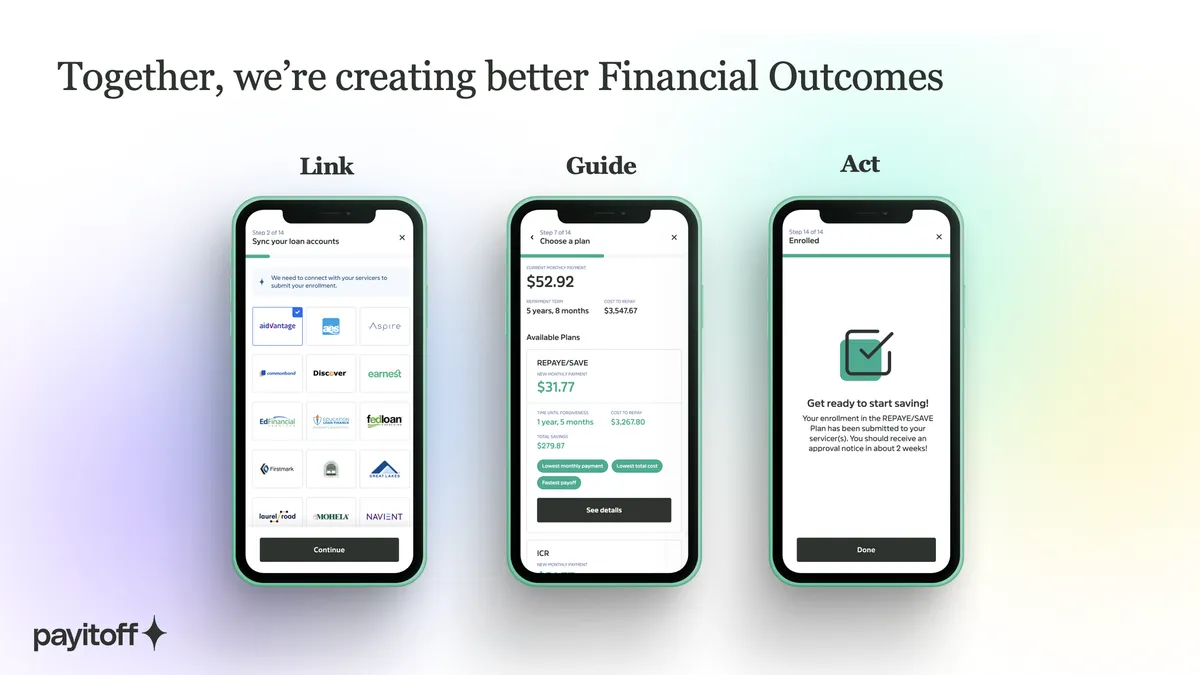

Payitoff, a provider of consumer debt guidance tools, has some product solutions lined up for borrowers to help them manage and lower their payments.

"We have been working with a lot of entities; the ones that are public – U.S. Bank, Earnest, LendKey — are all very recent large brands that have executed with us to help their customers find their servicer," Payitoff CEO Bobby Matson told Banking Dive. Since most borrowers don't know who their servicer is, he noted that Payitoff helps them find their servicer and set up their payment while saving on that payment by enrolling in federal programs.

"That's a lot of what we have been focused on — how do we help take the tech that we've built over many years prior to the pandemic and [apply] it in a way where there's a huge impact on financial services from this resumption? And we're helping to sort of lessen the blow of that payment shock," he added.

The U.S. Department of Education's COVID-19 relief for federal student loans has ended. Federal student loan interest resumed on Sept. 1 and payments restarted in October.

As the resumption began, U.S. Bank and fintechs like Earnest and LendKey collaborated with Payitoff to help their borrowers navigate payments as many borrowers find themselves on the edge of a significant shift in their monthly budgets.

With the latest partnership, Payitoff is powering a Federal Student Optimizer tool for LendKey that allows borrowers to input their federal loan information even if they need clarification on the servicer details. The tool provides personalized recommendations for federal income-driven repayment plans based on income, other debts and dependents. This might lead borrowers to save an average of $240 every month on top of the federal loan benefits, according to LendKey.

Meanwhile, U.S. Bank customers can search for and connect their student loan accounts on the Payitoff platform and answer the prompts about income and household information to get automated, personalized guidance that might help them save money during repayment.

Payitoff handles applications to federal repayment programs and keeps the borrowers updated on the status if an optimized repayment option is selected for the lender's customers.

According to a TransUnion study, 500,000 to 1.4 million consumers would become delinquent on one or more credit products due to the loan resumption. On top of inflation, higher interest rates and other factors, the resumption of payments will drive delinquencies higher and create a challenging environment for many consumers.

"Lenders with greater exposure to consumers who own student loans, particularly those who present higher credit risk or have lower incomes, must act with urgency to adjust their loss forecasts, underwriting strategies, and account management strategies," the study noted.

According to Matson, who himself had six-figure student loans and lots of credit card debt, there are many competing issues with the average consumer balance sheet.

"What we're seeing in behavior is increased shopping or similar levels of shopping on the same population, who now has $500 on average a month that's due. I think that you are going to see that competition, so I'm expecting very high credit-card balances," he noted.

He thinks that consumer spending will not be the same over time unless wages change significantly.

"The money that [the borrowers] are using towards the credit cards, the money that they are putting to their student loans or their debt obligations, maybe they are charging off, and it has impacted their credit," Matson highlighted. Borrowers might also charge off some personal loans or some buy now, pay later loans, he noted.

However, consumers might be willing to deal with the credit impact as well. "Those choices are happening, and they're going to keep happening," he added.

But, it is still too early to see the impact of the student loan resumption on the earnings report of the banks, according to the executive. He expects companies will take notice of the effect of payments resumption in January or February next year.

"We have seen the early adopters [and] are anticipating many more in 2024. We'll be making very serious investments and helping this population specifically," Matson said.