Following the collapse of a banking-as-a-service company that’s left thousands of customers unable to access some $160 million, Unit has launched a tool that allows banks to connect directly with the end customers of their ill-fated fintech partners – ensuring those customers never lose access to their funds.

Unit’s Business Continuity Tool, which the company quietly rolled out recently, was developed to prevent any disruption in service for end-customers, according to co-founder and CEO Itai Damti. The company plans to announce the launch Thursday.

The tool’s release comes at an interesting time. Four months ago, BaaS firm Synapse filed for bankruptcy, leaving the end-users of some of Synapse’s fintech partners without access to their life savings and prompting lawmakers to ask for answers on their behalf.

Unit had started working on the tool about two months before that. It’s the type of tool, Damti said, that banks have always needed.

“Whether or not the Synapse incident happened, a lot of programs have wound down over the years, and banks wanted to allow people to keep accessing the funds,” he said. “This is the first time that banks have the ability to continue the relationship with the end customers if the fintech company is winding down.”

Plenty of fintechs have failed over the years. In those cases, the banks behind the fintechs had one option, Damti said: offboard the end-users and follow a checklist for how to do it properly.

“In many cases, they even rely on a company that reached the end of its life, so it might not have the right amount of resources, it might not have the ability to build tech – so we just decided to make this an automatic process,” he said.

