Dive Brief:

- Microsoft is partnering with data aggregator Plaid on a personal finance app, Money in Excel, set to roll out in the coming months, both companies said in blog posts this week. The collaboration is part of the April 21 relaunch of Office 365, which will be rebranded Microsoft 365.

- The deal would give Office 365’s 38 million users exposure to Plaid, which already serves 11,000 institutions, including, Venmo, Square and Acorns, and is connected to one in four U.S. bank accounts, according to the company’s chief operating officer, Eric Sager. Visa announced plans to purchase the company in January for $5.3 billion.

- It's not the first foray into financial services for the tech giant. The company in 1991 launched Microsoft Money, a personal finance management program that let users check bank account balances, create budgets and track expenses. Microsoft discontinued it in 2009, saying "demand for a comprehensive personal finance toolset has declined."

Dive Insight:

Microsoft's re-entry into financial services follows a number of tech giants' entry into the space. Apple partnered with Goldman Sachs last August to launch a credit card. Google aims to offer checking accounts backed by Citi this year. And Facebook debuted its own payment service, in addition to its effort to create a cryptocurrency.

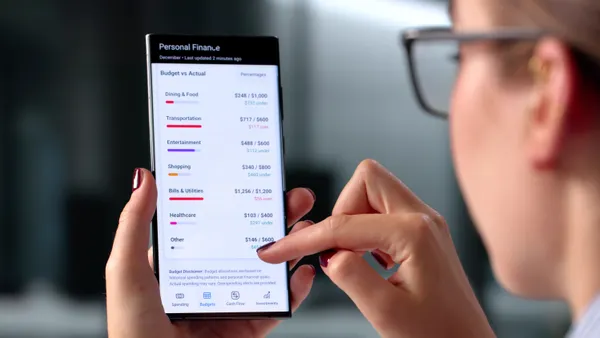

"For years, people have relied on Microsoft Excel to budget and track expenses for their personal finances or businesses, typically copying data over from multiple sources," Plaid wrote in a blog post, calling spreadsheets an early form of fintech. "Money in Excel features a Plaid integration, [which] allows users to securely connect their financial accounts, import the data within them, sync balances and transactions over time, and, ultimately, gain greater insights into their financial health."

Money in Excel will contain a Monthly Snapshot with personalized graphs and charts to help users better understand spending behaviors, according to PYMNTS.com. It will also feature proactive alerts about price changes for recurring payments, bank fees and overdraft warnings, Microsoft said. It will cost $7 a month for individuals and $10 a month for families, American Banker reported.

Since winding down Microsoft Money, smartphones have become more advanced — and ubiquitous — and a number of fintechs have filled the data-harvesting space, simplifying much of the math and tracking of personal finances for the user.

Plaid has direct data-sharing partnerships with such big banks as Wells Fargo and JPMorgan Chase. For banks that don't have such agreements, Plaid can screen-scrape for customer data.

In a separate blog post, Sager said the coronavirus crisis has made a "digitally delivered financial system" more crucial.

"People are learning new digital habits which may have long-lasting effects on consumer behavior," he wrote. "In many ways, the situation is shining a light on areas that need better experiences for consumers."

Sager also praised Microsoft as an innovator. "Many of these larger, tech-forward companies have little to no role in financial services today but will likely help shape our FinTech reality for decades to come given their consumer footprint," he said.

Microsoft may be looking to expand that consumer footprint in its larger rebranding of Office 365.

"Microsoft got rid of the word 'Office' to imply that it's not just about being in the office but also outside of the office,” Theodora Lau, a partner at the venture capital firm Unconventional Ventures, told American Banker. "I think they’re trying to rebrand this to be more family focused."

The timing of the rollout — in the midst of a pandemic — may also be fortuitous, Lau said.

"Especially after this crisis is over, we’ll need to focus on how do we rebuild our finances, which will then include looking at what we're spending, what can we change and what are the fees that we can minimize?" she said. "It's an interesting step in the right direction."