Failed crypto exchange FTX and its sister companies Alameda Research, FTX US, and FTX Trading filed a lawsuit Sunday against FTX Digital Markets, the companies’ Bahamas-based subsidiary, which they allege wrongfully claimed ownership of the firms’ assets.

The FTX debtors, in a filing with U.S. Bankruptcy Court for the District of Delaware, allege that FTX Digital Markets (FTX DM) and its Bahamas-based joint provisional liquidators claimed the Bahamian subsidiary was the “constructive owner” of FTX.com’s fiat and cryptocurrency, intellectual property and customer relationships.

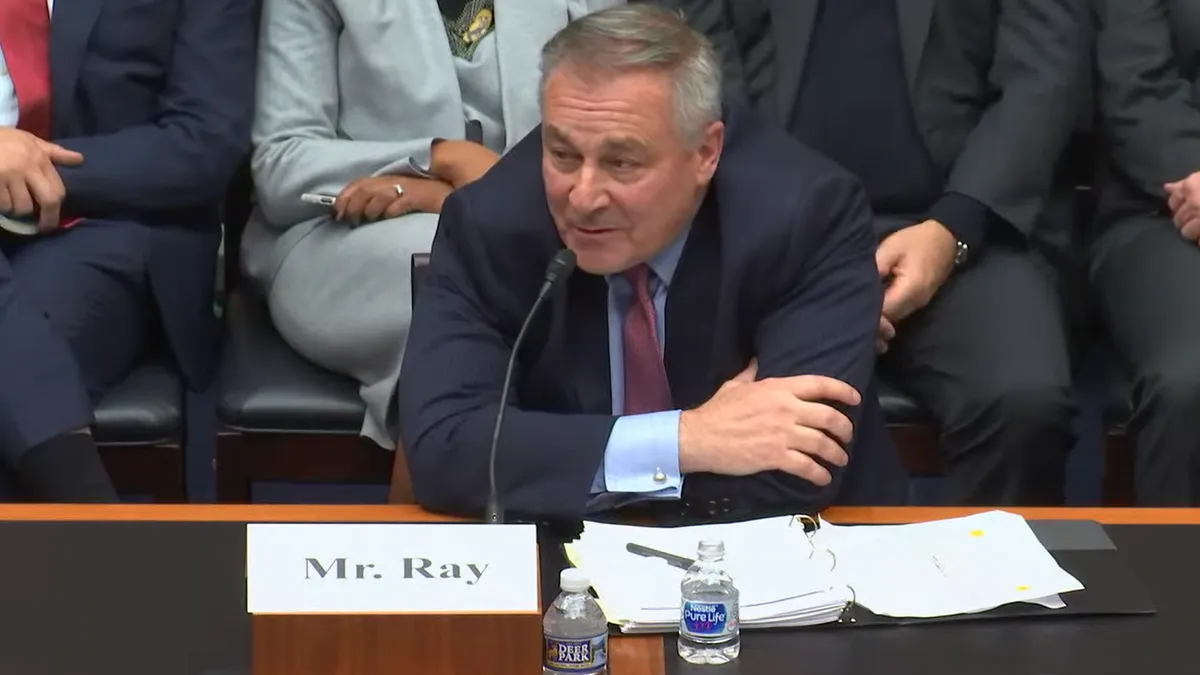

These claims “will harm FTX.com customers and all other creditors of the FTX Debtors” during ongoing U.S. bankruptcy proceedings, alleged the debtors, led by FTX CEO John Ray.

Ray requested the judge rule that FTX DM had no ownership interest in the firm’s fiat and cryptocurrency, intellectual property and customer relationships.

“The [joint provisional liquidators’] claim to ownership of FTX.com’s property is based largely on constructive, equitable, and other non-documentary arguments that depend upon the false premise that FTX DM was the center of the FTX Group,” the debtors wrote. “Nothing could be further from the truth. FTX DM was no more than a short-lived provider of limited ‘match-making’ services for customer-to-customer transactions, on the cryptocurrency exchange built, owned and operated by Debtor FTX Trading, its immediate corporate parent.”

FTX DM was an “economic nullity” within the FTX Group, debtors alleged, and a “legal nullity,” too.

“The peculiar history of FTX DM is a classic example of abuse of the corporate form,” the suit alleged. “It was created as a front to facilitate a conspiracy to defraud the Debtors’ customers.”

FTX DM functioned as an “offshore haven [for fraud, and a] conduit through which the fruits of that fraudulent scheme could be channeled to insiders and third parties outside of the reach of any independent and effective regulatory authority,” the suit alleged.

FTX Group filed for bankruptcy in U.S. court in November after a roller-coaster week in which then-CEO Sam Bankman-Fried asserted the solvency of the companies and then sought relief in the form of acquisition by rival Binance.

The acquisition deal was abandoned within a day of the announcement, resulting in bankruptcy. One day prior to the filing, the Securities Commission of The Bahamas suspended FTX DM’s registration and froze its assets.

Bankman-Fried and other FTX Group executives have since been hit with a variety of criminal charges, including wire fraud. Bankman-Fried, the only executive to plead not guilty, will stand trial in October.

Ray has been at the helm of FTX since November, and he’s pulled no punches in talking about how FTX operated under Bankman-Fried.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” he wrote in an early bankruptcy filing. “From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

A month later, in front of the House Financial Services Committee, he called FTX’s business dealings “old-fashioned embezzlement.”

These words, it should be noted, came from a man who guided Enron — a once-$60 billion energy company that filed for bankruptcy in 2001 after revelations of massive accounting fraud — through its bankruptcy proceedings.