Dive Brief:

- The Federal Reserve issued new rules Thursday barring its board governors, 12 regional presidents and senior staff from buying individual stocks, holding investments in individual bonds or agency-backed securities, or entering into derivatives. Senior officials’ future investments would be limited to “purchasing diversified investment vehicles, like mutual funds,” the central bank said in a release.

- Policymakers and senior staff would have to provide 45 days’ notice before buying or selling any allowed securities, must obtain approval for those transactions, and must hold any investments for at least a year, the Fed said. “Further, no purchases or sales will be allowed during periods of heightened financial market stress,” the Fed said.

- The new rules will force the 12 regional Fed presidents to publicly disclose financial transactions within 30 days — a policy to which Washington-based Fed governors and senior staff already adhere. Regional presidents had previously been required to make such disclosures annually. Reports will also be made public on the Fed’s website.

Dive Insight:

Thursday’s policy shift at the Fed marks the latest reform stemming from a scandal that erupted last month when financial disclosures indicated that two regional Fed presidents — Eric Rosengren of Boston and Robert Kaplan of Dallas — traded stocks last year while also helping to set monetary policy, a practice that met the central bank’s code of ethics but nonetheless raised concerns around potential conflicts of interest. Rosengren and Kaplan pledged to cash out the holdings or move them into diversified mutual funds by Sept. 30, but each resigned before that.

Similar disclosures, uncovered this month, found that Fed Vice Chair Richard Clarida moved between $1 million and $5 million from a bond fund into stock funds on Feb. 27, 2020 — a day before the central bank’s chairman, Jerome Powell, issued a statement signaling the Fed might cut interest rates.

And this week, a disclosure indicated Powell withdrew between $1 million and $5 million from a Vanguard stock index fund in October 2020. A Fed spokesperson said Powell made the sale, which was approved by government ethics officers, to cover family expenses, according to the Financial Times. The Fed was not rolling out new rescue programs at that time.

The Fed said it would incorporate the new rules “over the coming months” — once they are formally written and adopted, and when the central bank’s electronic systems are updated to process the disclosures and transactions, the Financial Times reported.

“These tough new rules raise the bar high in order to assure the public we serve that all of our senior officials maintain a single-minded focus on the public mission of the Federal Reserve,” Powell said.

Under the new rules, officials can continue to hold individual stocks they owned when they took office but would be subject to the one-year holding period and the advance notice of any sales.

New appointees will have to divest certain assets before joining, a Fed official told Bloomberg.

The Fed said the new rules were meant to "help guard against even the appearance of any conflict of interest in the timing of investment decisions.”

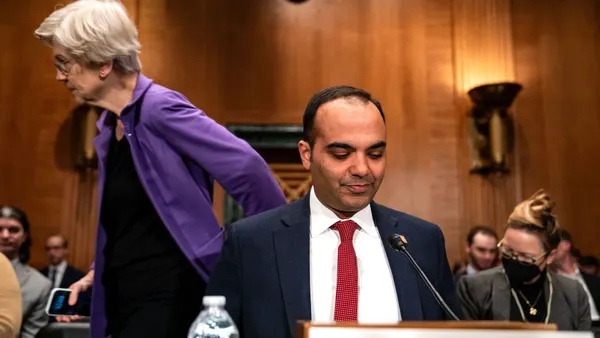

At issue, too, though, is whether the policy change comes in time to save Powell’s job. Powell’s term as Fed chair expires in February, and President Joe Biden has said he would indicate by this fall whether Powell will be renominated — a prospect once thought a given. The scandal, alongside other policy disagreements, pushed Sen. Elizabeth Warren, D-MA, in a hearing last month, to publicly state her opposition to Powell’s renomination.

“I don’t think there is anything that will satisfy Powell’s small but vocal group of critics,” Roberto Perli, a former Fed economist and partner at Cornerstone Macro, told Bloomberg. “But regardless, Powell showed leadership and the ability to do the right thing quickly. So, if anything, I think this strengthens his candidacy.”

Powell pledged “a thoroughgoing and comprehensive review" of the Fed’s ethics standards in the days after the disclosure scandal surfaced. The Fed this month also said it began discussions with its inspector general’s office to launch a review into whether the trading activity complied with the central bank’s ethics rules and the law.

Warren on Thursday called for that investigation, and a probe by the Securities and Exchange Commission (SEC), to be “completed promptly and without Fed interference.”

Email revelations

Warren sent Powell a letter Thursday asking the Fed to release a March 2020 email The New York Times uncovered earlier in the day, in which the central bank’s ethics office urged officials to “consider observing a trading blackout and avoid making unnecessary securities transactions for at least the next several months” amid the market tumult brought on by the COVID-19 pandemic. The Fed complied with Warren’s request.

The Fed — on the day of the ethics office email — announced a raft emergency-lending programs. And, it appears, central bank officials heeded the trading-blackout suggestion, with most refraining from financial activity in March and April, according to The Times.

After the new rules' release, Warren told Bloomberg she wants to ensure the policy has "real teeth" and isn’t "watered down.”

"The bottom line is that we still need to see a lot more from the Fed," she told the wire service.

The White House on Thursday told the Financial Times that Biden continued to have “confidence” in Powell. A spokesperson said the president respected the Fed's independence.

Analysts, meanwhile, remarked at how quickly the Fed moved to propel rule changes.

“At the pace that the government usually moves, this is breakneck speed,” Peter Conti-Brown, an associate professor at University of Pennsylvania, told Bloomberg.

In an interview with CNBC, Atlanta Fed President Raphael Bostic said he’s “hopeful that swift action will allow us to put this behind us and get us back focused on the job ahead.”

Aaron Klein, a senior fellow for the Brookings Institution, told Reuters, however, that this is no time for a victory lap.

"This should be the beginning of a comprehensive investigation in what's going on at the board and the reserve banks, not the end,” Klein said.

Dennis Kelleher, CEO of the financial watchdog group Better Markets, told The New York Times the Fed’s policy should be broader, encompassing “anyone at the Fed who is in possession of material nonpublic information.”

“New policies cannot be used to whitewash the prior bad judgment, failures of leadership, and violation of the Fed’s own policies if not the law,” Kelleher said.

Powell appears to be the only Fed governor with holdings subject to divestment under the new policy, according to Reuters. He may need to sell as much as $3 million in bonds to comply with the rules released Thursday, according to a review of his financial disclosures.