Majority, a neobank targeting the U.S. immigrant market with bundled services, has raised $37.5 million in a Series B funding round as it grows its physical footprint and explores new offerings, the company announced Wednesday.

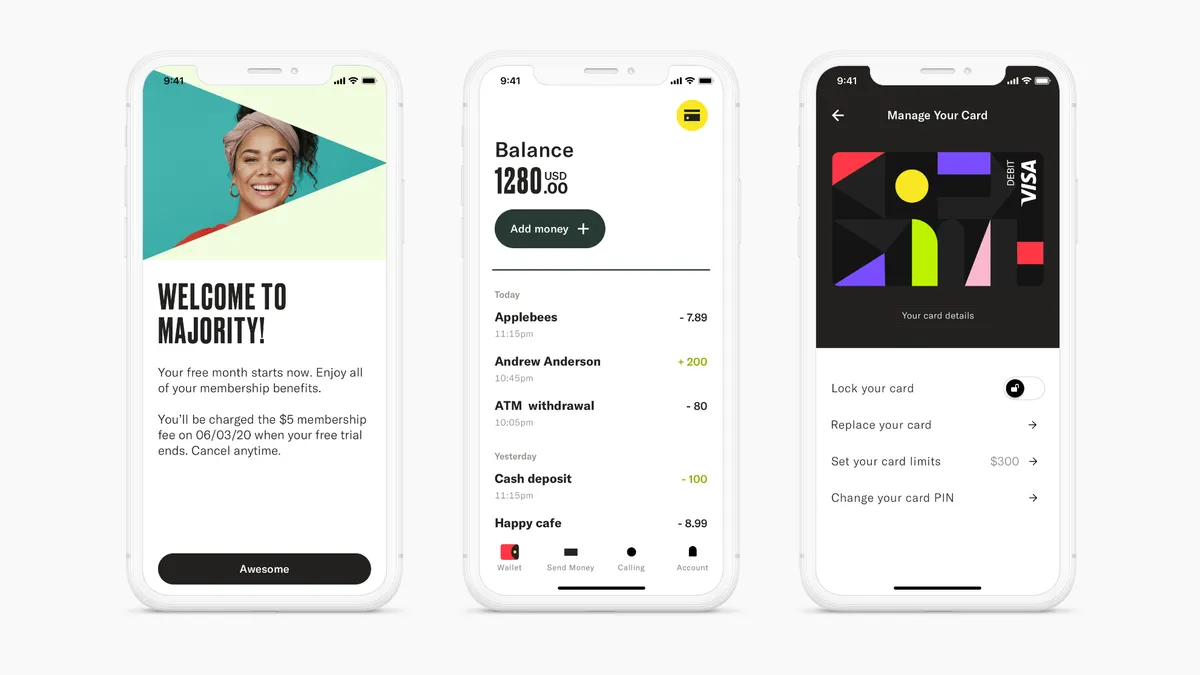

The digital bank, whose bundled services include a Federal Deposit Insurance Corp. (FDIC)-insured account, debit card, remittance and international calling, received $30 million from Valar and Heartcore Capital, as well as $7.5 million in debt financing from a U.S.-based commercial bank, the company said.

“Our plan wasn't to fundraise right now, but Valar, which led our seed round and A round, gave us an offer,” said Magnus Larsson, Majority’s founder and CEO. “As they say, you should fundraise when you don't need to. In this environment, it’s great to secure a very long runway. As an entrepreneur, you want to be able to do that.”

Majority, which first launched its digital banking platform in 2019 to serve the large Nigerian immigrant community in Houston, also announced the opening of three new locations in Florida, as well as a new location in Houston.

Part of the digital bank’s strategy to reach its target demographic is to establish physical “meet-up centers” in communities with large immigrant populations.

As part of its outreach efforts, the fintech hires local advisers who can help onboard and support users in each community.

The neobank, which declined to share its current valuation or number of users, has raised $83.5 million to date.

Majority has seen monthly transaction volume quadruple in the past year among its user base, Larsson said, while overall revenue has jumped fivefold.

The platform charges a monthly subscription fee of $5.99 for its services.

As the neobank looks to attract more of the country’s immigrant population, it has focused on solving several pain points the demographic faces in accessing banking and navigating life in the U.S.

The neobank announced last year that users could register for a Majority account without a Social Security number or U.S. documentation. Applicants only need international government-issued identification and some proof of U.S. residence o open an account on the platform.

Larsson said the neobank has partnered with Alloy on the identification verification front.

The fintech last year also released its Migrant Handbook, an online resource to help immigrants navigate life in the U.S. by providing information on banking, healthcare, taxes and housing.

As Majority looks to expand its services, Larsson said he is aware of the prevalence of “predatory” payday lenders in the U.S. and is looking at ways the fintech can provide credit and lending solutions.

“The credit system in this country needs development, in my eyes,” he said. “Our consumers and our communities that we work with are in need of good credit solutions that are fair and reasonable.”