When Abraham Williams applied to a big bank for a small-business loan to open a second location for his small business, his company was just a year old. But after a weeks-long process, the bank denied his application.

In the parking lot of the bank, he pulled out his phone and applied for a small-business loan with fintech startup Kabbage. He was approved within 10 minutes.

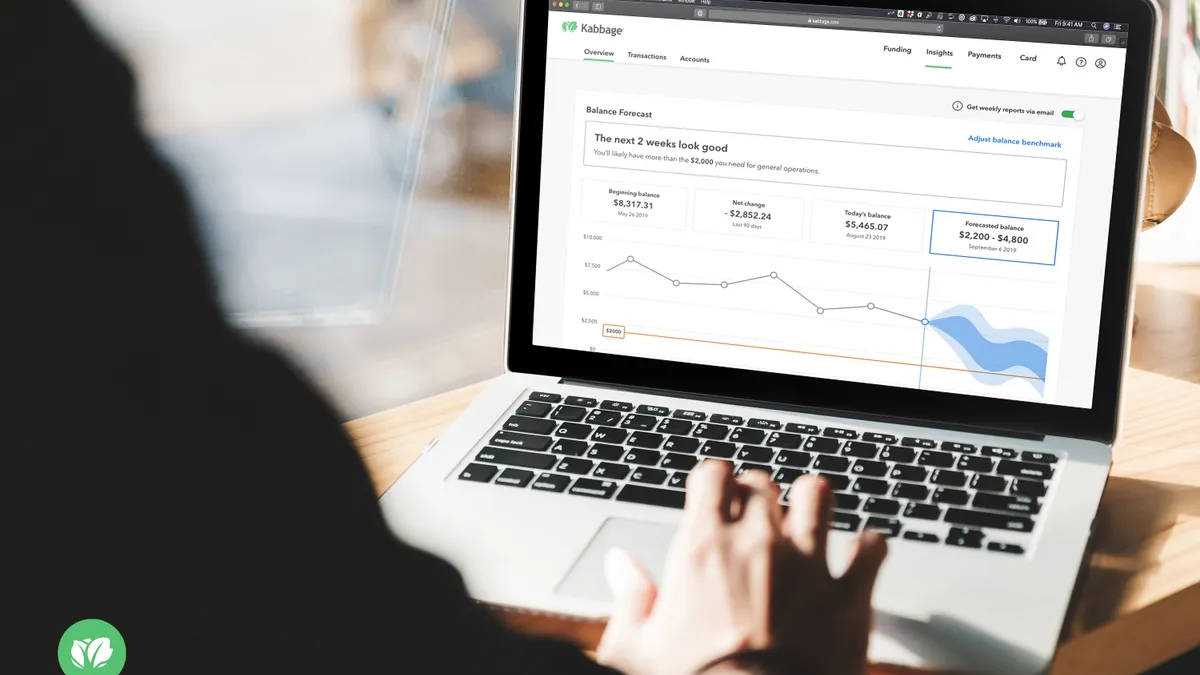

Now, Kabbage is diving deeper into the small-business market with its newly launched financial management platform tool, Kabbage Insights.

In conjunction with the recently launched Kabbage Payments — a way for small businesses to manage invoices — as well as Kabbage's small-business funding options, the fintech hopes to serve a market historically underserved by big banks due to its inherent risk and uncertain revenue potential.

Kabbage Insights grants its 220,000 small-business customers an accurate snapshot of their cash flow at any given point in time, which helps them simplify and streamline financial decisions, like borrowing.

According to Kabbage, 91% of small businesses "spend as many as 20 hours per week manually calculating cash flow." Kabbage Insights reduces that time to almost zero.

Williams, now head of product at Kabbage, told Banking Dive he uses Kabbage Insights for his own small business, and said the platform relies on machine learning, predictive analytics and artificial intelligence to analyze small businesses’ financial data and produce an accurate snapshot of their cash flow 24/7.

"In my mind, I do these calculations about how much revenue is going to come in probably, and when, and then I have all these expenses going out, so I’m always forecasting cash flow," he said. "Kabbage Insights actually shows me that without [my] having to think. There's no filtering or anything like that; it’s just a forecast. The cool thing about it is, with the lending products, we have this whole machine learning approach to whether we give someone a line of credit, and we’re basically using that for the cash flow platform for the customer. And it’s actually pretty accurate. The cash flow projections it’s showing are pretty right on."

Paul Bernardini, head of communications at Kabbage, described Kabbage Insights as a natural outgrowth of the fintech company’s robust lending program.

"Most of the customers we’re serving were not being served by [big banks]; they were being declined [for small-business loans]," he told Banking Dive. "Our lines of credit are available to any business, not just businesses basing their financial data on Kabbage Insights. Those lines of credit are dynamic and can adjust, so we can give them greater capital to match their cash flow."

According to Bernardini, while a small-business loan application process can take weeks or months with a big bank, Kabbage approves small-business loans in minutes, creating a valuable competitive advantage.

Kabbage specifically markets its financial services to small businesses that have been running for just a few years or even months. The company noted that, while for funding purposes, a business must be at least a year old, any customer can use its Payments and Insights tools.

"Ninety percent [of our customers] have less than 10 employees," Bernardini said. "The government has always defined small business in a very broad way (less than 500 employees), which is not really representative of the heartland of mainstream America, which is who we really serve."

Bernardini said there’s substantial added value to using the company's full suite of services, including the Kabbage Small Business Revenue Index, which enables small businesses to compare their financial performance to competitors in their state or industry.

"We’re pretty rapidly moving toward platform management and helping businesses get capital they need when they need it," Bernardini said. "Our customers by and large are wearing 15-20 hats to run a company, and if we can manage the cash flow, we want to help them."

Kabbage isn’t the only fintech ramping up its small-business offerings: according to a recent CB Insights report, more than 140 fintech startups now offer a variety of financial services to small businesses, and banks such as Goldman Sachs, noticing the competition, are looking to partner with tech companies including Amazon to offer similar services, like small-business loans.