Dive Brief:

- Jelena McWilliams, the former chair of the Federal Deposit Insurance Corp. (FDIC), is joining Cravath, Swaine & Moore as a partner, anchoring the firm’s new Washington, D.C., office, the law firm announced Monday.

- Also joining the D.C. office as partners are two former Securities and Exchange Commission (SEC) staffers: Elad Roisman, a former commissioner and acting chairman of the regulator, and Jennifer Leete, a former associate director in the SEC’s Division of Enforcement, the law firm said.

- The move marks McWilliams’ return to the private sector after spending 3½ years at the helm of the FDIC. A holdover from the Trump administration, McWilliams stepped down from the regulator in February following a dust-up with two Democratic FDIC board members.

Dive Insight:

McWilliams, who started her legal career in private practice in Silicon Valley and Washington, D.C., will serve as managing partner of Cravath’s new D.C. office, which aims to advise clients in the financial services, fintech and emerging technology sectors on regulatory and corporate governance matters, the firm said.

“Our clients face an increasingly complex and active regulatory environment, and our move today enhances our ability to provide the most creative advice in addressing their most challenging matters,” Faiza Saeed, Cravath’s presiding partner, said in a statement. “With nearly half a century of combined public service, Jelena, Elad and Jennifer will bring exceptional regulatory experience, legal acumen and leadership on critical issues. We are thrilled to welcome them to Cravath.”

The firm will also focus on mergers and acquisitions, initial public offerings and other capital markets transactions, Cravath said.

“Building the Washington, D.C. office for a firm as venerable as Cravath — its second U.S. office in over 200 years — is an opportunity of a lifetime. I am honored to be joining the Cravath partnership at this important moment for the Firm,” McWilliams said in a statement.

During her final months at the FDIC, McWilliams found herself in the midst of a fierce power struggle after two Democratic members of the FDIC’s board published a review of bank merger policies without her approval.

The FDIC issued a response the same day calling the move an invalid affront to a “proud 88-year history of Board members working together in a collegial manner.”

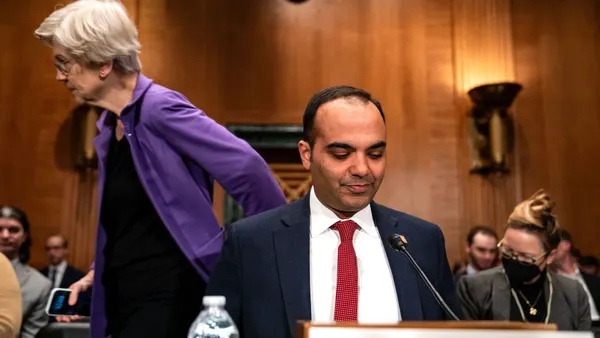

During an FDIC board meeting the next week, McWilliams struck down a request by Consumer Financial Protection Bureau Director Rohit Chopra to include in the FDIC’s official minutes a request for information and results of a vote on bank merger policy.

McWilliams described the actions as a “hostile takeover” in a Wall Street Journal op-ed published the following day.

“This episode is an attempt to wrest control from an independent agency’s chairman with a change in the administration,” McWilliams wrote. “More than that, it’s an example of the erosion of America’s democracy.”

McWilliams, whose term was set to expire in 2023, announced her resignation from the agency in December. FDIC board member Martin Gruenberg became acting chair of the agency after McWilliams’ departure in February.

Prior to joining the FDIC, McWilliams served as executive vice president, chief legal officer and corporate secretary for Fifth Third Bank.

She also served as chief counsel and deputy staff director with the Senate Banking Committee and assistant chief counsel with the Senate Small Business and Entrepreneurship Committee.

During the financial crisis, McWilliams served as a consumer protection attorney with the Federal Reserve Board of Governors.