A new challenger bank targeting middle-class American families launched in private beta on Tuesday.

The bank, called One, is the latest venture for former Intuit and PayPal CEO Bill Harris, and Brian Hamilton, the former CEO of digital bank Azlo and a former Capital One executive.

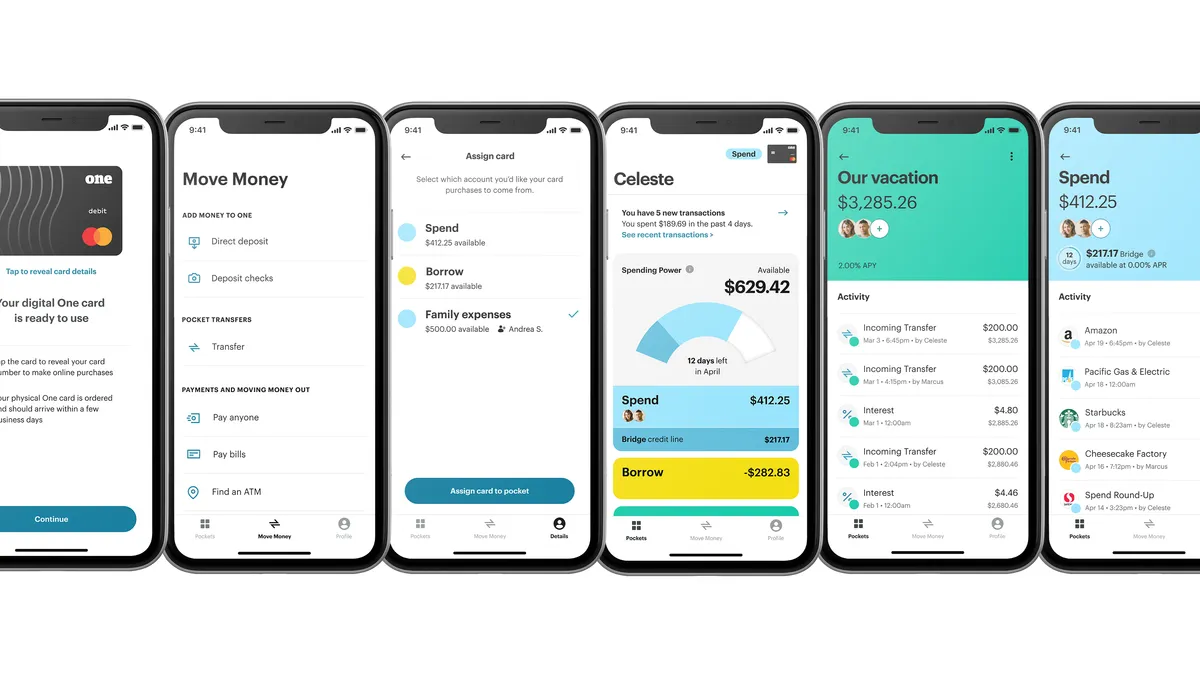

One aims to unify customers' finances, allowing them to save, spend, borrow and share money through one account. The startup is partnering with Everett, Washington-based Coastal Community Bank, to offer the FDIC-insured accounts.

Harris will serve as chairman of the neobank while Hamilton will head the company as CEO.

For Harris, a fintech veteran with an extensive background in personal finance, it's his first venture into the banking space.

New fundamentals

"I’ve done payments, accounting software, tax software, portfolio management, digital wealth management … a whole series of things," he told Banking Dive. "But I've never done the thing that matters most, which is fundamental banking."

The new bank, however, represents the third-such launch for Hamilton, who has already started two digital banks, one within Capital One and another within BBVA.

"He did the first two within the belly of the beast," Harris said. "Now he's got the opportunity to do something without the shackles of being within a large bureaucracy."

Harris said the San Francisco-based startup, which has raised $26 million in funding, will serve a demographic that hasn't had its needs adequately met by traditional banks or the current fintech offerings that are available in the market.

"Fintechs, for the most part, are focused on young digital natives and an important reason for that is, they're easier to market to — people who live on Facebook or Instagram," he said. It's relatively easy and low cost to attract initial customers. The limiting factor is that you get many low value relationships."

Harris said most challenger banks offer thin products for a demographic with relatively simple financial needs.

"It’s a card with an app for the most part, for young audiences, Gen Z and maybe the lower end of millennials," he said. "They’re often single. They often rent. Not a whole lot of complexity."

Traditional banks, on the other hand, are increasingly focused on attracting affluent customers, leaving a gap in the market for products that meet the needs of middle income households, he said.

Pursuing the middle

"What nobody seems to be doing is addressing the mainstream market, middle class families, people with good jobs, good earnings, creditworthy people, not super prime, but also not subprime," he said.

Harris said One will focus on the middle class, 30-50 year olds whose household income is in the $44,000 to $72,000 range, depending on geography.

"The average American family has upwards of 10 financial accounts," he said. "What we're trying to do is put that entire suite of full service banking into one simple account."

The bank features designated "pockets" for saving, spending or borrowing money as well as an automated savings option, which includes a 3% annual percentage yield.

"If we go out with a headline rate of 3% on auto savings, we're gonna get a lot of people who come in just for that, and then get to know us for the other things that we offer," Harris said.

The startup also has plans to obtain its own bank charter in the future, Harris said.

"The plan of record is to establish our operating history and determinacy, and then apply for a de novo charter with the [Office of the Comptroller of the Currency]," he said.

As the spread of the novel coronavirus continues to disrupt travel, businesses and the daily lives of millions around the world, the startup is launching during an uncertain time.

But Harris said the widespread disruption currently taking place illustrates the need for and importance of digital offerings.

"Brian Hamilton and I, we share a view that the entire financial services landscape is on an obvious move from physical delivery to virtual delivery," he said.

"Major financial institutions will get there, but slowly and awkwardly. In the meantime what the country needs is people who can get out there first right now with fully digital offerings. That's particularly the case now that we’re looking at the possibility that for some period of time we will be relatively restrained in terms of physical interactions," Harris said.