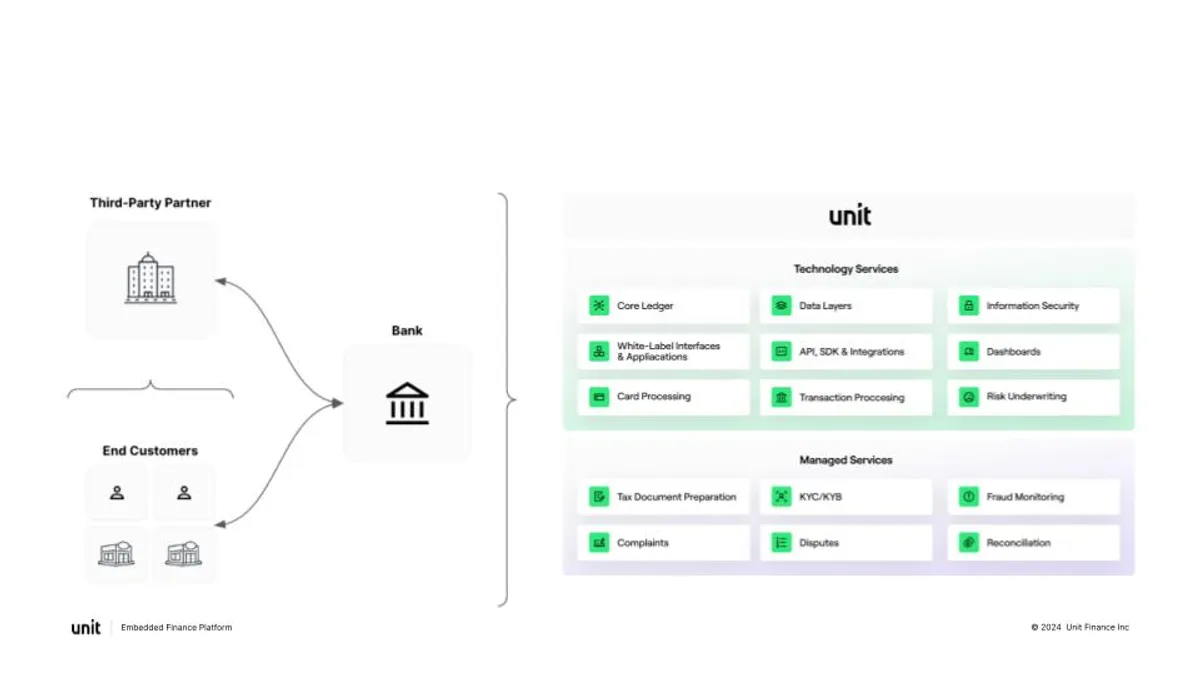

Embedded finance platform Unit Finance invested in strengthening its bank oversight products this year to help banks respond to an uptick of regulatory scrutiny of third-party partnerships, CEO and founder Itai Damti said.

Unit's oversight suite provides banks tools for managing compliance, reconciliation, and third-party risk; and aims to give banks real-time data access, greater transparency, and improved controls to mitigate risk and perform oversight over programs.

“We're at a point in time where the bar for operating in the space is rising quickly for banks, and Unit wants to be well-positioned to serve those banks and grow our partner bank network,” Damti told Banking Dive.

Regulators have had bank-fintech ties under a microscope for the past two years, handing out consent orders to several banks – Blue Ridge Bank, First Fed Bank and Piermont Bank to name a few – over issues within their fintech programs. And recently, the Federal Reserve, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp. jointly released third-party risk management guidance for community banks.

As regulators try to play catch up with the fast-moving world of fintech, “banks have to answer more questions as part of their exam cycles, and the better we are at helping them answer those questions, the more they are well-positioned to provide in the space,” Damti said.

Questions banks face from regulators “move in seasons,” he said: After the Russia-Ukraine war started, banks faced more questions related to IT and security; and after the collapse of Silicon Valley Bank, they faced more questions on deposit stability.

“By staying attuned to the needs of the bank partners and to the type of questions that they might have about their audiences, we can build more tools that make them successful and make them answer [regulator] questions at higher quality. We don't believe that tech can be a replacement for risk management, but tech can enhance risk management, and make things more efficient for the bank partners,” Damti said.

He sees regulatory scrutiny as a sign of a maturing ecosystem – and overall, a good thing, even if it means some players within the system see it as a time to step away.

“Historically, these things happen when ecosystems become more important. And historically, the result of elevated scrutiny is more clarity,” he said.

Clarity, he said, “leads to companies and banks operating with more confidence and the understanding that regulators want to sustain the space, they just want to sustain it in the best way, as opposed to being fearful that there is a future event that might take the ecosystem back.”

The pendulum between investing in the future, as with the bank oversight investment, and seeking more immediate lucrative results is constantly swinging, Damti said. Based on the company’s existing balance sheet, Unit can “eventually become profitable without additional fundraisers,” he said.

He stopped short of providing a timeline, noting that investors can choose to invest more, thus delaying profitability.

“If there's an opportunity that presents itself or set of opportunities that present themselves, we want to be able to make those judgments in real time and not bind ourselves now to a timeline that we decide on today,” Damti said. “But we are definitely trying to be thoughtful about our business success, revenue growth and margins of the company.”