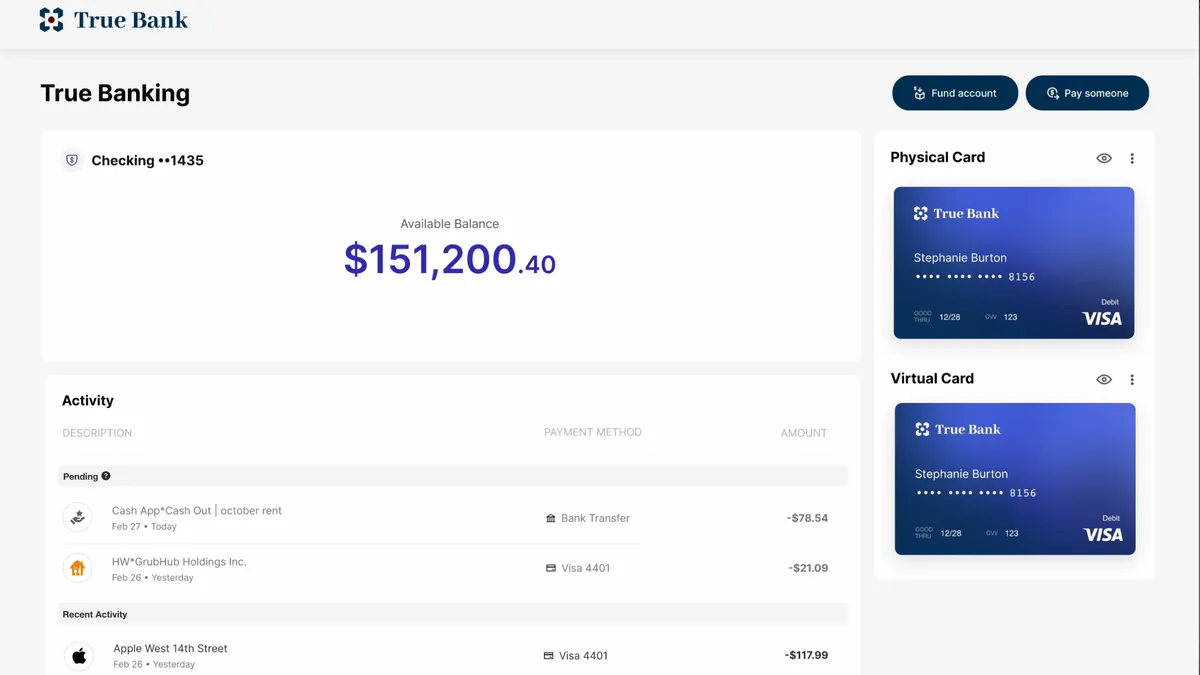

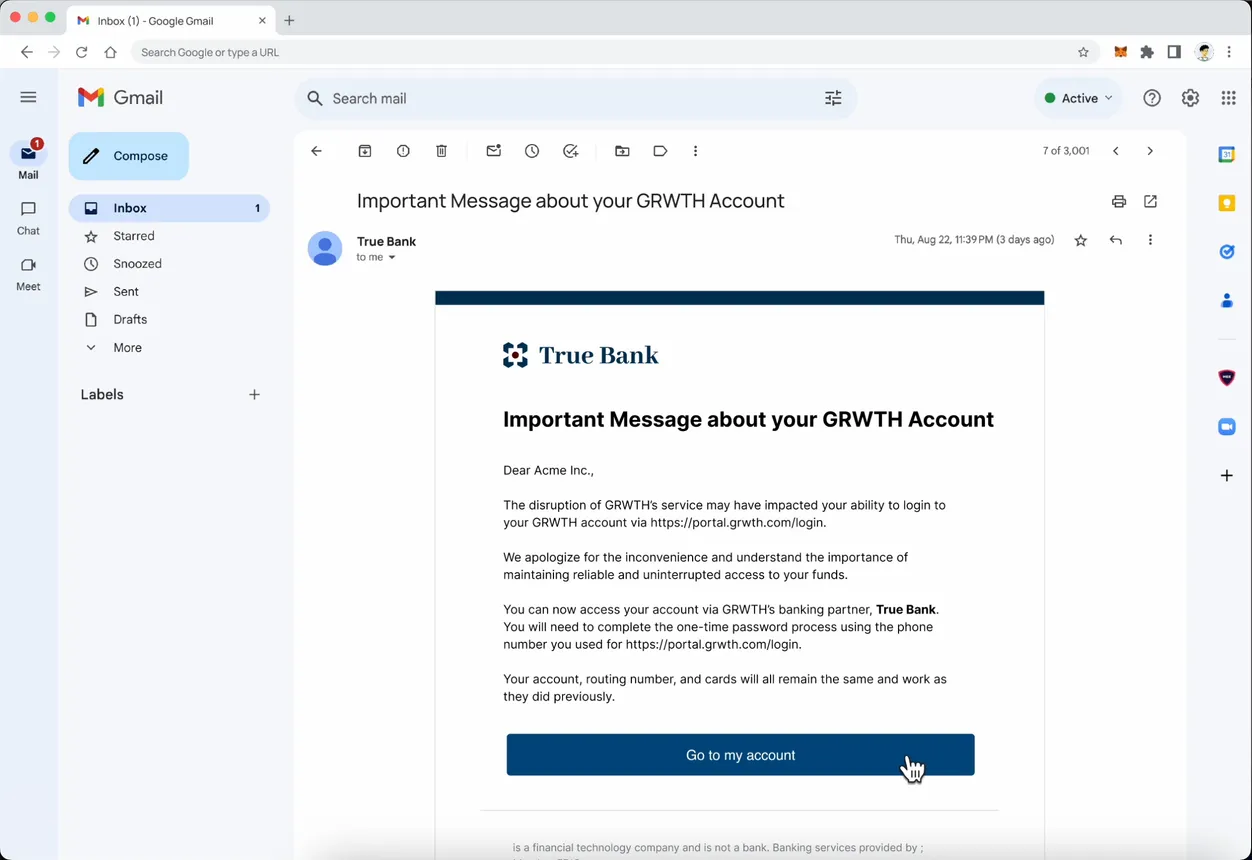

Unit has seven partner banks that power a number of fintechs; and its technology touches about 1.5 million individual users. In the event that one of those fintechs fails, the bank can go to Unit’s dashboard and activate an emergency mode for that fintech. At that moment, Unit emails the fintech’s end users, informing them that their account was impacted and giving them access to their bank account, now through Unit’s white-labeled dashboard.

“At this point, [end-customers] can do everything from funding their account to withdrawing funds to some outside bank account that they might own. They can see all of their cards, physical and virtual. They can see the recent transactions. They can download statements. They can see their balances. They have almost fully functional banking experience that doesn't rely on [the fintech’s] ability to keep serving them,” Damti explained.

“Statements, ACH in and out, wire in and out, checks,” he went on to say. “They can keep getting paid interest according to the original terms, they keep paying the same fees for ACH and the wires and checks as the bank originally agreed to.”

The tool gives users the same access to the bank that the fintech had had, thus allowing banks to retain these customers long after the fintech has fizzled away.

“You can retain the deposits. You can retain the fees. You can talk to the end customers directly. You can basically treat them as your core end-customer,” Damti said. “Effectively, once a bank activates the emergency mode, all these end-users are turning into their direct end-users, or their kind of channel end-users. But it's the same system, right? It's the same core that everything flows from."

Unit’s partner banks are in the process of studying and getting trained on how to implement the tool, Damti said.