Several digital banks targeting the U.S.’s immigrant market hit significant milestones this week, as the race to become the No. 1 financial services choice for the underserved market continues to gain momentum.

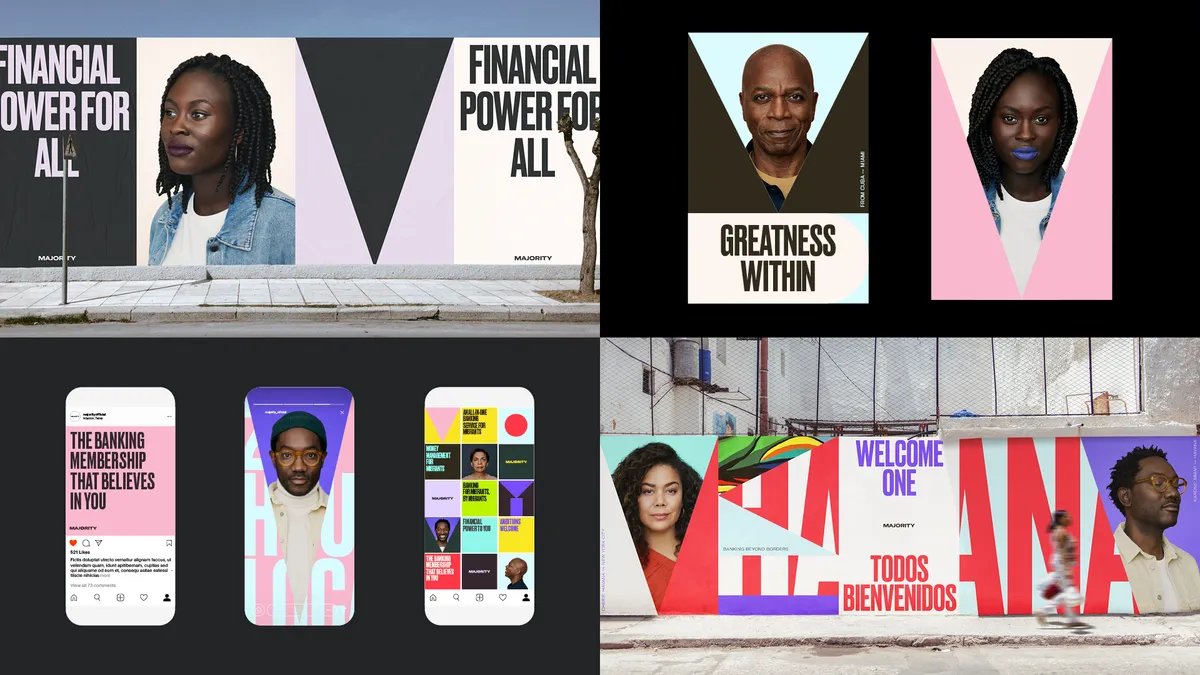

Majority, which first launched its digital banking platform in 2019 to serve Houston's large Nigerian immigrant community, announced Monday it raised $19 million in seed funding from investors, including New York-based venture capital firm Valar Ventures, with participation from Avid Ventures and Heartcore Capital. The fintech said it plans to use the funds to expand nationally and hire more employees.

Majority’s subscription-based banking services, which it offers in partnership with Ohio-based Sutton Bank, provides customers with a Federal Deposit Insurance Corp. (FDIC)-insured account and a Visa prepaid card. The service costs $5 per month and features unlimited remittances, as well as international calling services — products that appeal specifically to the immigrant demographic it aims to serve.

While still a digital bank, Majority has a goal to establish physical "meet-up centers" in the communities it serves. The neobank debuted its first center in Houston last year, and opened another in Miami's Little Havana in March.

"Given the current climate, we are thrilled to be in a strong position to ramp up our expansion plans and lead the way in building the best solutions for migrants to thrive in their new country," Majority founder and CEO Magnus Larsson said in a statement. "Since we are a company of immigrants for immigrants, we also look forward to hiring diverse talent that exists within the different immigrant communities we serve. This is more important now than ever given that many have been hit hard by the pandemic."

Larsson said the growing number of neobanks targeting immigrant banking indicates his startup is "in the right place."

"I think we're in pole position right now, but we need to work really hard to stay there," he told Banking Dive in March. "I think it's also proof that the banking space is going to become verticalized. I'm quite sure about that."

Remitly adds new features

Remitly announced Wednesday it added a slew of new features to Passbook, the digital banking platform it launched last year.

The Seattle-based digital remittance company debuted Passbook in an effort to offer financial services to the immigrant demographic that already uses its money-transfer services.

The company said its new enhancements include a streamlined identity verification process, more than 40% faster bank transfers on average, early payday, person-to-person payments, and immediate activation of its Passbook Visa debit card. Remitly said its early payday function also applies to tax returns and stimulus payments.

John Scrofano, vice president of Passbook, said Remitly’s goal is to ease financial services pain points often experienced by individuals not born in the U.S.

"For so many, the process of opening a bank account or sending money home to loved ones is often difficult. Between high fees, restrictive documentation requirements and an array of hidden costs, immigrants have long been disadvantaged by traditional financial services," he said. "We are constantly exploring how to make financial services more relevant and accessible for immigrants while addressing the distinct challenges they face. We believe the work we’ve done to improve Passbook is important progress toward opening those doors."

Fair launches

Fair, another fintech that got its start in Houston, said it officially launched its platform this week, after raising $20 million from 250 investors in February and amassing a waitlist of 50,000.

Founded by Houston-based entrepreneur Khalid Parekh, Fair’s subscription-based multilingual platform features international money transfers and no Social Security number requirements to open an account.

The platform also features a 2% annual dividend account, and members can access two free debit cards designed for their children.

Parekh, who founded the tech firm Amsys Group, told Banking Dive in April he plans to add lending and investment products to the platform this summer, with business accounts slated to launch later in the year. He also has plans to offer a robo-adviser product.