Dive Brief:

-

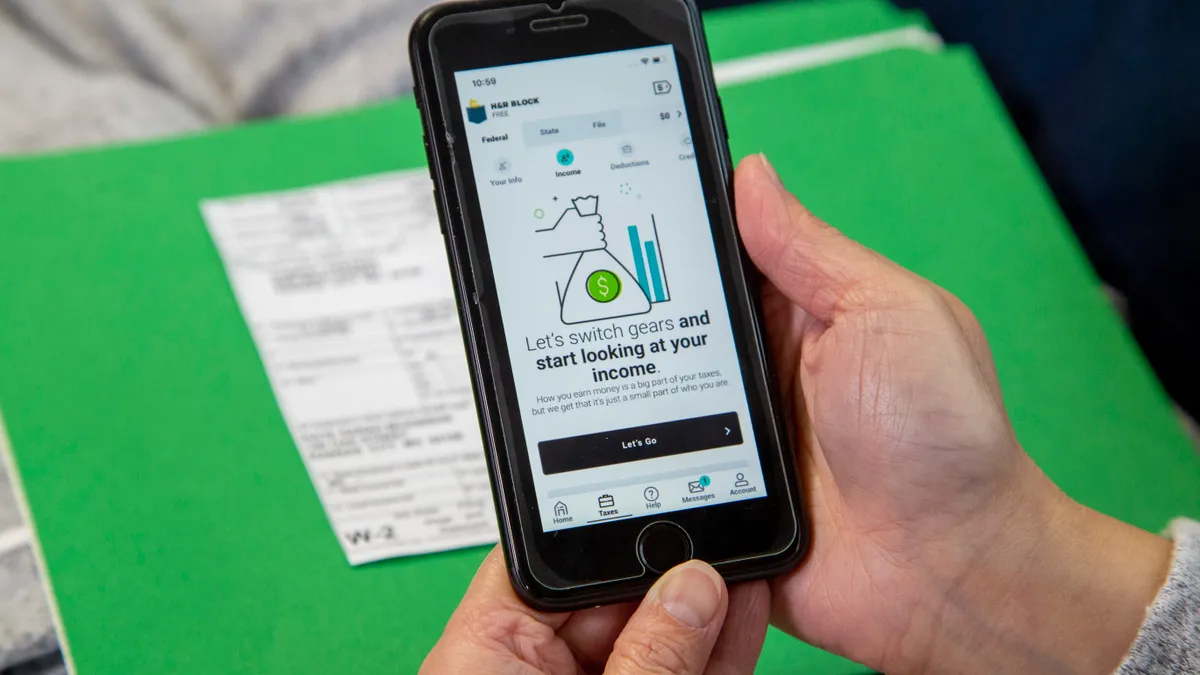

H&R Block plans to launch digital checking and savings accounts for consumers and small businesses, as the Kansas City, Missouri-based company aims to move beyond tax preparation, its signature service, CEO Jeff Jones told Business Insider on Wednesday.

-

The firm expects the digital bank will be available by next tax season and will target existing customers with the service.

-

While the company will join a competitive field of digital players vying for consumer and small-business accounts, H&R Block’s brand awareness and physical presence could give it an advantage over fintechs.

Dive Insight:

H&R Block first outlined its banking ambitions at its investor day in December, where the firm shared details of its five-year strategic plan.

Jones said the bank’s existing market reach will give it a leg up in the growing digital banking space.

"We know we have a trusted brand. We know we have an acquisition engine built in because we have tens of millions of customers that come every year for the [tax] refund," Jones told Business Insider. "And so that, we believe, gives us an advantage over some great brands that are building scale, but are starting from scratch on technology, brand, customer acquisition, et cetera."

H&R Block is not new to the banking space. The company, in fact, once held its own bank charter.

The firm surrendered the charter when it sold H&R Block Bank to BofI Federal Bank, now Axos Financial, in 2015.

"This is an important step in ceasing to be regulated as a savings and loan holding company, which we believe is in the best strategic interests of our company and our shareholders," Bill Cobb, H&R Block's former president and CEO, said at the time.

Since divesting its charter, H&R Block has offered its customers a prepaid debit-card account through bank partnerships, a business model used by digital banks such as Chime and Current.

The company is partnering with South Dakota-based MetaBank for its Emerald card, following the termination of its deal with Axos last year. H&R Block plans to launch its digital bank through its MetaBank partnership, according to American Banker.

H&R Block has not indicated any plans to pursue its own charter, as digital challengers Varo Bank and SoFi have done.

"The company learned a lot when we were a federally chartered bank — in particular, the capital requirements required relative to the seasonality of our business and paying a dividend," Jones told Business Insider. "We've said publicly that the move from Axos to Meta got us great partner capabilities and very favorable economics. And that feels like a very strong win for us."

Under Jones, a former president at Uber, H&R Block has been expanding its offerings beyond tax preparation with services for small businesses.

The company purchased small-business financial management company Wave Financial for $405 million in 2019, and launched Wave Money, a checking account for small businesses, last year.

"We like where we start, given the business we’re in," Jones told American Banker. "But make no mistake, we have to translate strategy into execution and product development, which is what’s underway now."