Fintech Clair raised $175 million in funding to expand and launch its new tool aimed at getting front-line workers paid soon after completing a shift, the company announced last week.

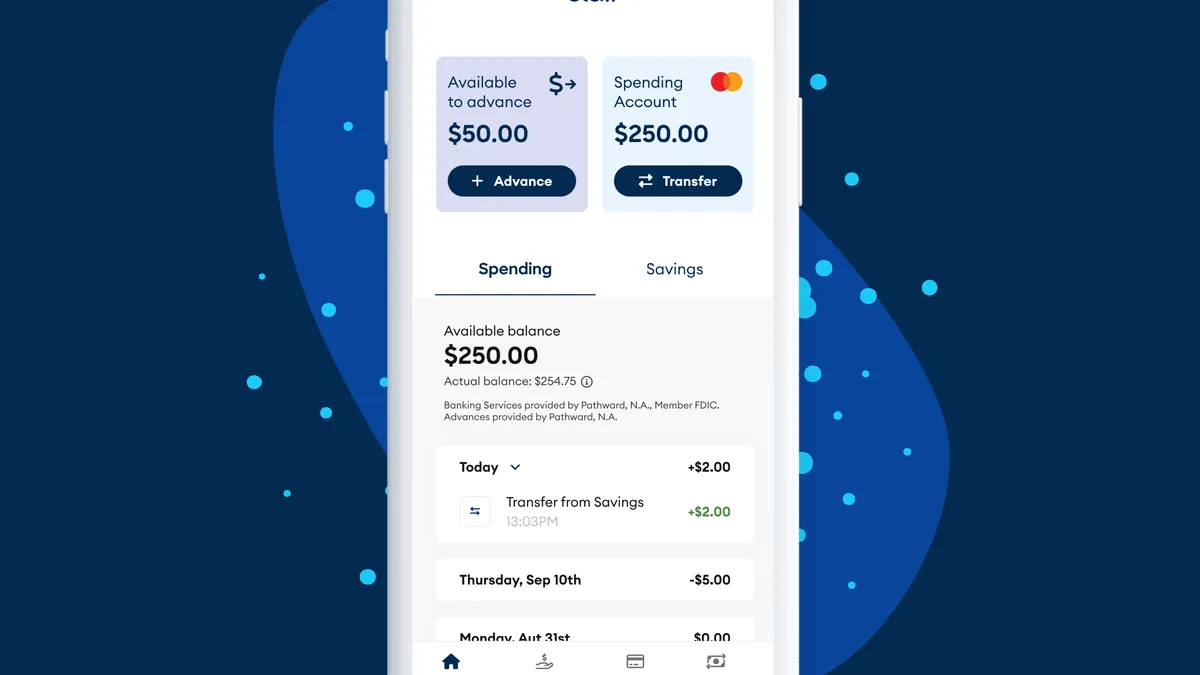

The on-demand pay solution is backed by Pathward, a Federal Deposit Insurance Corp.-insured bank helping consumers get access to its Clair spending and savings account, the fintech said.

The consumer lending program provides for a participation amount of up to $150 million in addition to the $25 million in equity funding that the fintech raised from the venture-capital firms led by Thrive Capital, the company noted. Upfront Ventures and Kairos also participated in the equity round. Michael Presser, investing partner at Kairos, has been appointed as a board observer, according to the statement.

“Front-line workers are the backbone of our economy, yet they have been unfortunately overlooked and underserved by many banks,” Clair CEO Nico Simko said. “At Clair, we are committed to building the best banking experience for hourly workers, empowering them to bridge the gap between paychecks and achieve financial stability. We’re grateful for Pathward, our other partners and our investors for believing in our vision and helping Clair serve even more companies and workers.”

Many of Clair’s customers are underbanked Gen Z-ers or millennials who are trying to either avoid or pay back debt and gain financial independence, Simko said. With over 76 million hourly workers representing 56% of the U.S. workforce, Clair sees this as an opportunity to help workers access the money for expenses as employers attract and retain the workers, he added.

The New York City-based fintech serves more than 50,000 customers and is available at over 10,000 employers and to nearly a dozen workforce management platforms like TCP Software’s Humanity Scheduling, When I Work, Gusto Embedded and 7shifts, the company said.

Employees can also refer their employer if they want to sign up for Clair, Simko said.

The fintech earns revenue from merchant fees every time a customer uses its Clair Debit Mastercard, he said.

“A lot of people think there’s some kind of catch behind Clair. In reality, it’s just a really unique and innovative business model. We make money when they have money to spend,” Simko said.

The fintech’s safety net “enables them to keep up with their expenses and avoid being pulled into a toxic debt cycle,” Simko said.

“Our employer partners have seen improved morale and increased retention, productivity and filled shifts among their workforce,” he said.

Employees who use Clair’s platform pick up 15% more shifts and stay employed 25% longer, the fintech’s internal research found. “That can have a meaningful impact on a company’s bottom line,” Simko said.

An employer-centric model

The fintech launched Clair for Employers in beta a few months ago and is ready to offer it to the public, the company said. It requires a one-time setup and rollout and doesn’t require manually adding wage deductions or paying invoices to Clair. Further, employees of companies using the new offering can access additional features in their Clair Spending Account, including 3% cash back on gas and groceries bought using their Clair Debit Mastercard, the company said.

Clair built a banking app that is catered to the customer needs and can be used after they leave their jobs, Simko said. Clair’s partnership with a regulated financial institution is what draws customers, he added.

“We think partnerships between banks and fintech companies are mutually beneficial. Established banks offer security and scale, while fintechs bring innovation and agility,” Simko said. “Both parties help each other succeed and reach new customer audiences.”