Dive Brief:

- KeyBank is eliminating non-sufficient funds (NSF) fees and reducing its overdraft charge to $20 per instance beginning late this year, the Cleveland-based bank said in a press release this week.

- The bank also will cut — from five to three — the maximum number of times a customer can be charged an overdraft fee per day.

- KeyBank is also instituting a negative account balance threshold, wherein it won't charge customers an overdraft fee unless their account is $20 or more in the red, the bank said.

Dive Insight:

KeyBank previewed its policy changes at its investor day in March, and signaled it is working on a handful of other offerings for future rollout, including early wage access (two days ahead of payday with direct deposit), instant access to mobile-deposited funds, and a small-dollar loan product meant to give clients short -term liquidity, the bank said in its press release.

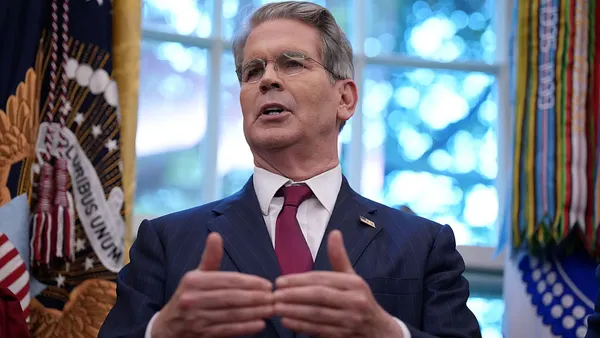

"KeyBank remains committed to providing our clients a competitive range of products and services to meet their individual needs,” Victor Alexander, the bank's head of consumer banking, said in the release. “These changes to our overdraft policies — combined with our existing Hassle-Free checking offering which does not charge overdraft fees — will provide our clients the tools and support they need to manage their finances effectively."

The bank's overdraft system now is tiered. Customers pay $33 for the first two overdraft or NSF fees charged in an 11-month period, $38.50 for three or more such fees in that time frame, and $28.50 if their account remains negative for five consecutive business days, according to KeyBank’s website.

With the changes, KeyBank becomes the latest lender to curb overdraft an other fees. U.S. Bank did away with NSF fees in January. Later that month, Wells Fargo pledged to do the same. Bank of America, meanwhile, committed to cutting its overdraft charge from $35 to $10 per instance. Regional banks such as M&T and Huntington have followed suit — each pledging to trim overdraft charges from $36 to $15.

Other banks went further. Citi in February became the largest U.S. bank to eliminate overdraft fees altogether, joining Ally and Capital One, which jettisoned the charges last year.

KeyBank took in $142.7 million in service charges associated with consumer deposits between July 2020 and June 2021, according S&P Global. That ranked 13th among U.S. banks, according to that dataset.

KeyBank also announced this week it would roll out $0 overdraft protection for all linked accounts. The bank isn't alone there, either. Truist in January said it plans to discontinue returned-item, negative account balance and overdraft protection transfer fees for all existing personal accounts in the coming months.