Atlanta-based fintech Greenlight is working to secure more partnerships akin to those it’s struck with U.S. Bank and Workday.

The company, which offers a banking app and debit card for teens and children, has about 75 partners currently, including JPMorgan Chase. The firm has “hundreds” of potential partners in the pipeline, although CEO and co-founder Tim Sheehan declined to identify future targets for numbers of partners.

Banks, credit unions and large companies pay Greenlight to offer the fintech’s services to their customers or employees. Chicago-based bank Northern Trust said this month it’s linked with Greenlight, to give its clients access to Greenlight’s services. The fintech also said this month it’s collaborating with tech giant Google to integrate Greenlight into kids' smartwatches.

The corporations aspect of Greenlight’s partnerships endeavor is the newest, which includes its tie with human resources software firm Workday. “Several of the largest companies in the U.S.” are considering adding Greenlight as a benefit for their employees, Sheehan said during a recent interview, although he declined to name them, or say whether he expects to announce another partner this year.

“If we can form a partnership, then it's often free to the end consumer,” Sheehan said of Greenlight’s services. Last year, the fintech said such partnerships were expected to aid Greenlight’s effort to become profitable. Similar to other software-as-a-service pricing models, what partners pay Greenlight is based on their size, a spokesperson said, without providing more detail.

Sheehan wouldn’t say whether Greenlight is profitable or not, saying the company is “in a comfortable position.” It’s collected about $556 million in venture capital, and another fundraise isn’t on the horizon, he said.

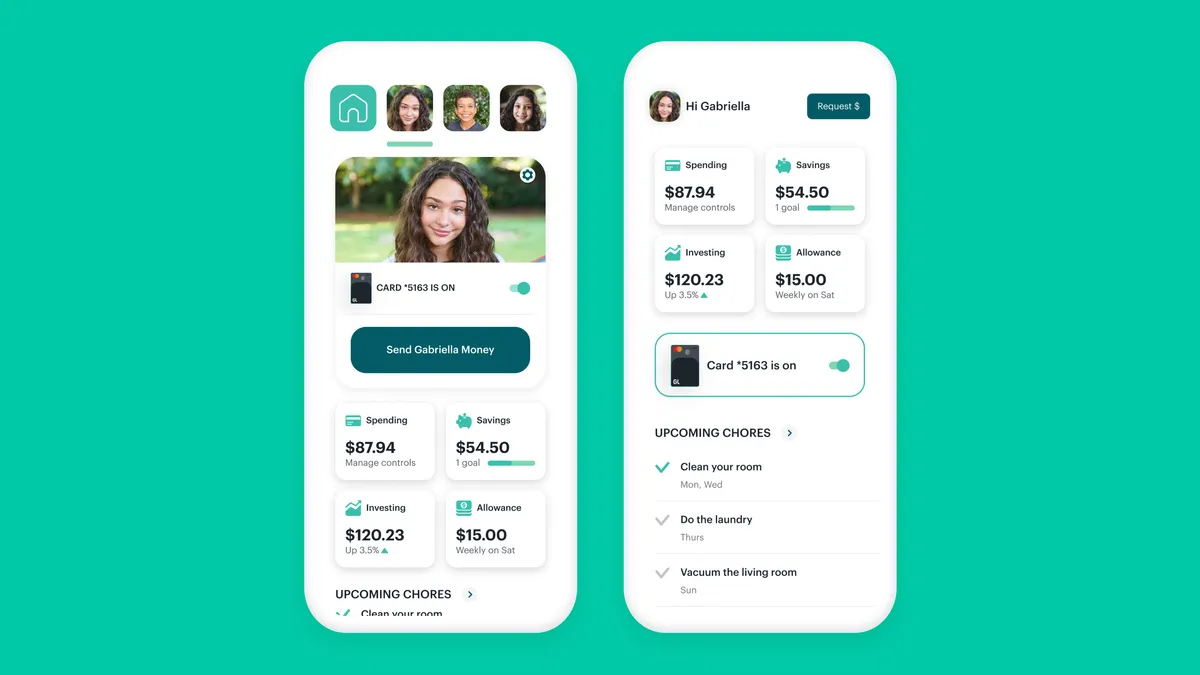

The fintech counts about 6.5 million parent and child users; monthly plans range from about $6 to $15 per month.

Greenlight, which has about 400 employees, did some “restructuring” earlier this year, although Sheehan declined to provide more detail other than to note the company sought to be more efficient. The fintech has continued hiring, particularly in sales and business development and in engineering and product, he said.

Editor’s note: This interview has been edited for clarity and brevity.

BANKING DIVE: Does Greenlight currently get more business through these partner avenues than direct-to-consumer?

TIM SHEEHAN: We don’t share the breakdown. Partnerships are growing really fast, both in terms of the number of partners, but also the number of consumers and families engaging through our partnerships. That makes sense because our direct-to-consumer business has been around a lot longer; we launched that in 2017.

The embedded aspect of the U.S. Bank partnership is unique, compared to other partnerships Greenlight has struck. Do you expect more banks to follow suit in that specific aspect?

Yeah, I think so, because it’s a clever way to essentially include Greenlight in your product, if you’re a bank or a credit union, and yet leverage the innovation and speed of Greenlight. So as Greenlight innovates and adds more functionality and features, you can quickly include that in your offering to consumers, because you’re using our embedded software development kit. You will see a lot of that. A lot of people will probably roll it out leveraging our embedded SDK.

Where do you see further opportunity, in terms of new products or services?

The safety area is pretty ripe. We’ve added family location sharing and crash detection. We also have an SOS button, for a kid or a parent who ever feels unsafe. It can notify their family or emergency services, which will then be dispatched to their location.

We’re close to announcing some more safety stuff that we’re testing right now. This whole area of safety for families is the most new functionality we’ve added.

That’s interesting because it kind of veers from the banking and spending focus.

It’s just about serving families, in ways that are truly helpful. Parents want to teach their kids to be smart about personal finance and smart about money, but they also want to keep them safe. It just seemed like a very natural thing for us to add on, especially because we felt like we could add real value there.

How does Greenlight aim to stay on top of what parents and young consumers are looking for in banking products?

A lot of people who work at Greenlight are parents, and relate to the problems we solve for families, so they kind of have that insight. I have four kids. Co-founder Johnson Cook has three kids.

Honestly, we just pay very close attention to all the feedback coming in; that could be app reviews, or emails we get, or phone calls we get. And then we’ll just proactively reach out to customers and families, and ask questions and listen. What are they worried about? That’s really how we were led to a lot of things we’ve done; the financial literacy game came from conversations with customers. Safety, we felt we really understood well because we talked to so many customers.

With so much said about “coopetition” between banks and fintechs, what does the future of bank-fintech partnerships look like to you?

Greenlight, at least, is a good example of partnerships that can make a lot of sense, because it’s complementary to the bank; it’s not competitive with the bank.

There’s obviously fintechs who are directly competing with banks and credit unions. When venture funding was more readily available a few years ago, it was easier for fintechs to raise money and directly compete with the banks. A lot of those fintechs, I think, are running out of money, and finding it difficult to compete with the banks.

Thoughts on competitors?

The ones I’m worried about tend to be bigger companies, like Apple. I see some of the things they’re doing as more competitive versus any small company.