Diversity and inclusion strategies at big banks need an upgrade, House lawmakers concluded in a recent report, and the onus is on executives to drive those efforts.

"There is no shortage of diverse people and businesses for banks to hire and promote. Just a shortage of leaders, including bank leaders, with the will to make it happen," said Rep. Al Green, D-TX, in a statement.

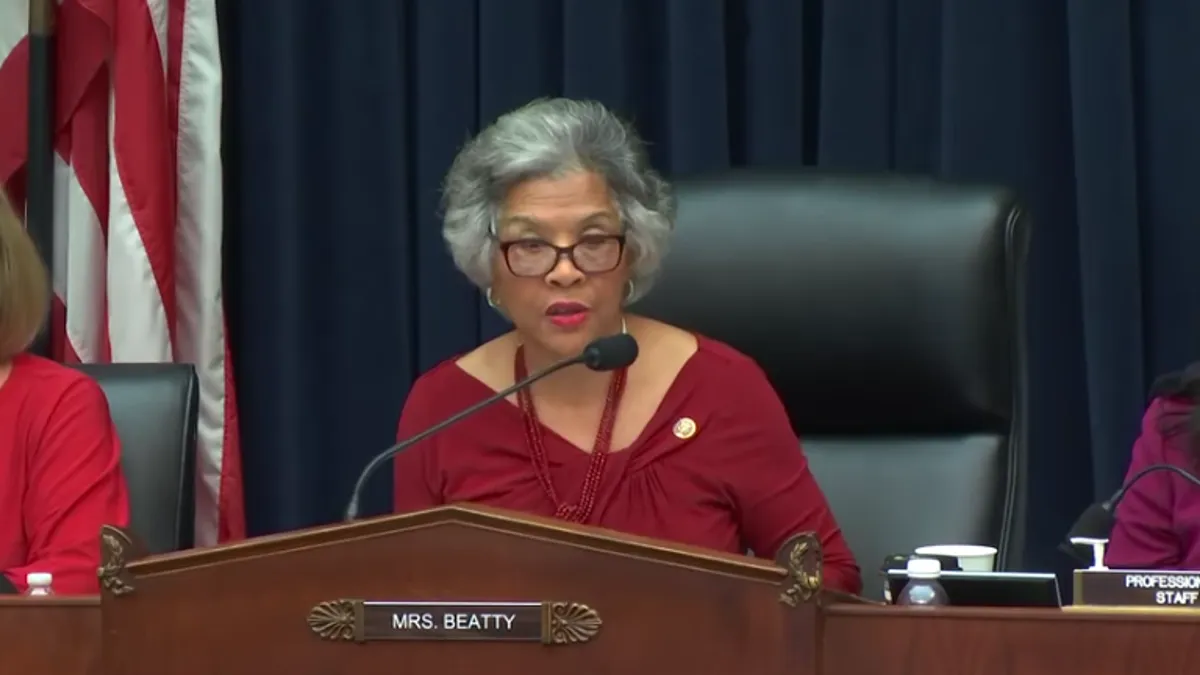

U.S. House Financial Services Committee Chairwoman Maxine Waters, D-CA, and Diversity and Inclusion Subcommittee Chair Joyce Beatty, D-OH, requested in June 2019 that 44 of America's largest bank holding companies and savings and loan holding companies, with $50 billion or more in assets, provide the committee their diversity and inclusion data and policies. The committee released the resulting report, Diversity and Inclusion: Holding America's Large Banks Accountable, Feb. 12.

The analysis revealed that banks' board of director seats continue to be filled predominantly by white males, and representation of women and minorities often diminishes significantly at the senior management level. Banks sharing career-level demographics indicated that women made up less than one-third (about 29%) of their executive and senior level workforce, and white individuals made up 81% of the executive suite.

Responses that included detailed race and ethnicity data showed that blacks and Latino individuals comprise 4% or less of banks' executive and senior level employees and 6% or less of first and mid-level leadership employees. "Bank workforce diversity is more visible in entry level rather than executive and senior level positions," the report said.

‘Companies must be more transparent'

All 44 banks asked responded to the committee's request for workforce data, which included employee race, ethnicity and gender information. However, the report said, they did not all fully respond to each question posed in a letter from Waters and Beatty. The congresswomen requested data from 2015 onward, but the years submitted by each bank varied.

This lack of transparency was highlighted in a February 2019 report from the U.S. Government Accountability Office (GAO). The office examined trends in the diversity of financial services firms' management and potential talent pools from 2007 to 2015. According to the findings, the overall management representation in the financial services industry increased marginally for minorities and remained unchanged for women. "[Q]uestions remain about the diversity of the workforce in the financial services industry," GAO's report concluded.

Beatty said in a video statement the banks' responses confirmed that "banks and other financial services companies must be more transparent with diversity data so that regulators, Congress and the American people can hold them accountable."

While some such requirements are in place, including those in the Dodd-Frank Wall Street Reform and Consumer Protection Act, Beatty said the voluntary nature of other requests makes accountability challenging.

D&I planning

Some banks, the report noted, are making progress. Common diversity-focused policies and practices include linking diversity and inclusion results to performance; creating employee resource groups; connecting with diverse communities; creating pathways for diverse talent; and collecting data on diversity results.

Citigroup, for example, plans to have at least 40% of assistant vice president through managing director roles filled by women by the end of 2021, according to the report. To meet that goal, the company told the committee it tracked the number of women being interviewed and applied a Rooney Rule — a debated NFL mandate that teams interview at least one minority candidate for head coach vacancies — "for these types of senior level positions to better guarantee that women and minority candidates have a stronger opportunity to be considered and ultimately selected."

The House report will be the first of several deep dives by the committee into the financial services industry's diversity and inclusion practices, Waters said in a video statement.