German digital bank N26 has reached 250,000 U.S. customers five months after its U.S. launch, the bank announced Monday.

The Berlin-based startup, which was founded in 2013 by Valentin Stalf and Maximilian Tayenthal, launched its beta platform to 100,000 U.S. customers on its waiting list last July, before its official public launch in August.

The company also reported it surpassed 5 million customers globally, a 43% jump from the 3.5 million users it reported last summer.

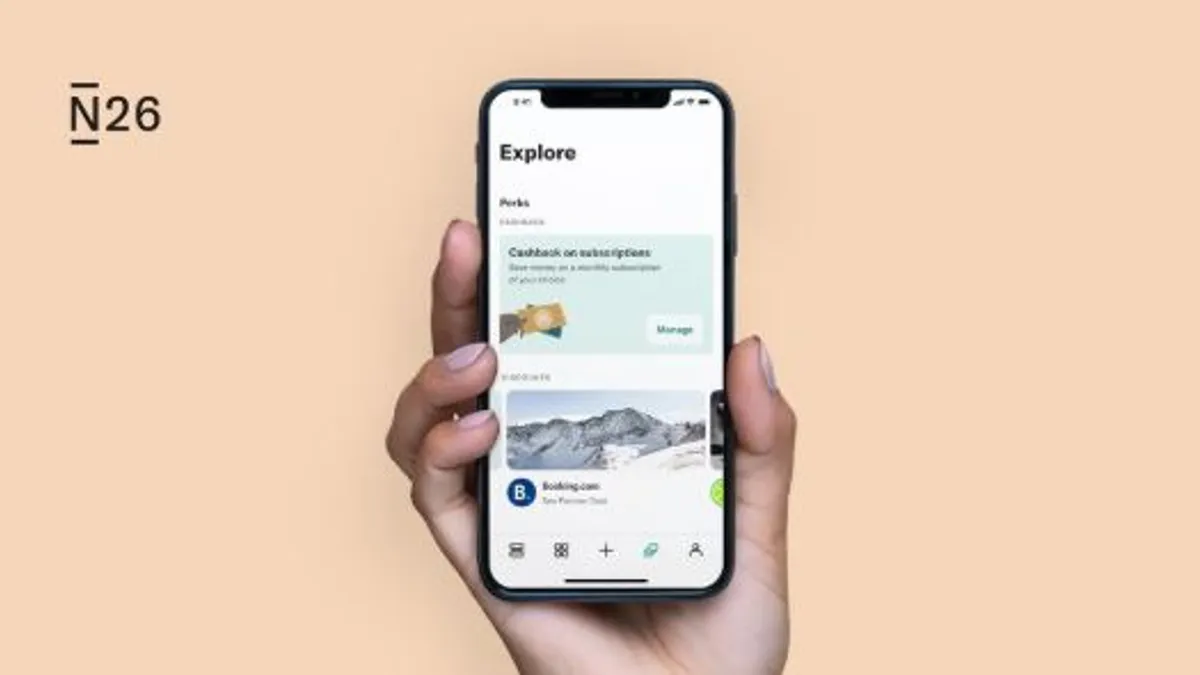

N26, which offers online banking through its mobile platform, recently expanded its Perks program, a debit rewards program that offers cash back and discounts from brands, including Booking.com, Lime and Headspace.

Banking Dive spoke with Nic Kopp, the company’s U.S. CEO about the digital bank’s strategy for growth, challenges and the nuances between the European and U.S. markets.

This interview has been edited for clarity and brevity.

BANKING DIVE: Do you plan to expand beyond retail banking in the U.S.?

NIC KOPP: Right now, we only serve retail customers in the United States. At the global level, we have a freelance product where it’s basically sort of a version of a business bank account, from a regulatory perspective. There are some nuances, but they are basically freelance accounts and business accounts that we offer at a global level. In the United States, we don't. But never say never. There are no active plans here in the U.S. But it’s definitely an industry that I’m closely following because I do think some of the pain points that retail customers have, you can also observe for businesses.

What are some of the common misconceptions some people have about N26?

KOPP: I used to get asked if our product is only for early adopters, the young folks in their early 20s. I usually answer that more than 40% of our global user base is actually older than 35. That gives you a little bit of flavor of the age distribution, and that this is not just only skewed toward the early adopters.

The way we speak and market to customers is very much targeted at people that just want to do banking on their mobile phones and that treat that as an additional value and convenience in their lives versus having to go visit a bank branch in person.

What are some of the biggest differences between the U.S. and European markets when it comes to financial services?

KOPP: I’ve actually done a fair bit of research on that, especially since coming over more than two years ago. I basically moved with N26 from our global European office to build out the U.S. part of the business. … I found behavior around earning points really fascinating here in the U.S. There is a real focus on where they're spending and what they're getting when they're spending, like on dining and travel. And that's much less prevalent in Europe than it is in the United States. That's one distinguishing factor, which also led us to start building out our Perks program.

The other thing that I observed is just the savings rate of people here in the U.S. If you look at student debt and then just the propensity to take on debt and generally to save less, in the U.S. it’s a lot higher than Europe. The difference between Germany and the U.S., the savings rates are more than five times higher in Germany than they are, for example, in the U.S.

This behavior around saving less here in the U.S. is also something that I'm thinking through quite a bit. Spaces, for example, is a product that helps you create sub-accounts for different purposes in real time. It’s one way of addressing that here at N26. But we need to continuously think about these really deeply ingrained behaviors that come with the U.S. consumer population and how we can best help people live better and healthy financial lives based on the findings that we have here.

We’re seeing a lot of challenger banks spring up. Can the market support these new digital banks, as well as the traditional banks?

KOPP: I have the belief that what we’re doing here at N26 — but also what some of our peers are doing — is really fundamentally changing the industry. And the industry that we're changing together is vast. Money touches all components of people's lives. You deal with money one way or another multiple times a day.

The technology today actually allows you as a banking institution or company that offers banking services to be really close to these interactions with mobile phones. ... If you assume it's a very deep industry and an industry that can be formed and changed like Airbnb created its own industry, like Uber created its own industry, then I think you can probably argue that the industry or the future industries around financial services are able to support more than one player.

What are your biggest challenges as you look to grow N26?

KOPP: The key challenge and what I think about a lot is, how do we get there? What are the milestones that we can execute again, to get to the end result of fundamentally changing the industry?

And that's where I actually spend most of my time. I spend a lot of time recruiting and bringing the best talent on board, and I spend time on strategic discussion of these milestones. I see, actually, the challenge is more in the execution, than in the manner of getting there, so a lot of growth on the global level through organic channels. You can really sense a pull in the market of consumers toward these mobile-first products.

And so for me, what I actually think about most is, how can we actually harness that power to make that change as fast as we can and serve our customers?