Dive Brief:

- Climate-conscious neobank Aspiration is laying off more than 180 workers as part of a companywide restructuring, the fintech disclosed in a Worker Adjustment and Retraining Notification letter it filed with California last month.

- The startup, which notified a handful of other states where it has remote workers, including Ohio and Wisconsin, said the layoffs are necessary to “streamline and restructure the business in light of current economic conditions and the limited capital available.”

- The letter was signed by Aspiration CEO Olivia Albrecht, who said the company “is saddened to have to take this step.”

Dive Insight:

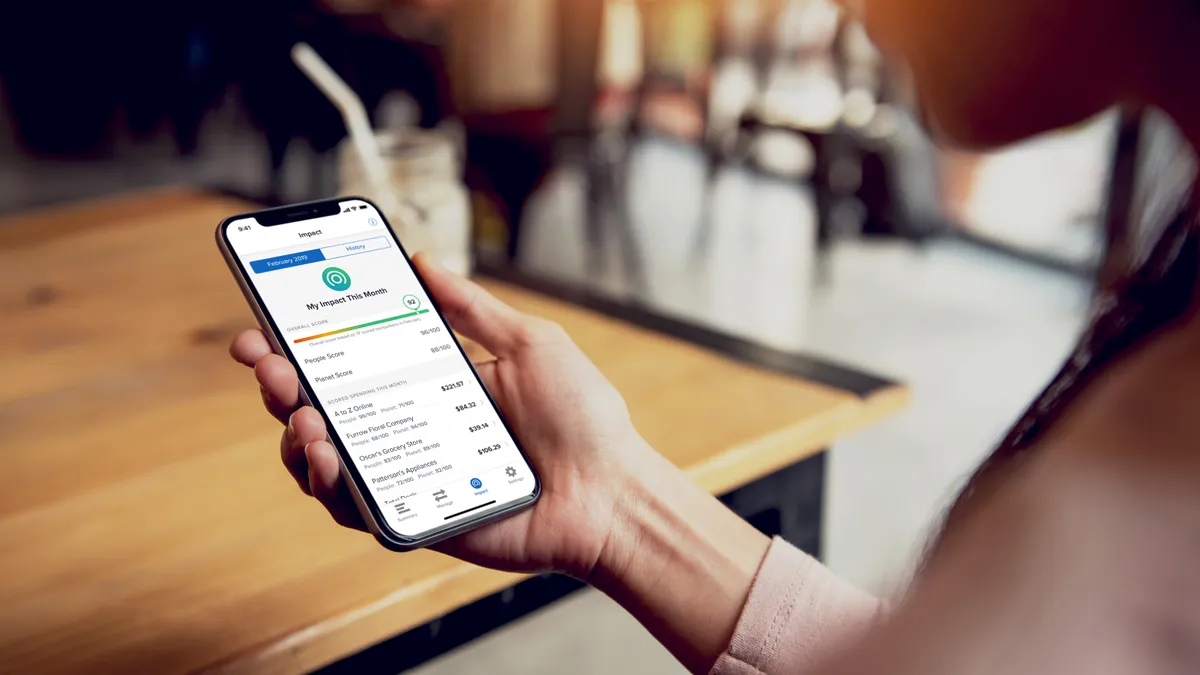

The Marina Del Rey, California-based firm, which sweeps users’ deposits into community banks that it certifies as fossil-fuel-free in their own lending practices, said the layoffs will occur between May 26 and June 1.

The layoffs span multiple departments at the neobank, and include dozens of software engineers and marketing positions.

Aspiration’s chief of staff and its chief administrative officer have also been let go, according to the fintech’s WARN notice.

The company did not immediately respond to Banking Dive’s request for comment.

Aspiration’s cuts follow a round of layoffs the firm initiated in December, where it laid off close to 100 employees, according to Forbes.

The recent restructuring also follows the firm’s leadership change last fall, in which former CEO Andrei Cherny, who co-founded the neobank in 2013, was replaced by Albrecht, previously the firm’s chief sustainability officer.

Under Albrecht, Aspiration shifted its focus to selling carbon credits to corporations, and has paused the rollout of new digital banking products, a former employee told Forbes.

Meanwhile, the firm’s plan to go public through a merger with special-purpose acquisition company InterPrivate III Financial Partners Inc. has encountered several delays.

The deal, announced in August 2021, valued the fintech at $2.3 billion, and was expected to be completed in early 2022.

The transaction, however, was pushed to Dec. 31, 2022, then to March 31 and most recently to May 1, Forbes reported.

At the time it was announced, Aspiration said the SPAC would provide it with more than $400 million in cash — capital it aimed to use for marketing and product innovation and technology investments.

The firm, which claims to have more than 5 million accounts, has attracted investments from celebrities including Leonardo DiCaprio, Cindy Crawford and Orlando Bloom.

Since its launch, Aspiration has raised over $500 million, according to CB Insights.