Dive Brief:

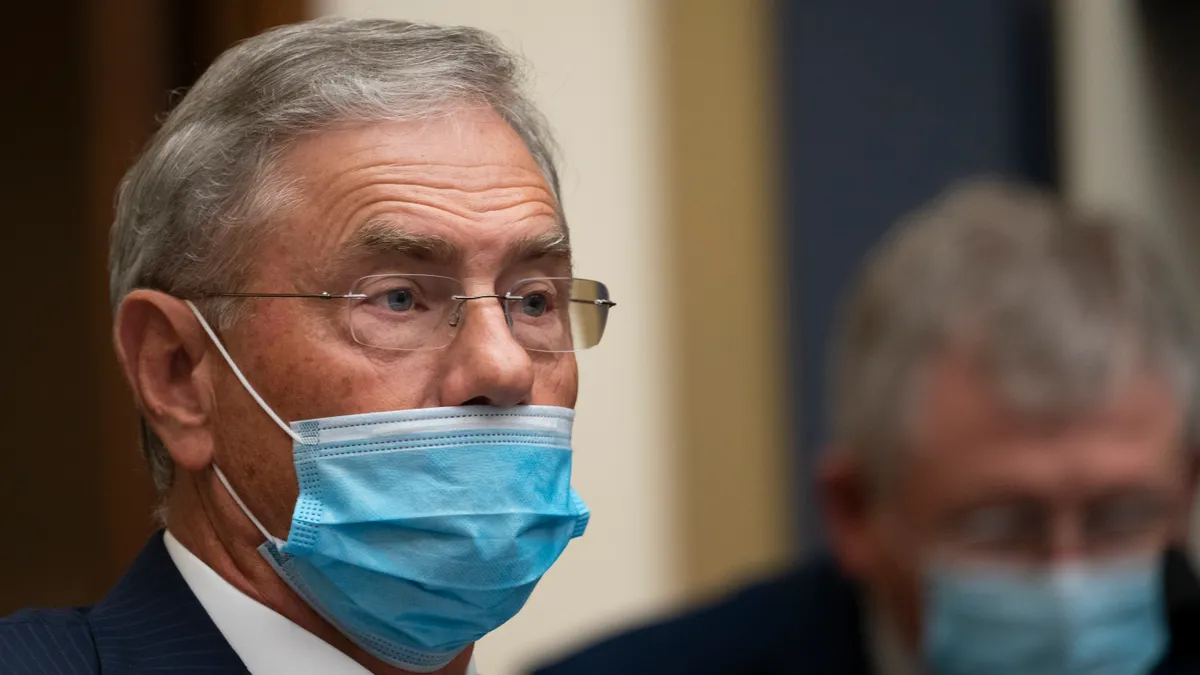

- Rep. Blaine Luetkemeyer, R-MO, introduced a bill Thursday that would divest the head of the Consumer Financial Protection Bureau (CFPB) of voting rights on the board of the Federal Deposit Insurance Corp. (FDIC).

- The bill has garnered the support of every Republican on the House Financial Services Committee, after CFPB Director Rohit Chopra last week said the FDIC board voted to launch a review of the agency’s Bank Merger Act policies without the sign-off of the regulator's Trump-appointed chair, Jelena McWilliams.

- Republicans on the House Financial Services Committee, led by Rep. Patrick McHenry, R-NC, launched an investigation Tuesday into the notational vote held by Chopra and fellow FDIC board members Martin Gruenberg and Michael Hsu.

Dive Insight:

The power struggle between McWilliams and the rest of the FDIC’s board continues to unfold, as Republicans voice discontent with the actions taken by Chopra, Gruenberg and Hsu, who also serves as acting chief of the Office of the Comptroller of the Currency (OCC).

Democrats Chopra and Gruenberg — himself a former FDIC chair — published a joint review of bank merger policies last week without McWilliams's approval.

“The recent actions of Director Chopra and Director Gruenberg illustrate that the FDIC Board of Directors is in serious need of reform,” Luetkemeyer said in a press release published Wednesday.

The FDIC Board Accountability Act aims to rebuke Chopra for holding a notational vote via email and publishing a request for information and comment on bank mergers — on the CFPB's web page — without the FDIC chair's buy-in.

The bill also would introduce a two-term limit which would cap FDIC board members' tenure at 12 years. Gruenberg, for reference, has served on the FDIC board since 2005.

However, with Democrats in control of the House, Senate and presidency, the bill is unlikely to pass.

Instead, the measure is a symbol of the partisan rift in Congress and inside the regulator.

“As I have repeatedly stated, as the Director of the CFPB, Mr. Chopra wields unchecked power over our economy," Luetkemeyer said in the press release. "In this position, he should be focused on ensuring consumers are protected in our financial system, not interfering with safety and soundness requirements such as liquidity and capital for America’s financial institutions."

Meanwhile, Republicans on the House Financial Services Committee launched an investigation Tuesday into the conflict on the FDIC board, and wrote a letter to committee Chairwoman Maxine Waters, D-CA, requesting a hearing on the issue.

The FDIC held a public meeting Tuesday, in which McWilliams struck down a request by Chopra to include the request for information and notational vote results in the organization’s official minutes.

“Of the 20 chairmen who preceded me at the FDIC, nine faced a majority of the board members from the opposing party, including Mr. Gruenberg,” McWilliams wrote in an opinion piece published Wednesday by The Wall Street Journal. “Never before has a majority of the board attempted to circumvent the chairman to pursue their own agenda.

"This episode is an attempt to wrest control from an independent agency’s chairman with a change in the administration," McWilliams continued. "More than that, it’s an example of the erosion of America’s democracy."