Goldman Sachs’ profits jumped 45% year over year, to $2.99 billion, the bank announced Tuesday in a quarterly earnings call.

The bank reported $12.7 billion in revenue for the quarter, up 7% from the same three-month span last year.

Investment banking fees jumped 20% year over year, to $1.87 billion, largely on stronger net revenues in debt underwriting, the bank said.

Investment banks like Goldman have struggled with a slump in deals amid two years of rapidly increasing interest rates. But last month, the Federal Reserve lowered the federal funds rate by a half-point to a range between 4.75% and 5%, signaling a better environment to come.

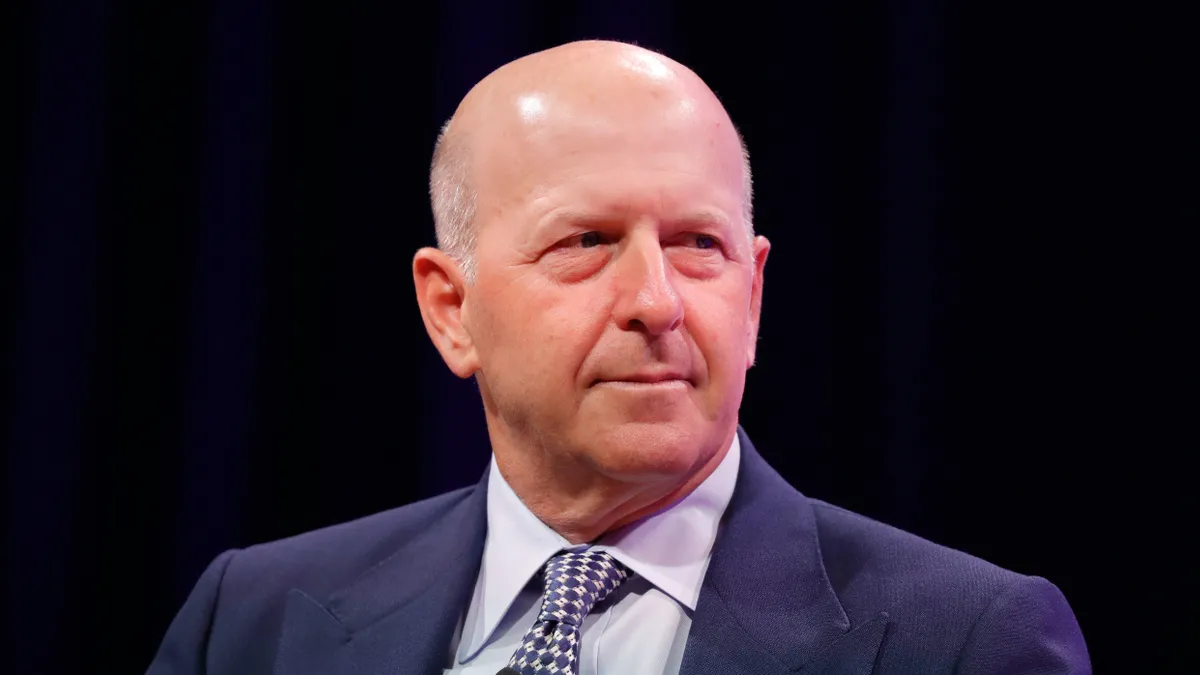

Goldman CEO David Solomon said Tuesday the bank is seeing “significant pent-up demand” from clients.

“The beginning of the rate cut cycle has renewed optimism for a soft landing, which should spur increased economic activity,” he said.

Goldman’s increase in investment banking fees was not as sharp in the third quarter as competitors JPMorgan Chase (31%) and Wells Fargo (37%). But the bank saw double-digit percentage-point increases elsewhere.

Asset and wealth management saw a 16% year-over-year increase in net revenue, to $3.75 billion, the bank said. Net revenues in private banking and lending were up, as well, reflecting higher overall deposit balances.

“Our performance demonstrates the strength of our world-class franchise in an improving operating environment,” Solomon said in a prepared statement. “We continue to lean into our strengths – exceptional talent, execution capabilities and risk management expertise – allowing us to effectively serve our clients against a complex backdrop and deliver for shareholders.”

Following the earnings announcement Tuesday, Goldman’s stock price briefly hit an all-time high of $540.51.

The bank’s third-quarter report wasn’t all rosy, though. Goldman’s Platform Solutions unit – the vestige of its brief and expensive foray into consumer banking – undermined overall earnings with a 32% year-over-year and 42% by-quarter decrease in revenue to $391 million. The bank cited significantly lower net revenues on its consumer platform, including from its General Motors credit card partnership, which is ending and transitioning to Barclays.

Platform Solutions is also home to Goldman’s Apple Card, another deal that both parties have sought to end.

The bank also set aside $397 million in provisions for credit losses.