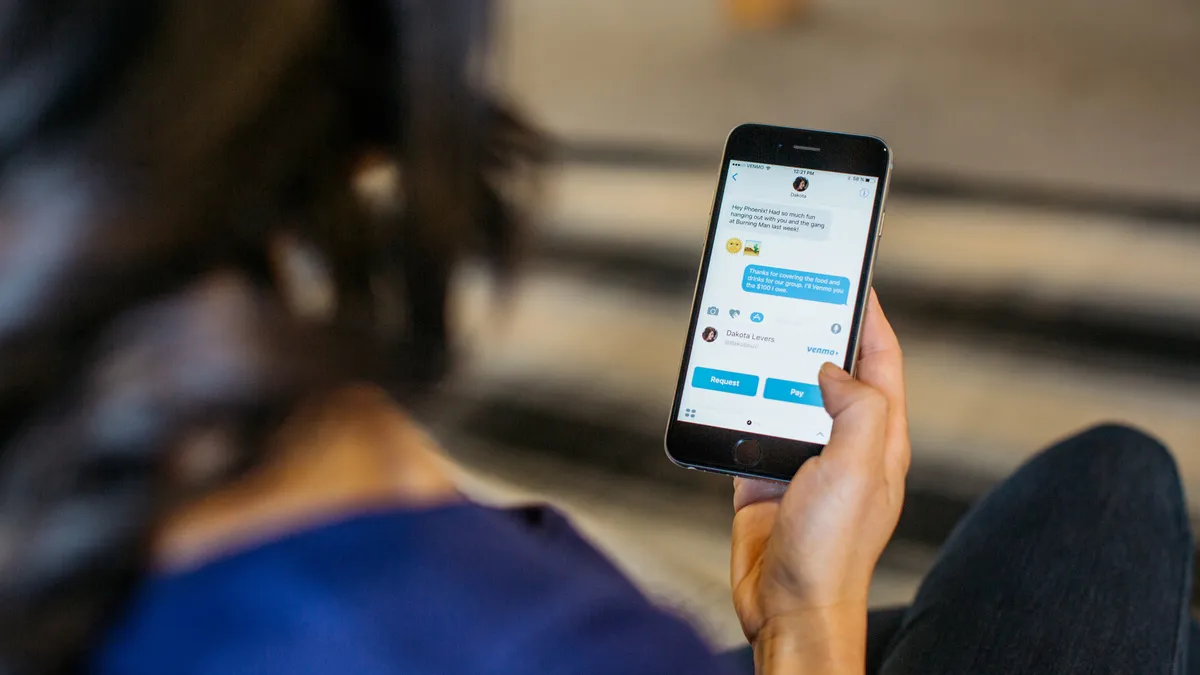

New payments and money transfer platforms such as Venmo and Stripe are keeping banking executives up at night, a survey by Promontory Interfinancial Network found.

The survey was conducted at the end of 2019 and looks at a broad range of issues bankers are keeping tabs on, including the global economy, central bank policy, and changing banking patterns among consumers.

The survey findings don't anticipate the impact of the coronavirus on the global economy, but bankers' views on how their long-term competitive posture is affected by payments platforms and other rising fintechs would remain broadly relevant. Their global economic outlook would need updating, though, because of the deep and broad impact the viral outbreak is having on commerce.

The survey gauged banker attitudes on four categories of fintech:

- Payments

- Specialty lenders such as Quicken Loans and Kabbage

- Online investment platforms such as Betterment and Wealthfront

- Crowdfunding or other direct to investor financing sources

The payments and money transfer platforms, which in addition to Venmo and Stripe include companies like PayPal and Apple Pay, are viewed as the biggest threat to brick-and-mortar banks because younger consumers are using them like ATMs, says Paul Weinstein, a senior policy adviser at Promontory.

"There’s a lot of nervousness, fear and skittishness," he told the American Bankers Association. "This is probably one of the areas where the financial technology sector has made some of the biggest inroads."

In the survey, 76% of the 543 bankers surveyed said they feared the payments and money transfer platforms. Twenty-one percent said they only had a little bit of fear of them, and only 3% said they weren’t worried at all.

The next biggest worry is over specialty lenders such as SoFi, Earnest, Quicken Loans and Kabbage, although most bankers don’t view the growth of these companies as a major concern. Fifty-three percent said they’re either no or only a little threat, compared to 47% who said they’re something to really worry about.

Platforms for online investing and crowdsourcing funds don’t appear to be keeping most bankers up at night.

Forty-one percent say online investment platforms including Robinhood and Stash pose a problem for them and only 9% say crowdfunding platforms like LendingClub and CircleUp are a big issue.

Separately, to capture the banking business of younger consumers, the bank executives said they’re looking to mobile banking services to help them appeal to that segment. Fifty percent of bankers said that was their number one outreach strategy to young people.

Among their other strategies: social media advertising (26%), online banking (7%), cause marketing (3%), tailored products (3%), and sports sponsorships (2%).