With the recent breakthroughs in artificial intelligence, fintechs are leveraging generative AI to create innovative applications that aim to transform the financial sector.

Keeping up with the trend, fintech Wildfire Systems launched a product that it said would help companies earn revenue from the content they create with the help of AI, the company announced last month.

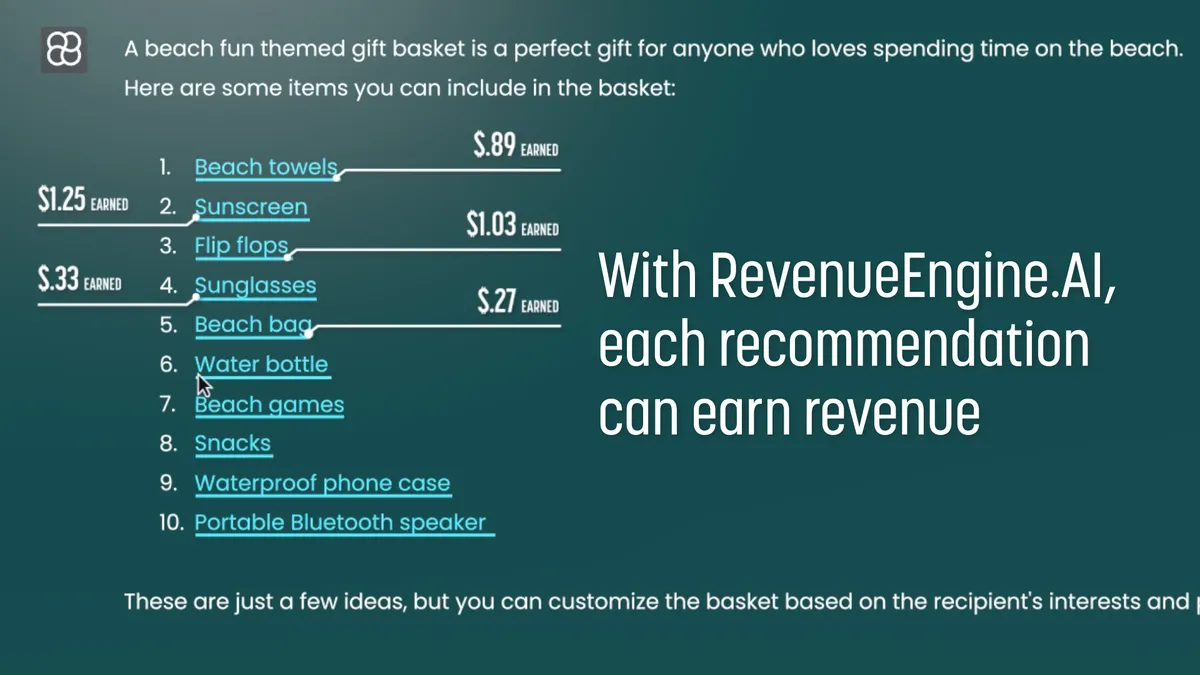

RevenueEngine is a platform that enables any content creator and innovator who is using generative AI to create content and earn revenue from it whenever people make purchases, according to Wildfire.

“Banks are increasingly focused on being part of their users' daily lives and not just being the place where they store money,” Jordan Glazier, CEO of Wildfire Systems said. “And the movement over the last several years has been to be more focused on [being] part of people's daily lives through services like financial wellness … [services] that help people not just store their money, but … save money.”

Glazier said RevenueEngine works with banks directly to power their rewards and loyalty programs to help drive consumer retention and new user acquisition, similar to Capital One Shopping and PayPal Honey.

Visa, Microsoft, Royal Bank of Canada and Acorns are some of Wildfire's partners.

Wildfire’s revenue stream is outside the traditional revenue streams that banks usually have, and that aids in building white-label rewards that benefit the customers and drive revenue, Glazier said.

“A lot of the traditional revenue streams that card issuers and banks are accustomed to are actually under pressure right now, whether it's through legislation or competition,” Glazier noted. “What we do is help them earn new revenue streams from value-added services, like cashback rewards and shopping assistance and things like that, [which] are beneficial to consumers and, at the same time, drive revenue.”

Banks take cues from the data they have about their customers to give recommendations that are relevant for different life stages using generative AI and other innovative technologies, Glazier said.

“I anticipate that the banks are going to have this infinitely easy ability to create high quality, personalized content for every customer based upon the data that they have, and when they do, Wildfire is there to help them monetize that content with new revenue streams,” he said.

Founded in 2017 and based in San Diego, California, Wildfire has over 58,000 merchant programs across the world with an established network that helps them earn a share of any purchases made through the platform.

For example, if a bank is recommending a mini fridge that points to Walmart and runs through Wildfire’s platform, Walmart pays a referral to the fintech, which Wildfire shares with the bank, he said.

“So, the bank earns a portion of commerce that they are able to drive when they are recommending products or purchases to their customers,” Glazier noted.

There has been a wave of signups since its launch a few weeks back, from startups to midsize companies, he said.

“There's definitely a need in the market, and we are there to meet that need,” Glazier said. “When you look at the revenue pressure that banks are under, whether it is caps on fees that are coming through the pipe or downward pressure on interchange, we are hearing from our bank partners and others that there is a real appetite to find new revenue streams, and this is a great one.”

According to Bloomberg Intelligence data, the generative AI industry might grow from $40 billion in 2022 to $1.3 trillion by 2032, the company said.

“RevenueEngine is an infrastructure layer for the [generative] AI economy,” he said. “I think that we are at the very earliest days of generative AI. It is going to permeate every industry and it is going to revolutionize content creation. And with every content creation, businesses from newspapers and magazine publishers all the way through to digital and everything else, their underlying objective is to make money, and this is a complimentary way to monetize content.”