Dive Brief:

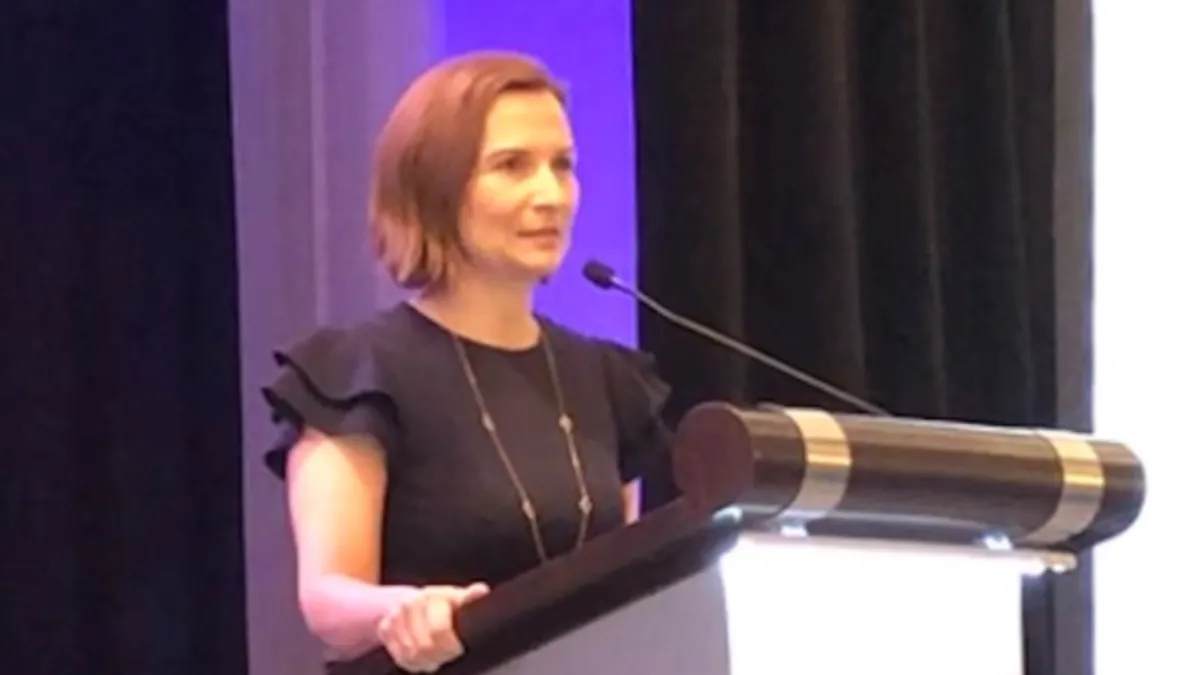

- Friday marked Federal Deposit Insurance Corp. (FDIC) Chair Jelena McWilliams' last day at the agency, about a year and a half before her five-year term was originally slated to end.

- "I knew that, going into this job, we could, hypothetically speaking, have a crisis of some kind," McWilliams said in her closing speech Thursday. "What I could not possibly have anticipated was that the crisis we would have on our hands would be unlike any other the FDIC has endured."

- McWilliams referred to the COVID-19 pandemic, which spanned the latter half of her tenure atop the regulator and began with the economy contracting 31.2% in 2020's second quarter, compared with the same period a year earlier.

Dive Insight:

Some Republican lawmakers may argue McWilliams endured another unique crisis in her final months as the agency's chair. Two Democratic members of the FDIC's board published a review of bank merger policies without McWilliams' approval, sparking a fierce power struggle over whether the chair alone, or rather a majority of directors, can control the FDIC's agenda.

The FDIC slammed the review by Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra and FDIC board member Martin Gruenberg as an invalid affront to a "proud 88-year history of Board members working together in a collegial manner." Sen. Pat Toomey, R-PA, the ranking member of the Senate Banking Committee, went so far as to call the effort a failed "coup."

McWilliams resigned Dec. 31. In her speech Thursday, she lauded the efficiency and agility of the FDIC and other institutions to adapt to the COVID-19 crisis. About 22.4 million Americans lost their jobs during the first two months of the pandemic, she said.

"The story of how financial regulators, central banks, and the global financial system responded to the pandemic is one of great success," she said.

McWilliams also spotlighted an uptick in the approval of deposit insurance applications for de novos. The FDIC gave the green light to 49 such applications during her tenure, as opposed to 10 from 2011 until she ascended to the agency's top role in 2018.

McWilliams also applauded how the agency implemented S. 2155 (Regulatory Relief for Community Banks), modernized brokered deposit rules, simplified the Volcker Rule and altered prudential regulations to achieve economic growth and stability.

"Guided by a firm belief that the role of government in our society is to promote, not inhibit, growth and innovation, I challenged myself and the FDIC staff to think outside the box to support a thriving, competitive and innovative banking system that will continue to propel this nation forward," she said.

McWilliams also pressed regulators to clarify their intentions regarding stablecoins. "My personal view is that generally bank-issued stablecoins closely resemble digital representations of deposits," she said Thursday. "I encourage the agencies to be mindful of the many possible iterations of stablecoins we may see, and to avoid a one-size-fits-all approach.

"For example, the regulatory framework for a [global systemically important bank] issuing stablecoins may need to be very different from that of a $1 billion bank," she added. "Likewise, a bank experimenting with stablecoins as a small percentage of its business likely warrants a different regulatory approach from a bank whose sole business is stablecoin issuance."

Regulatory dust-up

McWilliams did not mention, in her closing speech, the potential bank merger policy review that likely hastened her exit.

McWilliams rejected a proposal by Chopra to add to the official minutes of a Dec. 14 board meeting a record of a vote to request a public comment period on the agency’s Bank Merger Act policies. In a Wall Street Journal op-ed published the next day, McWilliams called the move a "hostile takeover."

Gruenberg will become acting chair of the agency after McWilliams' departure.

In a statement shared with Banking Dive on Thursday, Richard Hunt, the CEO of the Consumer Bankers Association (CBA), wrote: "Chairman McWilliams has served our nation and the banking industry with professionalism and class. As the head of the FDIC, she was accessible and responsive to all stakeholders, working in tandem with America’s leading banks to support families and small businesses throughout this pandemic. CBA is grateful for her years of service, and we wish her well in future endeavors."

In a letter to the FDIC last month, the trade group urged the agency to quickly nominate a replacement for McWilliams, and to "avoid passing any new rules or regulations until a board member representing the views of the minority party is seated."