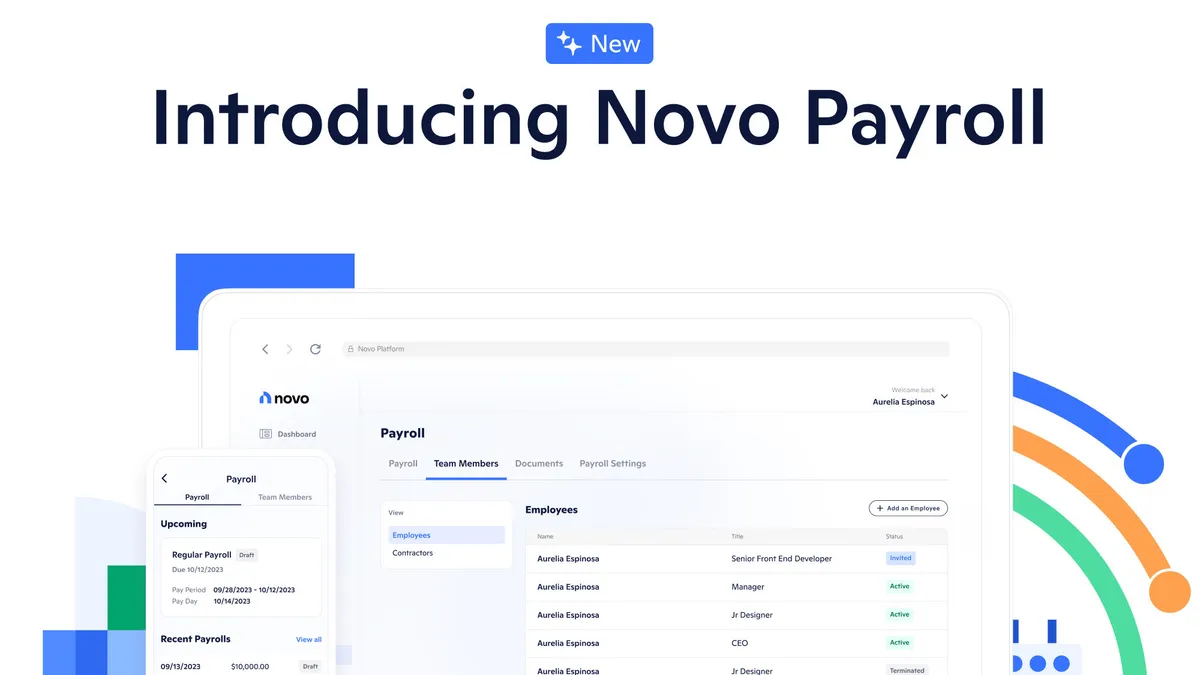

Novo, a financial solutions platform for small businesses, launched Novo Payroll, which allows any of its customers to run payroll directly from a checking account.

The new solution rolled out on Wednesday, is powered by Check, a payroll infrastructure company that developed the product using its payroll application programming interface. Novo Payroll is fully integrated into the fintech’s small business banking platform, streamlining the payroll process in an effort to both save time and ensure regulatory compliance.

“Traditional small business payroll solutions consist of standalone applications characterized by high fees, burdensome cash-on-hand requirements, and either clunky or non-existent integrations between payroll and business bank accounts,” Michael Rangel, founder and CEO of Novo, said in a statement Wednesday. “In collaboration with Check, we built a payroll solution that simplifies and speeds up the process of paying small business employees.”

Novo Payroll is a brand new product that complements and expands the fintech’s platform, Brad Paterson, EVP of marketing and partnership at Novo, told Banking Dive.

He added that Novo received feedback from its customers, primarily small business owners, that they were worried about complying with several payroll taxes and laws, which vary across the 50 states. They were also paying high fees for the services to process their workers’ payroll.

“There’s a number of payroll options in the market today. Very few are built for small business owners; most are built for more medium-sized businesses and above, which means that they’re charging exorbitant prices,” Paterson said. “We’ve managed to build a product that is streamlined in partnership with Check that does everything a customer needs, allows him to be 100% compliant, but at a fraction of the cost.”

Novo will offer all the essential features of the new product, including tax filing and end of year reports, at $35 per month with an additional fee per worker, the company said.

Through Novo Payroll, small businesses that need additional funds to run a payroll cycle can apply for Novo Funding and, once approved, use the capital immediately.

In August, the Miami, Florida-based company received a $125 million facility from Victory Park Capital to provide its customers with working capital through Novo Funding, which gives small businesses a fast and flexible way to access the capital.

Customers using Novo Payroll can contact the support team to get answers to any questions they have about payroll. According to the company, recipients can also receive their paychecks the next day after their payroll is processed at no extra cost.

Novo Payroll, available across 50 states, automates tax filings for small businesses with employees in a single state and multiple states.

“You do still have to file your own business taxes later on; that’s separate, but we do all of the initial withholding and reporting, and that’s what you expect of a payroll company,” Andrew Brown, co-founder and CEO of Check, told Banking Dive. “With Novo [Payroll] powered by Check, you just get the forms directly in the application. You download them, and it’s super simple to then pass those to your business tax filing solution.”

Novo has conducted a beta of the new tool and will make the product available to its customers in the coming weeks. But for now, customers can join the waitlist, which is a way for the company to ensure they get what they need, Paterson clarified.

The launch is also well-timed, he noted, since many small business owners are reassessing their payroll options at the beginning of the year.

“We realized that launching just after peak season was important. There are a number of small business owners making payroll decisions in January and February,” he said. “We have now well over 200,000 small business customers on our platform. Being able to offer it to the right customers at the right time was important, and we needed to move fast as well, [which] we were able to do with Check.”